- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Indexes Continue To Rally Within A Defined Range

This week ended with the S&P, Dow Jones Industrials and NASDAQ stalling near recent highs. From a technical perspective, both Thursday and Friday set up small range price bars (Doji candles or small Spinning Top type bars) after the upside price move on Wednesday. These are indicative of price consolidation and indecision.

The news events that initiated this rally, nearly a week ago, continue to drive sentiment in the markets. Yet the news from the ECB that new stimulus efforts would begin with $20 billion euros monthly invested in assets until they decide it is not required any longer suggests the EU is desperate to support extended growth and some renewed inflation. This move by the EU pushed banks and the finance sector higher while the U.S. stock market stalled near the end of the week.

At these lofty levels, almost all of our indicators and predictive modeling systems are suggesting the U.S. stock markets are well within overbought mode. Of course, the markets can continue in this mode for extended periods of time as central banks and external efforts to support the asset/stock market continues, at some point investors/traders will recognize the imbalance in price/demand/supply as a fear of a price contraction.

We are very cautious that the market is setting up a lofty peak at this time. It is important for traders and investors to understand the global situations that are setting up in the markets. With precious metals moving higher, it is important to understand that FEAR and GREED are very active in the markets right now. The continued capital shift that has been taking place where foreign investors are shifting assets into U.S. and more mature economies trying to avoid risks and currency risks is still very active. Yet the lofty prices in certain segments of the U.S. stock markets means that this capital shift may take place where investment capital is shifted away from more risky U.S. assets (high multiple speculative stocks) and into something that may appear to be undervalued and capable of growth.

The shifting focus of the global markets, the EU and the continued need for stimulus at this time is somewhat concerning. Our view is to watch how the global markets play out and to maintain a cautious investment strategy. We shifted into an extremely cautious mode back in February/March as the U.S. market completed the October/December 2018 breakdown and precious metals started a move higher. We continue to operate within this extremely cautious investment mode because we believe the foundation of the global markets are currently shifting and we don’t believe the stability of the markets is the same as it was after the February 2017 market collapse.

What do we believe is the result of this shift in our thinking? This is very simple. We are entering into the final 13+ months of the U.S. presidential election cycle, the trade wars between the U.S. and China continue to drag on with is muting economic activity, the EU continues to battle to find some growth/inflation while Great Britain attempts to work out a BREXIT deal as soon as possible. Meanwhile, we continue to try to find opportunities in the markets with these extreme issues still pending. We don’t believe any real clarity will happen until we near October/November 2020.

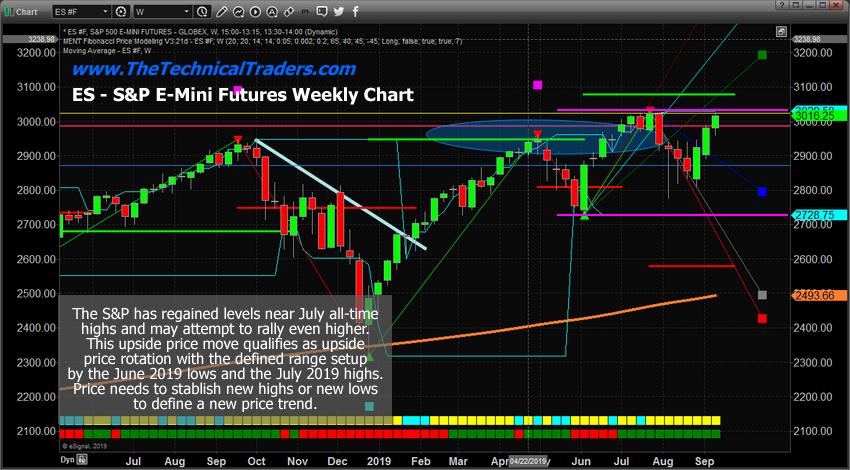

This ES Weekly chart highlights the range-bound price rotation that currently dominates the U.S. stock market. Overall, the U.S. stock market and the economy are much stronger than any other economy on the planet. The risk factor is related to the fact that the capital shift which has been pushing asset prices higher as more and more capital flows in the U.S. stock market may have reached a point of correction (headed into the U.S. presidential election cycle). As long as price stays within this range, we believe continued extreme volatility will continue. Our Fibonacci system suggests price must close above 3178 to qualify as a new bullish trend and/or close below 2577 to confirm a new bearish trend.

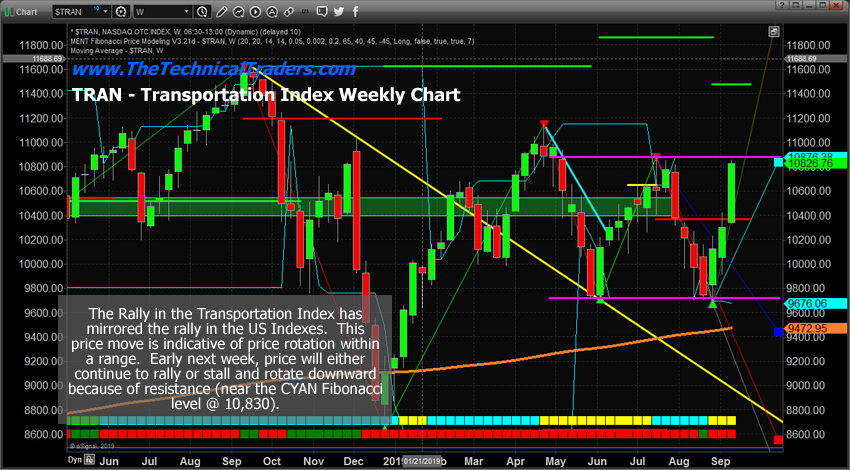

This Transportation Index weekly chart shows a similar setup. Although the Fibonacci price trigger levels are vastly different. Price would have to climb above 11,475 to qualify for as a new bullish trend whereas it would only have to fall below 10,371 to qualify as a new bearish trend. Given the past rotation levels, it is much more probable that price may rotate into a bearish trend before attempting to reach anywhere near the bullish price trigger level.

Our Custom volatility index suggests price has rallied last week well into the upper “weakness zone.” This move suggests the upside price move may already be well into the overbought levels (again) and may begin to stall. Traders need to be cautious near these level. We continue to suggest that skilled technical traders should look to pull some profits from these lofty levels to protect cash/profits. Any extreme volatility and/or a bigger price rotation could be disastrous for unprepared traders.

We are excited to see what happens early next week. News will be a big factor – as it always is in this world. Pay attention to how the markets open early this week and keep your eyes open for any crisis events (wars, bombings or other geopolitical news). And get ready for some really big volatility to hit the global markets.

This is the time for skilled technical traders to really shine as these bigger moves roll on.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Related Articles

One of the easiest risks to minimize in investing is excessive fund fees. That’s why, when looking for ETFs, you should always try to minimize the management fee, which is the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Six Best High Dividend ETFs: Main Similarities and Differences Dividend ETFs offer excellent protection for investors across volatile market cycles and provide great portfolio...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.