- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

USD/CAD: Canadian Dollar Remains Adrift

The Canadian dollar has shown little movement this week. Currently, USD/CAD is trading at 1.2865, up 0.02% on the day. On the release front, there are no Canadian events on the schedule. In the US, today’s key event is Building Permits, which is expected to slow to 1.25 million. We’ll also get a look at Current Account and Housing Starts. On Wednesday, the US publishes Existing Home Sales and Canada releases Wholesale Sales.

President Trump fared badly when he tried to replace Obamacare, but his tax reform proposal is poised to become law, barring any unexpected surprises. On Friday, the legislation passed a major milestone, as the House and Senate hammered out the differences in their tax proposals and drafted a uniform bill. The legislation is expected to be voted on in the House on Tuesday and the Senate on Wednesday. With Democrats in both branches opposing tax reform, the Republicans will need every vote in the Senate, where they have a thin 59-41 majority. Several Republican senators who were undecided have said they will vote in favor, so the bill is likely to pass through Congress and will then be signed into law by President Trump. This marks the first major overhaul of the US tax code in 30 years, and would represent a huge victory for Trump, ahead of Congressional elections in 2018.

Bank of Canada Governor Stephen Poloz presented an optimistic picture of the economy last week, but also acknowledged that the BoC has some significant concerns as we wrap up 2017. With the Federal Reserve raising rates last week, and almost certain to do so again at the January meeting, the BoC is under pressure to increase rates early in 2018, or else the Canadian dollar could take a tumble. Another headache for the Poloz is NAFTA, as the US has threatened to pull out of the free-trade agreement if Canada and Mexico do not agree to major concessions. If NAFTA does unravel, the Canadian dollar would likely drop, as Canada sends 75% of its export to its southern neighbor and the economic repercussions would be severe.

USD/CAD Fundamentals

Tuesday (December 19)

- 8:30 US Building Permits. Estimate 1.27M

- 8:30 US Current Account. Estimate -116B

- 8:30 US Housing Starts. Estimate 1.25M

- Tentative – US FOMC Member Neel Kashkari Speaks

Wednesday (December 20)

- 8:30 Canadian Wholesale Sales. Estimate 0.5%

- 10:00 US Existing Home Sales. Estimate 5.53M

*All release times are GMT

*Key events are in bold

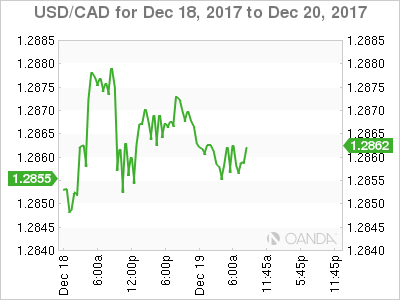

USD/CAD for Tuesday, December 19, 2017

USD/CAD, December 19 at 8:05 EDT

Open: 1.2862 High: 1.2877 Low: 1.2850 Close: 1.2865

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2630 | 1.2757 | 1.2860 | 1.3015 | 1.3161 | 1.3260 |

USD/CAD has shown little movement in the Asian and European sessions

- 1.2860 remains under pressure in support

- 1.3015 is the next resistance line. It has held firm since early July

- Current range: 1.2860 to 1.3015

Further levels in both directions:

- Below: 1.2860, 1.2757, 1.2630 and 1.2494

- Above: 1.3015, 1.3161 and 1.3260

OANDA’s Open Positions Ratio

In the Tuesday session, USD/CAD ratio is showing movement towards short positions. Currently, short positions have a majority (55%), indicative of trader bias towards USD/CAD breaking out and heading lower.

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.