- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Valley National Gets All Approvals To Buy USAmeriBancorp

Valley National Bancorp (NYSE:VLY) announced that it has received all necessary approvals to acquire Clearwater, FL-based USAmeriBancorp, Inc. The latest nod was from the shareholders of both the companies.

Earlier in October, Valley National got all requisite banking regulatory approvals (including that from the Fed and the Office of the Comptroller of the Currency) to close the transaction, announced in July. Now, both the companies project the deal to be effective Jan 1, 2018, subject to the completion of remaining closing customary conditions.

Deal Details & Benefits

Per the agreement terms, shareholders of USAmeriBancorp will receive 6.1 shares of Valley National for each share held, subject to adjustment if Valley National's stock price falls below $11.50 or rises above $13.00 prior to closing. The transaction was valued at about $816 million, based on Valley National's closing stock price on Jul 25, 2017.

The transaction is expected to be accretive to Valley National's earnings per share within 12 months from closing of the transaction.

As of Sep 30, 2017, USAmeriBancorp, with a branch network of 30 offices, held roughly $4.5 billion in assets, $3.6 billion in net loans and $3.6 billion in deposits. Following the closure of the deal, the combined company will have more than $28 billion in assets and 238 branches.

After closing of the deal, USAmeriBancorp’s CEO, Joseph V. Chillura, will join Valley National as executive team member while the Chairman of the acquired company, Jennifer W. Steans, will join as a board member.

Road Ahead

The deal will significantly boost Valley National’s presence in the Tampa Bay market. The acquisition will also bring Valley National to the Birmingham, Montgomery and Tallapoosa areas in Alabama.

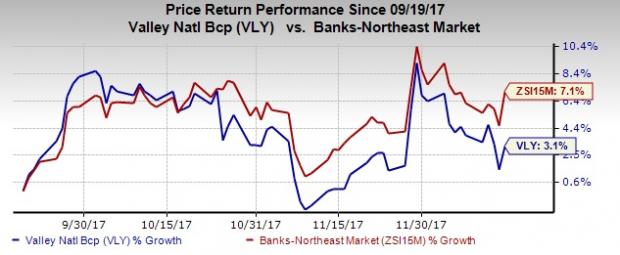

Driven by stable balance sheet position, Valley National is expected to continue with its inorganic growth strategy. Further, over the past three months, the company’s shares have rallied 3.1%, underperforming the industry’s gain of 7.1%.

Currently, Valley National carries a Zacks Rank #4 (Sell).

Stocks Worth Considering

Some better-ranked stocks in the same space are First Commonwealth Financial Corporation (NYSE:FCF) , S&T Bancorp, Inc. (NASDAQ:STBA) and Two River Bancorp (NASDAQ:TRCB) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Commonwealth Financial’s current-year earnings estimates have been revised 2.5% upward over the past 60 days. The company’s share price has been up around 15.6% in six months’ time.

S&T Bancorp’s Zacks Consensus Estimate for current-year earnings have moved 1.7% upward over the past 60 days. The company’s share price has been up around 14.9% over the past six months.

Two River Bancorp’s current-year earnings estimates have been revised 2.1% upward, over the past 60 days. Over the past six months, the company’s share price has been up 8.7%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

S&T Bancorp, Inc. (STBA): Free Stock Analysis Report

First Commonwealth Financial Corporation (FCF): Free Stock Analysis Report

Valley National Bancorp (VLY): Free Stock Analysis Report

Two River Bancorp (TRCB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.