- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Varian Gains Ground On New Applications, Grows In Australia

Varian Medical Systems (NYSE:VAR) recently announced that Australia-based Peter MacCallum Cancer Centre (also known as Peter Mac) has selected the company’s flagship Eclipse treatment planning system to replace the existing cancer treatment platform across all sites. Notably, Varian registered this order in the fourth quarter of fiscal 2017.

The Eclipse treatment planning system is an integrated and comprehensive platform, which supports radiation treatment such as photon, FFF beams, protons, electrons, external beams, low-dose-rate brachytherapy and cobalt therapy. The system creates optimized radiotherapy treatment plan for patients.

The platform is supposedly the first Microsoft (NASDAQ:MSFT) Azure-hosted system to be deployed in Australia. In fact, the latest development includes the introduction of Varian’s Velocity platform to Peter Mac for adaptive radiotherapy.

Newer Applications Gain Prominence

Varian continues to witness strong market acceptance of its software solutions, particularly for Eclipse treatment planning and ARIA oncology information systems. Other new applications such as RapidPlan, multi-criteria optimization, InSightive analytics solution, 360 Oncology cloud-based cancer operating platform and the Velocity longitudinal cancer imaging solution have been fortifying the company’s foothold.

The launches of Halcyon and HyperArc platforms in 2017 are noteworthy. The platforms are used for cancer treatment through image-guided volumetric intensity modulated radiotherapy.

Varian operates in a technology-driven environment where success depends on innovation and frequent product updates. The company has been successful on the R&D front, evident from year-over-year expansion in its top line. The company’s other varied offerings include TrueBeam and Edge platforms, Qumulate QA and RapidPlan knowledge-based treatment planning. We believe that Varian’s innovative product pipeline will continue to drive overall growth over the long term.

Market Potential

A research report by Markets And Markets suggests that the global radiotherapy market is projected to reach a worth of $9.47 billion by 2022, up from $6.81 billion in 2017, at a CAGR of 6.8%.

Further, Global Information Inc. suggests that the radiotherapy markets in APAC are expected to reach a worth of $2.34 billion by 2024 at a CAGR of 11.5% in the 2017-2024 period. Per the report, APAC has been segregated into 11 geographical divisions, wherein Australia is a major contributor to radiotherapy revenues. Varian has been the key player in the region, followed by Elekta AB (OTC:EKTAY) and Accuray, Inc (NASDAQ:ARAY) .

International Growth in Focus

In November, Varian announced plans of opening a facility in Jundiai, Brazil, reflecting long-term commitment and partnership with the Brazilian Ministry of Health. The facility will provide access to advanced radiotherapy treatment in Latin America, particularly in the Brazilian oncology market.

The development closely follows the receipt of Shonin approval from the Japan Ministry of Health, Labor and Welfare to market the Varian Halcyon system.

Price Performance

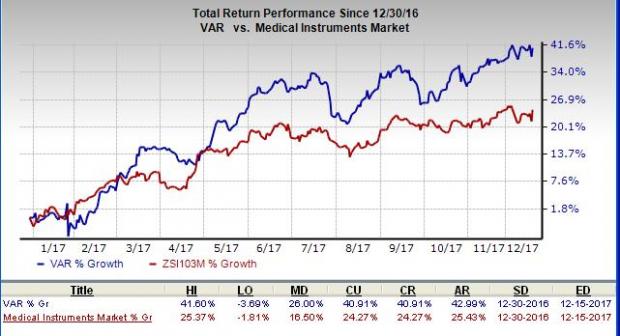

Year to date, Varian has outperformed the industry in terms of price performance. Shares have returned 40.9%, comparing favorably with the sub-industry’s rally of just 24.3%. Also, the current return is higher than the S&P 500’s gain of 22.9%.

Zacks Rank & Key Pick

Varian has a Zacks Rank #4 (Sell).

A better-ranked stock in the broader medical space is The Cooper Companies Inc. (NYSE:COO) . The stock sports a Zacks Rank #1 (Strong Buy) and has a long-term expected earnings growth rate of 10.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

Elekta AB (EKTAY): Free Stock Analysis Report

Cooper Companies, Inc. (The) (COO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.