- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cheniere Energy Initiates Work Under KOGAS LNG Supply Deal

U.S.-based natural gas exporter Cheniere Energy, Inc (NYSE:LNG) recently commenced work under its long-term supply contract with South Korean natural gas utility Korea Gas Corporation , aka, KOGAS. The first shipment – loaded on Jun 3 – is in transit from Sabine Pass to South Korea’s Tongyeong and is likely to arrive on Jul 1.

The 20-year supply contract, inked in Jan 2012, aims to supply U.S.-sourced LNG from the Sabine Pass Liquefaction facility in Louisiana to KOGAS. Per the deal, Cheniere Energy is expected to deliver about 3.5 million tons of LNG per year which is 10% more than South Korea’s total annual demand.

South Korea depends heavily on Middle Eastern countries including Oman and Qatar for its import requirements through state-run KOGAS. The country is the second-largest LNG importer in the world due to the paucity of domestic resources to meet its energy demands. Further, post the election of Moon Jae as the President of the nation, the country is likely to make a shift to natural gas and other renewable sources of energy as opposed to coal and nuclear power. As such, the 20-year sales and purchase agreement will enable KOGAS to position itself better to capitalize on the transition policy. KOGAS intends to import 1.5 million tons of natural gas this year, increasing the South Korea’s imports to 36 million tons.

KOGAS, being the largest buyer of natural gas in South Korea, is also in talks with Cheniere Energy to acquire additional capacity for the commercialization of its two liquefaction trains.

With the energy production boom in U.S., the nation is likely to become the world’s largest LNG supplier by 2035, transcending Australia and Qatar. Cheniere Energy, which is the only LNG exporter of U.S., is expected to ship 200 LNG vessels this year. The company exports natural gas to around 20 countries. The gas contract with KOGAS is likely to generate over $548 million of revenues for Cheniere Energy per year.

Zacks Rank & Key Picks

Cheniere Energy is primarily engaged in liquefied natural gas-related businesses. The company owns and operates the Sabine Pass liquefied natural gas terminal in Louisiana through its 57.9% ownership interest in and management agreements with Cheniere Energy Partners, L.P. (NYSE:CQP) .

The company, under the Zacks categorized Oil and Gas - United States - Exploration and Production industry, carries a Zacks Rank #3 (Hold).

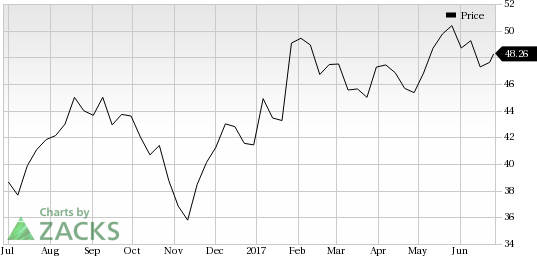

Cheniere Energy, Inc. Price

Some better-ranked players in the same industry include Viper Energy Partners LP (NASDAQ:VNOM) and W&T Offshore, Inc. (NYSE:WTI) . While Viper Energy sports a Zacks Rank #1 (Strong Buy), W&T Offshore carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Viper Energy Partners delivered a positive earnings surprise in each of the trailing four quarters, the average being 20.35%.

W&T Offshoredelivered a positive earnings surprise in each of the trailing four quarters, the average being 69.21%.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500. See today's Zacks "Strong Sells" absolutely free >>

Cheniere Energy Partners, LP (CQP): Free Stock Analysis Report

W&T Offshore, Inc. (WTI): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Viper Energy Partners LP (VNOM): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.