- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ViaSat Looks Good On Solid ViaSat-2 & Government Segment

ViaSat Inc.’s (NASDAQ:VSAT) recently-reported quarterly earnings were, no doubt, hurt badly by escalating research and development costs, and ramped-up expenses, ahead of offering subscribers service with its new high-speed satellite. Despite the same, we believe the company has numerous growth drivers in place.

The stock has appreciated 8.8% over the past six months, ahead of the industry’s average gain of 1.3%. Let’s discuss a few of those growth catalysts for this Zacks Rank #3 (Hold) stock and shed light on some of the risks it faces.

ViaSat’s Government Systems business has been outstanding in recent times and has been gaining even greater momentum. The segment reported striking revenue growth of 15% fiscal year to date compared with the previous year’s comparable period. The growth was driven by an expanding service base and strong momentum in tactical data-link products, government mobility platforms, and secure networking products. It also recorded strong growth in cyber-security and information assurance products. Splendid growth in revenues drove strong year-to-date Adjusted EBITDA (up 30% year over year).

The company recently launched the ViaSat-2 satellite. ViaSat-2, touted to have twice the bandwidth and seven times more broadband coverage, is a massive improvement over ViaSat-1 and has immense prospects. The company is ready for the service roll out of the ViaSat-2 satellite in February 2018. Per initial tests, the company anticipates to grow its distribution channel significantly, leading up to the ViaSat-2 service launch.

In-flight connectivity is also sustaining robust growth momentum and remains another strong potential tailwind for ViaSat. The company also projects sound growth in in-flight connectivity, with a significant increase in shipments and installations projected early next fiscal. It anticipates significantly greater growth early in the next fiscal. In fact, it expects to witness a significant ramp with Gen-2 installs later this fiscal year, particularly on American Airlines and Qantas. The Commercial Air business will likely prove to be a key profit driver in the quarters to come.

Last month, the company signed a new contract with JetBlue, for both aircraft connectivity and on-board Wi-Fi distribution. Under the contract, ViaSat will upgrade JetBlue’s fleet with its next-generation connectivity suite. The aircraft will then have improved access to the coverage and capacity offered by ViaSat's next-generation ViaSat-2 satellite platforms.

ViaSat maintains a leading position in the satellite and wireless communications market. The company has garnered enough economics of scale and scope to serve the vast emerging markets in South America, Africa, the Middle East and Western Asia. This should be a key catalyst for the company’s operations in the quarters to come.

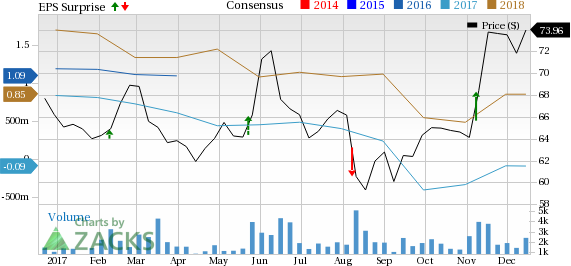

ViaSat, Inc. Price, Consensus and EPS Surprise

Lately, ViaSat’s earnings have suffered quite a lot due to R&D expenses, but per the company, total R&D investments look set to peak this fiscal year. The primary drivers are the ViaSat-3 payload, pre-flight development and testing, and commercial in-flight connectivity, STCs and line-fit activity. This indicates that we can see more pressure on profits in the upcoming quarters. Also, the costs related to the ViaSat-2 service launch activities and preparations for the large-scale in-flight Wi-Fi ramp are estimated to further burden the bottom line.

Also, stiff competition in the industry proves to be a major growth deterrent for the company, particularly for its satellite services segment. The satellite services business is also highly affected by seasonality of demand due to traditional retail selling periods.

However, strong backlog levels, robust prospects of core government business and significant demand for higher speeds of broadband connectivity in residential, in-flight, and government markets are likely to accelerate the company’s growth momentum. In addition, the ViaSat-2 satellite is anticipated to help this company fortify its foothold in new geographic markets.

Overall, while we acknowledge that ViaSat has a robust foothold in numerous markets and is enjoying strong growth momentum, we feel its earnings are set up for more pressure in the quarters ahead.

Stocks to Consider

Some better-ranked stocks in the same space include Comtech Telecommunications Corp. (NASDAQ:CMTL) , Motorola Solutions, Inc. (NYSE:MSI) and Harris Corporation (NYSE:HRS) . While Comtech Telecommunications sports a Zacks Rank #1 (Strong Buy), Motorola and Harris Corporation both hold a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

With four back-to-back, robust earnings beats, Comtech has a striking average positive surprise of 88.7%.

Motorola Solutions has an impressive earnings surprise history. The company recorded an average positive surprise of 13.2% over the trailing four quarters, beating estimates all through.

Harris Corporation has a decent earnings surprise history for the trailing four quarters, beating estimates thrice, with an average positive surprise of 2.8%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Harris Corporation (HRS): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL): Free Stock Analysis Report

ViaSat, Inc. (VSAT): Free Stock Analysis Report

Original post

Related Articles

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.