- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

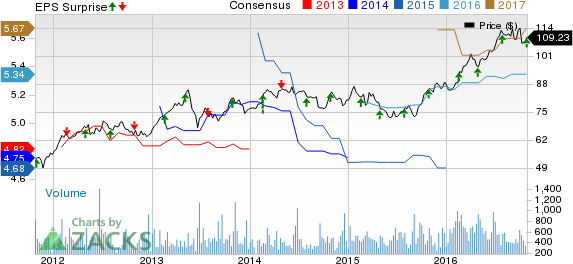

PS Business Parks (PSB) Q3 FFO Beats: Will The Stock Gain?

PS Business Parks Inc.’s (NYSE:PSB) third-quarter 2016 adjusted funds from operations (“FFO”) per share came at $1.43, beating the Zacks Consensus Estimate by 3 cents and improving 19.2% from $1.20 in the prior-year quarter. We expect this better-than-expected performance to lead to stock movement.

Results reflected a rise in net operating income (NOI) together with lower preferred distributions as well as reduced interest expense.

Total operating revenues came in at around $97.5 million, reflecting 4.3% growth from the prior-year period. The figure also surpassed the Zacks Consensus Estimate of $96 million.

Quarter in Detail

Same Park rental income climbed 3.8% year over year, mainly attributable to improving occupancy and rental rates; while Same Park operating expenses inched up 0.6%. As a result, Same Park NOI rose 5.3% year over year. On the other hand, non-Same Park NOI jumped 44.6% year over year led by an increase in occupancy.

Annualized Same Park realized rent per square foot rose 3.2% year over year to $14.81. Same Park weighted average occupancy in the quarter was 94.1%, up 50 basis points (bps) year over year; while Non-Same Park weighted average occupancy grew to 96.7% from 85.6% a year ago.

Liquidity

PS Business Parks exited third-quarter 2016 with cash and cash equivalents of $5.0 million, lower than the prior-year end tally of $188.9 million. The company had $190.0 million available under its $250-million unsecured credit facility at the end of the third quarter.

Dividend Update

Concurrent with its third-quarter earnings release, the company announced a regular quarterly dividend of 75 cents per share, payable on Dec 29 to shareholders of record on Dec 14.

Conclusion

PS Business Parks’ diversified portfolio and its ample liquidity augur well for long-term growth. Moreover, healthy fundamentals in the multi-tenant flex, office and industrial asset categories are expected to drive growth, while portfolio repositioning strategies can help the company emerge stronger. However, pricing pressure in certain markets, intense competition from developers, owners and operators, and any rise in interest rate are key concerns.

PS Business Parks currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of the other REITs – Essex Property Trust Inc. (NYSE:ESS) , Kimco Realty Corp. (NYSE:KIM) and The Macerich Company (NYSE:MAC) . All of them have their third quarter-earnings scheduled on Oct 27.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

KIMCO REALTY CO (KIM): Free Stock Analysis Report

MACERICH CO (MAC): Free Stock Analysis Report

ESSEX PPTY TR (ESS): Free Stock Analysis Report

PS BUSINESS PKS (PSB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.