- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

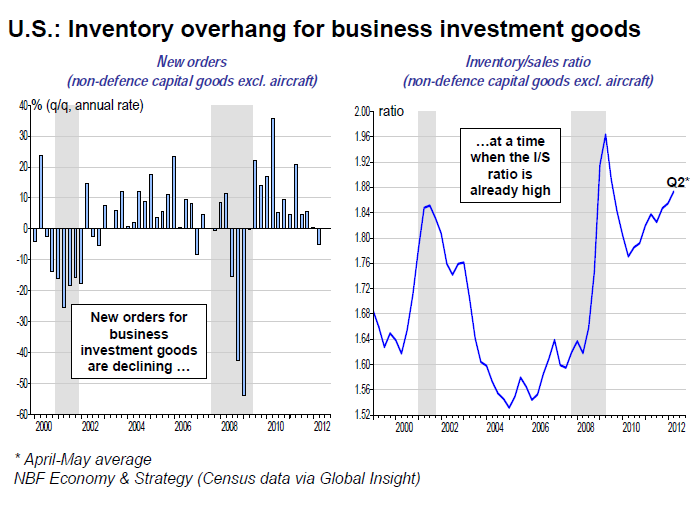

U.S.: Inventory Overhang For Business Investment Goods

The U.S. economy is showing tangible signs of an inventory overhang for business investment goods. According to just-released data, new orders for nondefence capital goods excluding aircraft rose for the first time in three months in May. Alas, this was not enough to make up for previous losses. As today’s Hot Chart shows, new orders are actually down an annualized 5% so far in Q2. In our opinion, new orders are likely to remain soft in the coming months on the back of declining activity in Europe and the uncertainty about U.S. corporate taxes in the coming year. Unfortunately, the softness in new orders comes at time when the inventory-to-sales ratio for business investment goods is at its highest level in over a decade outside a recession. In our opinion, this heralds a production slowdown in the coming months.

Related Articles

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Last week, we discussed the more extreme levels of bearishness that have gripped the markets as of late. “In other words, while the media scrambled to align reasons with the...

I’m sure this week will be interesting, given the CPI and PPI reports. I’m sure the administration will have plenty of on-again and off-again policy statements about something....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.