- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Veeva Systems (VEEV) Q4 Earnings Top, FY19 View Promising

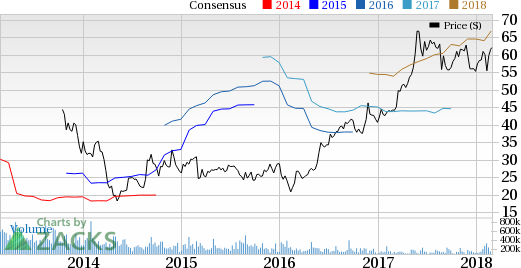

Veeva Systems Inc. (NYSE:VEEV) reported fourth-quarter fiscal 2018 adjusted earnings of 23 cents per share. The bottom line beat the Zacks Consensus Estimate by a couple of cents and improved 4.5% from the year-ago figure.

Full-year adjusted EPS came in at 93 cents, a 27.4% rally from the year-ago period. It also exceeded the Zacks Consensus estimate by 2.2%.

Total revenues were $184.9 million in the fourth quarter, reflecting an increase of 23.1% year over year. Moreover, the top line was ahead of the Zacks Consensus Estimate of $180 million. Veeva System’s strong growth in subscription revenues segment drove the metric.

The company reported revenues of $685.6 million in fiscal 2018, a 26% improvement from the year-ago number.

Segmental Details

Fourth-quarter subscription service revenues were $150.9 million, up 26.2% year over year. This upside was backed by stronger-than-expected bookings in the quarter. Subscription gross margin was 81%, reflecting contraction of roughly 25 basis points from the sequentially last quarter. Per the company, the year-over-year deterioration was due to duplicate expense associated with the company’s AWS migration.

Professional service revenues rose almost 10.7% to $34 million. In the quarter under review, services gross margin was 21%, down from 32% in the sequentially last quarter.

Margin Details

Gross margin at Veeva Systems contracted 91 basis points (bps) to 69% in the reported quarter. Operating income was $34.9 million, representing a 7.2% gain from the year-ago quarter.

Operating margin contracted 280 bps to 18.9% from the year-ago figure. Research and development expenses increased 41.8% to $37 million. Sales and marketing expenses rose 13.5% to $37.2 million and general and administrative expenses increased 37.7% to $16.8 million.

Balance Sheet

Veeva Systems ended the fiscal with nearly $761.9 million in cash and short-term investments compared with $518.9 million at the end of fiscal 2017.

Guidance

The company has provided financial guidance for fiscal 2019 ending Jan 31, 2019.

For the fiscal, total revenues are anticipated in the band of $815-$820 million.Adjusted earnings are projected between $1.30 and $1.33 per share. The Zacks Consensus Estimate for the metric is pegged at $1.01 on a revenue estimate of $807.19 million.

For first-quarter fiscal 2019, Veeva Systems expects total revenues in the range of $188-$189 million. Meanwhile, adjusted earnings are estimated between 30 cents and 31 cents.

Our Take

Veeva Systems exited the fiscal 2018 on a solid note with both revenues and earnings beating the consensus mark. Also, the company witnessed year-over-year growth on both counts. We are encouraged by the company’s consistent efforts in product innovation and launches through R&D (research and development). We are also upbeat about Veeva Systems’ product unveilings and its industry-focused approach. Growing global demand for cloud-based and vault applications also boost opportunities for the company. Moreover, the latest product additions are impressive as that might fortify the company’s position and enhance its prospects.

We are currently looking forward to the company’s deal with two top 10 pharmaceutical companies. According to Veeva, these partnerships while expanding usage of Veeva CRM in the emerging markets are likely to help set the company’s global benchmark for others to chase.

However, the contraction in adjusted operating margin is discouraging. Also, the company faces stiff competition across most of its product lines.

Zacks Ranks & Key Picks

Veeva carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical space are athenahealth, Inc. (NASDAQ:ATHN) , Centene Corporation (NYSE:CNC) and Mednax, Inc. (NYSE:MD) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

athenahealth has a projected long-term growth rate of 20.7%. The stock has returned 10% in the past three months.

Centene has a long-term growth rate of 14.4%. The stock has rallied 18.9% in the past six months.

Mednax has an expected long-term growth rate of 10%. In the past six months, the stock has jumped 26%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

athenahealth, Inc. (ATHN): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Mednax, Inc (MD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.