- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tyson Foods (TSN) Stock Gains On Q4 Earnings, Sales Beat

Tyson Foods, Inc. (NYSE:TSN) posted better-than-expected results in fourth-quarter fiscal 2017, wherein earnings and sales surpassed the Zacks Consensus Estimate. The company reported adjusted earnings of $1.43 per share that outpaced the estimate of $1.38 and improved 49% year over year. The results mainly benefitted from strong performance by the Beef and Chicken segments.

Following the results, Tyson Foods’ shares rallied roughly 1.3% during pre-market trading hours. We note that in the past three months, the stock has returned 12.6% compared with the industry’s rally of 6.9%.

Revenues and Margins

Net sales increased 10.8% to $10,145 million primarily on improved sales across all food segments and beat the Zacks Consensus Estimate of $9,951 million. Sales volume increased 3.2% during the quarter, while average sales price rose 7.3%.

Tyson Foods' adjusted operating income increased 53.9% to $902 million owing to improved performance by Chicken, Beef, Pork and Prepared Food categories. Adjusted operating margin expanded 250 basis points (bps) to 8.9%.

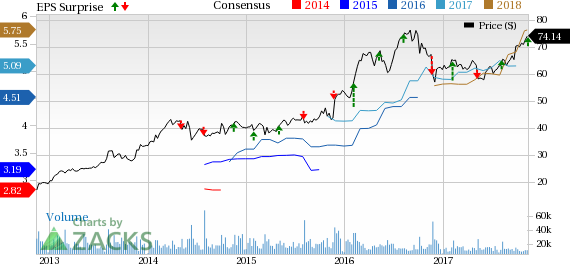

Tyson Foods, Inc. Price, Consensus and EPS Surprise

Segment Details

Chicken: Sales for the segment were $3,035 million. Sales volume increased 4.1% year over year owing to higher demand for chicken products and increased volumes, resulting from the AdvancePierre buyout. Average sales price in the quarter increased 3.7% due to change in sales mix. Adjusted operating income rose 46.4% to $322 million, while adjusted operating margin expanded 280 bps to 10.6% during the quarter.

Beef: Sales for the segment were $3,808 million. Sales volume rose 3.3% year over year owing to robust domestic demand for beef products, improved availability of cattle supply and higher exports. These factors positively impacted the average sales price, which increased 6%. Adjusted operating income in the quarter was $313 million, up from the prior-year figure of $139 million. Adjusted operating margin expanded 420 bps to 8.2% during the quarter.

Pork: Sales for the segment were $1,362 million. The segment’s sales volume declined 1.2% year over year, thanks to the company’s effort to balance supply with consumers’ demand. Average sales price increased 11.7%. Adjusted operating income for the segment was $124 million depicting a 14.8% increase from the prior-year quarter. Adjusted operating margin increased 40 bps to 9.1%.

Prepared Foods: Sales for the segment were $2,263 million. Prepared Foods’ sales volume grew 9.5% due to incremental volumes arising from the buyout of AdvancePierre. These were partially offset by fall in food service. Average sales price rose 12.5% owing to favorable product mix from the acquisition of AdvancePierre and higher input costs. Adjusted operating income was $152 million in the quarter depicting a 14.3% rise year over year. Adjusted operating margin contracted 50 bps to 6.7%.

Other: Sales for the segment were $92 million. Sales volume and average selling price in the segment declined 2.7% and 1.7%, respectively. The segment incurred operating loss of $9 million compared with the loss of $14 million in the year-ago quarter.

Fiscal 2017 Results

Sales for fiscal 2017 amounted to $38,260 million depicting a 3.7% increase from the year-ago figure. Adjusted operating income for the year totaled $3,263 million, improving 15.2% from the year-ago figure. Adjusted operating income per share for the fiscal was $5.31, reflecting a 21% growth from the year-ago figure.

Other Financial Update

Tyson Foods, which flaunts a Zacks Rank #1 (Strong Buy), exited the quarter with cash and cash equivalent of $381 million, long-term debt of $9.3 billion and shareholders’ equity of $10.6 billion. Further, management projects capital expenditures at approximately $1.4 billion for fiscal 2018.

On Nov 10, Tyson Foods raised quarterly dividend per share to 30 cents on its Class A shares and 27 cents on its Class B shares. This is payable on Dec 15, 2017, to shareholders of record as of Dec 1.

Guidance

For fiscal 2018, Tyson Foods anticipates sales to amount approximately $41 billion, up 7%. The upside can be attributed to higher revenues from AdvancePierre, increased volumes in its legacy business and enhanced pricing in the Chicken segment. The company envisions fiscal 2017 earnings in the range of $5.70-$5.85 per share, reflecting an increase of 7-10% year over year. The Zacks Consensus Estimate for the fiscal is currently pegged at $5.75.

During the fourth quarter, the company announced a Financial Fitness Program, which is expected to enhance operating efficiency in the forthcoming periods. For fiscal 2018, USDA expects overall domestic protein production (chicken, beef, pork and turkey) to increase roughly 3-4% year over year.

Looking for More Consumer Staple Stocks? Check These

Investors interested in the same sector may also consider stocks such as McCormick & Company, Inc (NYSE:MKC) , MGP Ingredients, Inc. (NASDAQ:MGPI) and Inter Parfums Inc. (NASDAQ:IPAR) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

McCormick delivered an average positive earnings surprise of 4.1% in the trailing four quarters. It has a long-term earnings growth rate of 9.4%.

MGP Ingredients delivered an average positive earnings surprise of 9.9% in the trailing four quarters. It has a long-term earnings growth rate of 15%.

Inter Parfums delivered an average positive earnings surprise of 19% in the trailing four quarters. It has a long-term earnings growth rate of 12.3%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.