- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

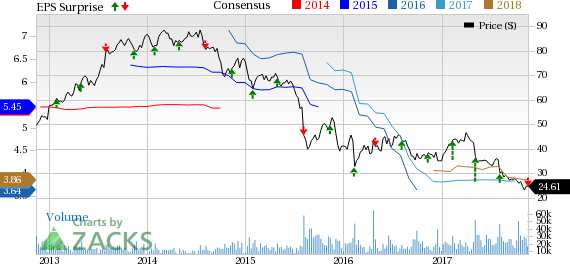

Viacom (VIAB) Q4 Earnings Miss, Revenues Beat Estimates

Viacom, Inc. (NASDAQ:VIAB) reported mixed results in the fourth quarter of fiscal 2017 (ended Sep 30, 2017), wherein revenues outpaced the Zacks Consensus Estimate but earnings lagged the same.

The company’s earnings (on an adjusted basis) of 77 cents per share missed the Zacks Consensus Estimate of 85 cents. The bottom line, however, expanded 11.6% on a year-over-year basis owing to lower expenses and higher costs.

Total revenues in the quarter was $3,319 million, up 2.9% year over year. The top line surpassed the Zacks Consensus Estimate of $3,240.5 million. The outperformance can be primarily attributable to growth in the Media Networks and Filmed Entertainment units.

Quarterly adjusted operating income grew 7% year over year to $578 million. At the end of fiscal 2017, Viacom had $1,389 million of cash & cash equivalents and $11.1 billion of debt (non-current) compared with $379 million and $11.9 billion, respectively, at the end of fiscal 2016.

The company’s cash balance during the quarter was boosted by the sale of a non-core asset. Moreover, Viacom is looking to bring down its debt levels.

Segmental Performance

Media Networks

Quarterly revenues for the company’s Media networks segment were $2.55 billion, up 3% year over year. The improvement came on the back of strong growth in advertising revenues on the international front. While domestic revenues declined 2% to $1.96 billion, international revenues surged 24% to $593 million. Foreign currency movements aided segmental results to the tune of 4%. The acquisition of Telefe boosted international revenues.

The segment generates revenues principally from three sources: (i) affiliate revenues (ii) advertising revenues; and (iii) ancillary revenues. Affiliate revenues declined 1% to $1.15 billion, hurt by decrease in subscribers on the domestic front. Consequently, affiliate revenues declined 3% to $948 million on the domestic front.

Advertising revenues increased 6% year over year to $1.22 billion, mainly owing to higher revenues on the international front. Advertising revenues were flat at $936 million on the domestic front. Ancillary revenues increased 5% to $181 million in the quarter, on the back of strong growth in international consumer products

Quarterly operating income (on an adjusted basis) declined 8% to $693 million in the reported quarter, due to higher programming expenses.

Filmed Entertainment

Quarterly revenues improved 2% year over year to $789 million on the back of the 30% increase in licensing revenues. This segment, however, witnessed a fall in Theatrical revenues to the tune of 43%. While Home entertainment revenues declined 5%, Ancillary revenues rallied 33%. This segment reported an operating loss (on an adjusted basis) of $43 million.

Annual Results

For fiscal 2017, the company’s earnings (on an adjusted basis) climbed 2% to $3.77 per share. Also, revenues increased 6% to $13.26 billion. The Zacks Consensus Estimate for earnings is pegged at $3.86 per share on revenues of $13.19 billion.

Another Important Development

Of late, Viacom announced the renewal of a distribution deal with Charter Communications (NASDAQ:CHTR) . Additionally, the companies have joined hands for the co-production of original content and collaboration of advanced advertising.

Zacks Rank & Stocks to Consider

Viacom has a Zacks Rank #4 (Sell). Better-ranked stock in the Media Conglomerates industry are Liberty Media Corporation (NASDAQ:FWONA) (NASDAQ:FWONK) and Pearson (LON:PSON) PLC (NYSE:PSO) . Both the stocks carry a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Liberty Media and Pearson have gained more than 9% and 2%, respectively, over the last six months.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Pearson, PLC (PSO): Free Stock Analysis Report

Viacom Inc. (VIAB): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Liberty Media Corporation (FWONK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.