- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

VIX At Lowest Level Ever Could Be Connected To French Elections

As the stock market appears headed towards a land where storytelling might be winning the day, odd occurrences are taking place underneath the market structure. A Goldman Sachs (NYSE:GS) report notes that the previous quarter’s volatility as measured by the VIX was at an all-time low “despite a quarter characterized by elevated policy uncertainty.” But more ominous is a volatility term structure inversion is occurring in Europe, a CBOE volatility expert first points out. Is there a connection to the upcoming French Election ?

VIX is odd, very odd

Wasn’t the story being told market participants that the “Trump rally” was based in part on legislative accomplishment? With a legislative agenda now in question and whiffs of a $1 trillion fiscal stimulus in the offing – and important details regarding how the cost will be paid conspicuously absent – coming alongside potential constitutional questions involving Russia, a question persists. How is stock market volatility, as measured by the CBOE VIX index, is at historically low levels?

Not only low levels, but the term structure is inverted, The Wall Street Journal first reported. The front month futures contract is higher priced than the back month, a particular oddity in the VIX index. “This typically happens during periods of market stress, for example, a selloff in equities,” Macro Risk Advisors analyst Pravit Chintawongvanich explained to ValueWalk. “If the curve is inverted, the market is essentially saying that it expects volatility to be higher in the near term, but revert back to lower levels in the longer term.”

But this inversion has people scratching their heads. “What’s odd is that the VIX curve inverted at very low levels without any market stress event, he noted. “What’s happening is that the front month April VIX futures are staying bid ahead of the French elections, since they are priced off S&P options that capture both rounds of French voting. Essentially, the US options market is starting to price in some risk premium for the French elections when it previously had not.”

In fact, volatility is at all-time lows amid such uncertainty is a calm that is unnerving market professionals like nails on a chalkboard.

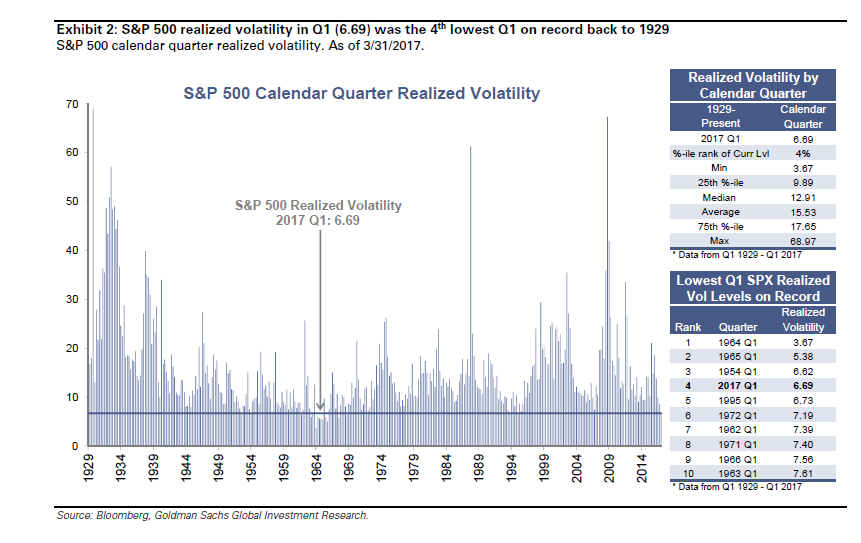

Goldman Sachs noted with an odd sense of irony the average CBOE VIX reading in the first quarter was 11.69, the lowest in history. It wasn’t just the average low, but the tight range of prices that caught Goldman’s options analyst Krag Gregory’s eye. It was Gregory who noted odd volatility patterns preceding the surprise Trump election. Low volatility was a persistent trend, trading in a range from 10.6 and 13.1 over the first quarter. Realized volatility over the more recent past tells a tale of abnormal volatility, the fourth lowest level since the Great Depression. Typically when volatility is high the stock market is trading at a value level.

Goldman Sachs notes oddity of low volatility, while connection with French Election is made

There are two levels of analysis. On a mechanical level, Gregory notes S&P 500 realized volatility was not that surprising. “The VIX is a market-based expectation for S&P 500 realized volatility and when the market isn’t moving the VIX will reflect that by dropping to the low end of its historical range,” he wrote in an April 3 note to clients.

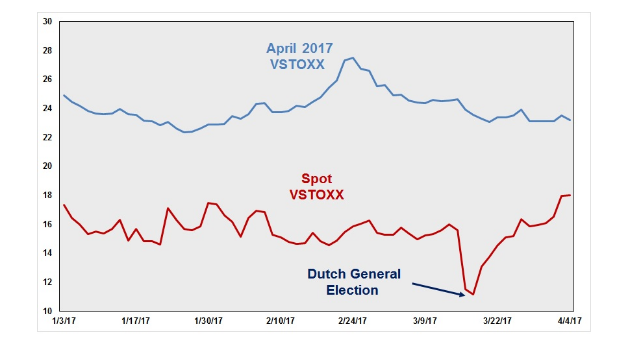

Looking at the term structure inversion more closely, Russell Rhoads, CBOE Director of Education and a noted VIX analyst, thinks the story goes deeper than the VIX, which measures US stock market buying of put options. He is looking at the VSTOXX futures, which measures European stock market volatility, as the bellwether.

“The key to watch is the April to May spread,” he told ValueWalk. April futures have been trading at a higher value than May, an unusual price pattern for this contract known as backwardation. “Volatility has historically priced farther out months higher due to a time premium. The fact VSTOXX is pricing the near term expiration higher is due to an expectation of pending volatility that could occur sooner rather than later.”

Rhoads looks to the French election on April 24 as a point of significant market concern — and core causation for the VSTOXX and VIX term structure inversion.

In March, the VSTOXX volatility index tumbled the day after the Dutch general election which barely influenced the futures pricing. Differentials in gamma, or the rate of change between the underlying cash index and futures contracts, is considered by certain volatility analysts as a sign of anticipated value. Leading up to French election, for instance, the April VSTOXX futures have been trading in a range from near 20 to 25. The previous two days the spot index has started to gravitate toward the April contract price, Rhoads notes. “As the first round of the election draws near this pattern may continue,” he said, noting that the VSTOXX market is also telling another story.

“After the election he implied volatility of Euro Stoxx 50 options could drop off,” he predicts, basing the analysis on how the May futures contracts settle relative to April.

ValueWalk has previously noted the important difference between the French election and Brexit involves with France leaving the currency union. While Brexit was a shock to the system, they maintained their currency. The significance of the French leaving the euro currency is that it would force renegotiation of many of the “risk contracts” which the banks have written. On a day when JPMorgan (NYSE:JPM) Chief Executive Officer Jamie Dimon said that Too Big To Fail bailouts were over, the world watches European derivatives contracts and oddly inverted volatility benchmarks and hopes for the best.

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.