- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Equities Rose Last Week While Most Other Markets Declined

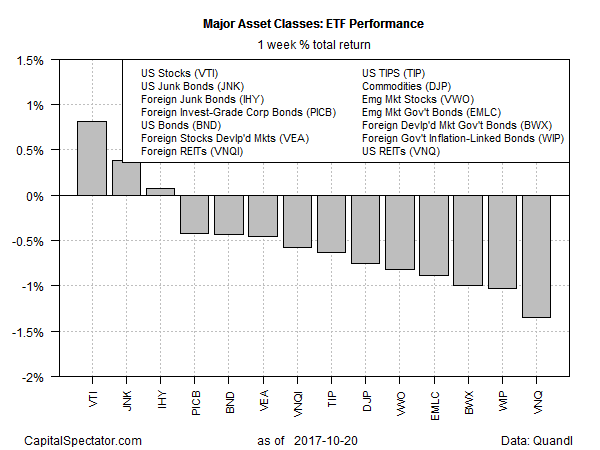

Losses dominated the major asset classes last week, based on a set of exchange-traded products. But three corners of the global markets bucked the trend with gains: US stocks, junk bonds in the US, and high-yield bonds in foreign markets.

The US stock market was the top performer for the five trading days through Oct. 20. Vanguard Total Stock Market (NYSE:VTI) gained 0.8% last week, marking the ETF’s sixth consecutive weekly advance.

Last week’s biggest loser: US real estate investment trusts (REITs). Vanguard REIT (NYSE:VNQ) shed 1.3%. The ETF’s slide is the first weekly setback since mid-September.

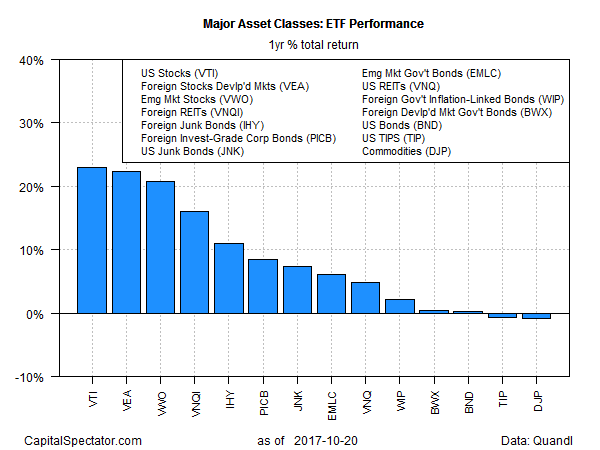

US stocks are in the lead for the one-year change too. VTI is ahead by nearly 23% over the past 12 months.

Foreign stocks are in close pursuit. The number-two performer for one-year results: Vanguard FTSE Developed Markets (NYSE:VEA), which is up 22.3% vs. the year-earlier level. The third-strongest performance for the trailing one-year change: a 20.7% total return for Vanguard Vanguard FTSE Emerging Markets (NYSE:VWO)

Meanwhile, broadly defined commodities continue to wallow in last place for year-over-year comparisons. iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) is down 0.9% vs. its year-ago price.

Related Articles

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

The major market indexes have struggled this year to produce returns. Many actively managed ETFs have fared better than their index counterparts. Here are 3 top actively managed...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.