- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Vail Resorts (MTN) Reports Ski Season Metrics, Skier Visits Down

Vail Resorts (NYSE:MTN), Inc. MTN reported certain ski season metrics for the period from the beginning of the ski season through Jan 2, 2022.

Ski Season Metrics

Season-to-date (through Jan 2, 2022) total skier visits fell 1.7% compared with the prior-year season-to-date period (Jan 3, 2021). The metric declined 18.3% compared with the fiscal year 2020 season-to-date period.

Lift ticket revenues (including an allocated portion of season pass revenues for each applicable period) increased 25.9% year over year but declined 4.6% compared with the fiscal year 2020 season-to-date period. Ski school revenues surged 59.1% year over year while dining revenues jumped 64.7% compared with the prior-year period. However, ski school revenues and dining revenue declined 25.2% and 45.1% compared with the fiscal year 2020 season-to-date period.

Retail/rental revenues for North American resort and ski area store locations increased 36.3% compared with the prior-year season-to-date period. However, the metric slumped 19.5% compared with the comparable season-to-date period in the fiscal year 2020.

Kirsten Lynch, CEO of Vail Resorts, said, “As expected, season-to-date 2021/2022 North American ski season results are significantly outperforming results from the prior year, due to the greater impact of COVID-19 and related limitations and restrictions on results from the 2020/2021 season. Relative to the 2019/2020 North American ski season, the 2021/2022 North American ski season got off to a slow start with challenging early season conditions that were worse than our expectations, resulting in delayed openings and limited open terrain that persisted into the first week of the holidays ending December 26, 2021.”

The company stated that the Omicron variant has been negatively impacting the company’s performance. However, the company’s season pass business, the relative strength of destination visitation over the holidays and lately improved conditions bode well.

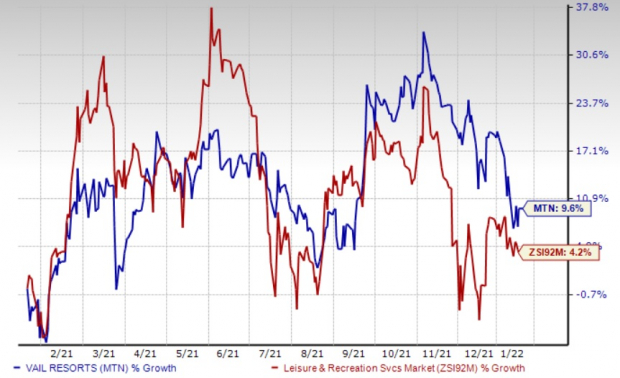

In the past year, shares of this Zacks Rank #3 (Hold) company have gained 9.6%, compared with the industry’s rally of 4.2%.

Key Picks

Some better-ranked stocks from the Zacks Consumer Discretionary sector include Hilton Grand Vacations (NYSE:HGV) Inc. HGV, Bluegreen Vacations (NYSE:BXG) Holding Corporation BVH and RCI Hospitality Holdings, Inc. RICK.

Hilton Grand Vacations sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 411.1%, on average. Shares of Hilton Grand Vacations have appreciated 58.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HGV’s 2022 sales and earnings per share (EPS) suggests growth of 27.7% and 154.4%, respectively, from the year-ago period’s levels.

Bluegreen Vacations sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 695%, on average. Shares of Bluegreen Vacations have surged a whopping 156.4% in the past year.

The Zacks Consensus Estimate for BVH’s 2022 sales and EPS indicates a rise of 7.6% and 0.4%, respectively, from the year-ago period’s levels.

RCI Hospitality flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 67.7%, on average. Shares of RCI Hospitality have soared 123.9% in the past year.

The Zacks Consensus Estimate for RICK’s 2022 sales and EPS suggests growth of 34.9% and 22.1%, respectively, from the year-ago period’s levels.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RCI Hospitality Holdings, Inc. (RICK): Free Stock Analysis Report

Vail Resorts, Inc. (MTN): Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV): Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.