- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Univar Acquires Certain Assets Of Mosaic's HFS Business

Univar Solutions Inc. (NYSE:UNVR) recently announced that it acquired certain assets of the hydrofluorosilicic acid (“HFS”) business of The Mosaic Company (NYSE:MOS) in late 2019.

Notably, Univar is a major supplier to the water treatment market, including the U.S. municipal market, with a wide variety of chemical products for application at all water treatment levels.

Per the terms of the arrangement, some of Mosaic's customer contracts, rail and supply-chain deals have been assumed by Univar to extend and boost its capabilities to better serve municipal drinking water plants. Notably, Univar is working with other HFS producers to ensure high quality and reliable supply of HFS.

Per management, with the addition of new capabilities, Univar is well-placed to help suppliers and customers overcome problems of complex water treatment. The company can help drive sustainable and next-generation solutions for customers throughout the United States by investing in its water treatment business and depending on the experienced team’s expertise.

Notably, the dedicated water treatment team of Univar provides on-site evaluations, technical assistance and specialized market expertise to solve the needs of complex water treatment.

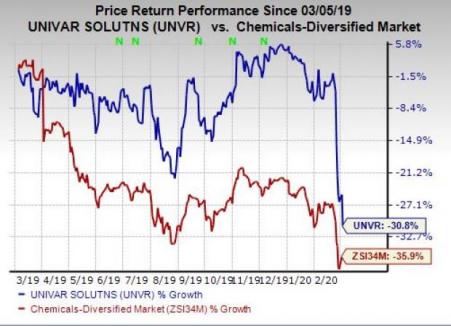

The company’s shares have lost 30.8% over a year compared with a 35.9% decline recorded by its industry.

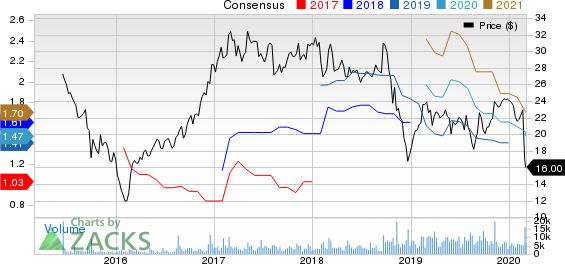

Univar slipped to a loss of $55.1 million or 33 cents per share in fourth-quarter 2019 from a profit of $1.2 million or a penny per share a year ago. Adjusted earnings per share of 29 cents per share lagged the Zacks Consensus Estimate of 33 cents.

Net sales rose 9% year over year to $2,155 million in the fourth quarter. However, it lagged the Zacks Consensus Estimate of $2,273 million.

On the fourth-quarter earnings call, Univar envisioned sustained weakness in end markets and a challenging competitive environment for the first half of 2020. It expected the first quarter to be the weakest of the year.

For 2020, the company sees adjusted EBITDA of $700-$740 million. Univar expects adjusted EBITDA of $150-$160 million for the first quarter of 2020.

It also expects to generate free cash flow of $120-$170 million for 2020.

Univar Inc. Price and Consensus

Zacks Rank & Stocks to Consider

Univar currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. (NYSE:DQ) , and NovaGold Resources Inc. (NYSE:NG) .

Daqo New Energy has a projected earnings growth rate of 353.7% for 2020. The company’s shares have rallied 73.9% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have surged 117.4% in a year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

The Mosaic Company (MOS): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

Univar Inc. (UNVR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.