- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

United Technologies Hits 52-Week High On Solid Growth Trends

Shares of industrial goods manufacturer United Technologies Corporation (NYSE:UTX) scaled a new 52-week high of $126.44 during Friday’s trading session, before closing a tad lower at $126.17 for a healthy year-to-date return of 16.5%. Barring minor hiccups, United Technologies’ share price has steadily been on an uptrend since mid-September.

Despite its strong price appreciation, this Zacks Rank #3 (Hold) stock has the potential to continue its upward trend with long-term earnings growth expectation of 8.4%.

Growth Drivers

United Technologies serves various end markets such as aerospace, defense and commercial construction, that move according to their own cycles. This business mix and diversification allow the company to remain profitable even during tough economic times.

In addition, United Technologies has a strong aftermarket business. The company not only manufactures and sells primary products such as elevators, aircraft engines and helicopters but also sells spare parts and offers related services to keep those primary products running.

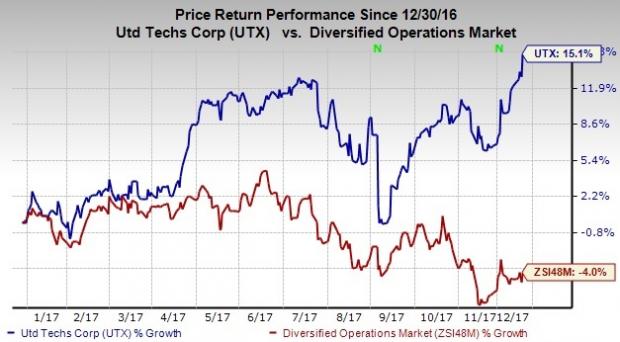

The company’s aftermarket services business is relatively stable compared to new product delivery. It further helps offset the negative impact of downturns in the new products market. With a diligent execution of operational plans, the company has outperformed the industry with an average year-to-date return of 15.1% against a decline of 4% for the latter.

United Technologies has also revamped its aerospace unit. This included an overhaul of its organizational structure in the aerospace business along with some key changes in the leadership positions within it. United Technologies anticipates that the streamlined organizational setup would enable it to better serve its customers. In addition, the company expects that the strategic moves will further ensure a successful entry and production ramp-up of its Geared Turbofan engines to thwart intense competition from other players in the market.

Incorporating its improved expectations for organic sales growth in the near future, management has raised its guidance for 2017. Adjusted earnings are currently anticipated to lie within the $6.58-$6.63 per share range compared with the previously estimated range of $6.45-$6.60. Additionally, the company raised its revenue guidance for 2017 from the previous projection of $58.5-$59.5 billion to $59-$59.5 billion (estimating an organic growth of 3-4% year over year). Despite a challenging macroeconomic environment and continued investments in the aerospace segment, the company expects to generate significant cash from operations to reward the shareholders with a risk-adjusted return through share repurchases and dividends. This represents improving business conditions and strong operating fundamentals of the company.

All these measures for a healthy near-term growth probably raised investor confidence and drove the shares to a 52-week high.

Stocks to Consider

Some better-ranked stocks in the industry are Danaher Corp. (NYSE:DHR) , 3M Company (NYSE:MMM) and Leucadia National Corp. (NYSE:LUK) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danaher has a long-term earnings growth expectation of 10.6%. It surpassed estimates in each of the trailing four quarters with an average positive surprise of 2.6%.

3M has a long-term earnings growth expectation of 10.2%. It delivered earnings beat thrice in the trailing four quarters with an average positive surprise of 2.5%.

Leucadia has an expected long-term earnings growth rate of 18%. It exceeded estimates thrice in the last four quarters with an average beat of 21.2%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

3M Company (MMM): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

United Technologies Corporation (UTX): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.