- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Dollar Index: A Near-Term Look

More chopping since the Sept 14 low at 78.60, trading in a tighter and tighter range and as the market continues to form a contracting triangle/pennant over the last few months. These are seen as continuation patterns, suggesting an eventual downside resolution (though such weakness may be limited, see longer term below). Note too the series of 3 wave moves in both directions (a-b-c's) adds to this view, as these patterns break down to a series of 5, 3 wave moves, but also suggests another week (or more) of ranging in the pattern first (see "ideal" scenario in red on daily chart below). Nearby support is seen at the base of the pattern (currently at 79.00/10), while resistance is seen at the ceiling (currently at 80.75/85).

Strategy/Position

With at least another week (or more) of trading within the triangle pattern ahead, would stay with the strategy of trading with a very short term bias (too short a timeframe for these emails), fading the extremes of the pattern, and then being very aggressive with trailing stops in an attempt to capture some of intra-pattern moves. For the purposes of the email, would remain patient but looking to sell once the confidence of an approaching resolution (likely nearing the ceiling) increases.

Long-Term Outlook

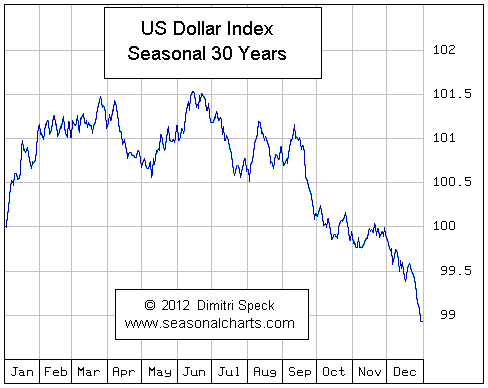

As discussed above, an eventual downside resolution to the multi-month triangle is favored. However, such a move lower may be limited and part of a more major bottoming, and not the start of a more significant down move (see "ideal" scenario in red on weekly chart/2nd chart below). Note that lots of support lies just below the Sept low at 78.60 in the long discussed 78.10/40 support area (March low, 50% retracement from the May 2011 low), and as often discussed, markets have a way of eventually reaching these key, longer term areas before reversing. Also, triangles/pennants occur just before the final leg in a larger trend (down in this case and in Elliott Wave terms occur in waves b or 4), the seasonal chart is firmer into the end of the year (see 3rd chart below), and the market remains within an even larger triangle since Nov 2005 with eventual gains to its ceiling (currently at 86.60/85) still favored.

Strategy/Position

Still a longer term bull but with a downside resolution of the triangle (and final downleg) favored, would be a bit more patient before switching the bias from neutral back to the bullish side.

- Near-Term: fade extremes of multi-month triangle, but with eventual down resolution favored.

- Last: sold Dec 7 at 80.45, too profit Jan 2 above t-line from Nov (79.80, closed 79.85 for 60 ticks).

- Longer term: neutral Dec 24 at 79.50 from bull Nov 5 at 80.75, but looking to switch back ahead.

- Last: bull bias Mar 12 at 80.05 to neutral Aug 6th at 82.30, another month or 2 of wide chop.

Related Articles

US Dollar Index is experiencing a very strong decline, a move we have been warning about for weeks. Since the start of the year, we have discussed potential dollar weakness, which...

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.