- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

UDR Sees Q1 Results In Line With Prior View, Updates On Liquidity

UDR Inc. (NYSE:UDR) recently announced that it expects its first-quarter results to be in line with the previously-issued guidance. However, the company will address its full-year guidance during the first-quarter earnings conference call.

The move comes in the wake of the coronavirus outbreak wreaking havoc on the global economy, with the number of infected patients in the United States skyrocketing. The crisis has battered most industries, the residential REIT sector being no exception.

Moreover, UDR’s measures include aligning of its operational policies with state and local regulations and this comprised eviction moratoriums in many markets. The company is making efforts in accommodating residents, commercial tenants and associates affected by the outbreak as required.

Uncertainties relating to the pandemic’s crippling economic impact, and associated government actions and regulations on the residential REIT sector’s performance have been heightening. Therefore, UDR’s residential REIT counterparts, including Mid-America Apartment Communities, Inc. (NYSE:MAA) and Apartment Investment and Management Company (NYSE:AIV) and AvalonBay Communities, Inc. (NYSE:AVB) have withdrawn their full-year 2020 guidance.

Given the current capital-market conditions and the uncertain environment, UDR has updated on its liquidity and debt position. The company said that it has a combined $1.175-billion revolving credit facility and working capital credit facility, with roughly $900 million in available capacity currently. While the revolving credit facility is scheduled to mature in 2023, there are options to extend the maturity to 2024.

Further, the company noted that with hard money deposits, it is under contract to vend two wholly-owned operating communities in Greater Seattle, WA, for $142 million in aggregate and the transactions are expected to close during the second quarter, assuring about the company’s liquidity position.

Regarding its debt position, UDR noted that through 2022, just 2%, or $105 million, of its consolidated debt outstanding is slated to mature. The figure, however, excludes commercial paper and amounts due under its $75-million working capital credit facility. Supporting its balance-sheet strength, the company’s unencumbered asset pool comprises 87.5% of total net operating income and as of Mar 25, 2020, the company has minimal external growth funding commitments with a development pipeline comprising less than 2% of enterprise value.

In addition to the above-mentioned financial updates, UDR announced certain additional steps to deal with this pandemic. These include practicing “social distancing” through reduction of on-site-leasing office staff, closure of leasing offices to only UDR Associates, closing all amenity spaces and several others. The company’s Next Generation Operating Platform also helped shift all property/home tours to virtual.

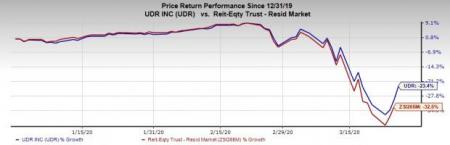

Shares of this Zacks Rank #3 (Hold) company have depreciated 23.4% so far this year, while its industry has declined 32.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Apartment Investment and Management Company (AIV): Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR): Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA): Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.