- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Jobs Market: April 12, 2012

To an extent, the market’s obsession with monthly job numbers is understandable. Over time, employment is the key determinant of economic growth, consumer spending, personal incomes and corporate profits. Unfortunately, the monthly post-mortems more often than not obscure the long-term structural dynamics and likely future evolution of the U.S. labour market.

In a detailed March 2012 report, entitled “The Future of Employment and Household Incomes in the United States: The Service Sector to the Rescue?” we argued not only that the employment numbers do not adequately reflect the realities of the job market but also, more importantly, that the quality of new jobs being created in the key service sector is declining. As a consequence, real hourly wages, benefits and disposable personal incomes are stagnating, undermining the ability of the U.S. consumer to spearhead a new era of robust and sustainable economic growth for the foreseeable future.

The March jobs numbers confirmed once again that the participation rate (i.e., the number of people working or looking for work) is continuing its long-term structural decline from a peak of 67% in 2000 to 63.8%. With the number of people looking for work down 164,000, the employment gains of 120,000 jobs was largely an illusion.

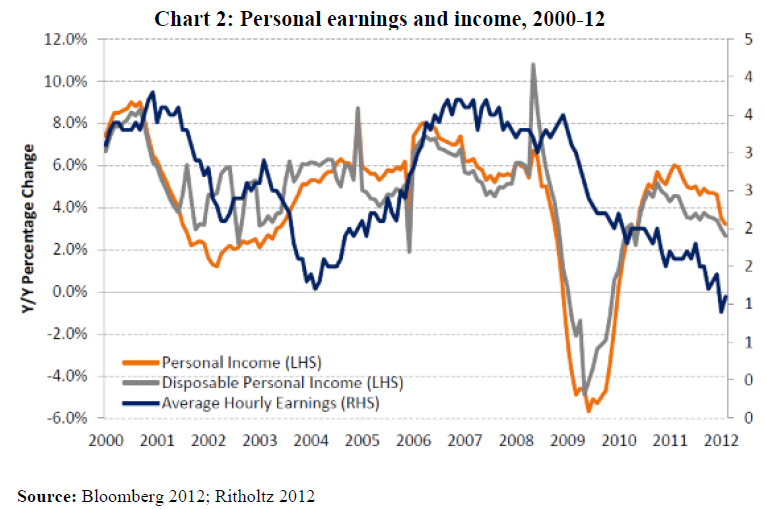

Real disposable income has grown only 0.3% over the past year, with declines in three of the past four months. While real spending increased 0.2% in January and 0.5% in February, personal savings as a percent of disposable income dropped to 3.7% in February from 4.3% in January. Considering negative real interest rates, fiscal deficits above $1 trillion and an aggressive Fed balance sheet, the numbers are mediocre at best.

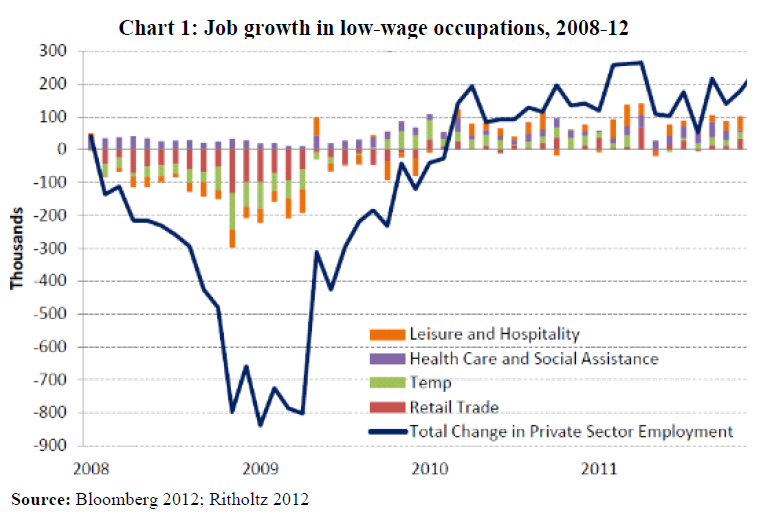

Recent data has supported our view that the quality of jobs being created is weak, and largely confined to the low-paying areas of the economy. As illustrated in Chart 1 below, roughly 41% of the jobs created since 2010 are in the low-wage sub sectors of leisure and hospitality, healthcare and social assistance, retail trade and temporary jobs – which currently only account for 29% of the total labour force.

As Joseph Brusuelas highlights, “Factoring in public sector job losses, these four sub sectors account for a whopping 70% of all gains during the past six months.” Unsurprisingly, and as Chart 2 illustrates, “the pace of income gains is well below that of the past two jobless recoveries and real average hourly earnings continue to decline” (“Labour Gains Increasingly Driven by Low-Wage Jobs”, Bloomberg Briefs, April 5, 2012).

Equally troubling is the fact that most of the job growth has been in the 55-and-over age group. According to John Hussman, “since June 2009, total non-farm payrolls in the U.S. have grown by 1.84 Million jobs. However, if we look at workers 55 years of age and over, we find that employment in that group has increased by 2.96 million jobs. In contrast, employment among workers under age 55 has actually contracted by 1.12 million jobs. Even over the last year, the vast majority of job creation has been with 55-and-over group (currently only 6.2% unemployment), while employment has been sluggish for all other workers, and has already turned down” (“Is the Fed Promoting Recovery or Desperation?”, Advisor Analyst Views, April 2012). While part of the explanation can be found in the aging of the workforce, current economic and financial conditions have pressured older workers to remain in or return to the workforce, and to accept low-skilled low-paying jobs.

Much has been made of the recent “manufacturing renaissance” in the United States. While it is real and should not be underestimated, it is largely the result of lower wages and benefits, some aggressive incentives by various levels of government and some “right-sizing” following the recession. While China’s wages have arguably increased, and some low-cost producers will leave China, the winners will likely be India, Vietnam, Bangladesh, Indonesia and eventually Africa.

High structural levels of unemployment – particularly among young workers – deteriorating household incomes and rising income inequalities will continue to accentuate the current gridlock and polarization undermining the ability of the U.S. political system to chart a clear path to deal with the deficit, national debt, taxes and growth.

The factors which have led to the outperformance of U.S. stock markets remain largely intact, including historically low interest rates, the advance of automation and offshoring, lower labour costs and growing exposure to reasonably resilient emerging markets. Going forward, however, other than the key geopolitical risks in Europe and Iran, investors will need to consider that robust and sustainable consumer spending will not underpin U.S. economic growth for the foreseeable future.

Related Articles

We haven’t had to change our subjective probabilities for our three alternative economic scenarios for quite some time. We are doing so today and may have to do so more frequently...

The US, Japan, and parts of Europe had a rough week, while China, Germany, France, and the Euro Stoxx 50 stayed steady. Tariffs, central banks, and the war in Ukraine keep...

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.