- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

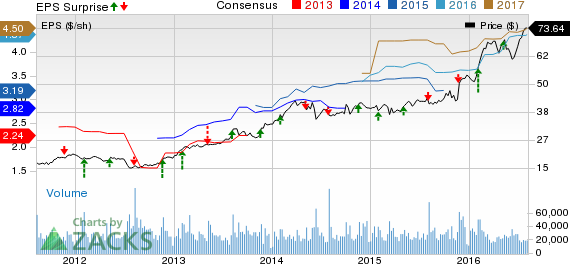

Tyson Foods (TSN) Q3 Earnings And Sales Beat Estimates

Tyson Foods, Inc. (NYSE:TSN) posted third-quarter fiscal 2016 results, wherein both earnings and revenues beat the Zacks Consensus Estimate.

In the fiscal third quarter, adjusted earnings of $1.21 per share surpassed the Zacks Consensus Estimate of $1.07 by 13.08% and improved 51% from the year-ago tally of 80 cents on higher margins.

Revenues and Margins

Net sales gained 6.6% to $9.403 billion due to higher sales across most of segments like chicken, beef, pork and prepared foods segments. Sales outpaced our expectation of $9.23 billion by 1.8%. Sales volume dipped 2.7%, while average sales price (ASP) went down 4.1%.

Tyson's adjusted operating income surged 35.03% to $767 million due to lower feed costs. Adjusted operating margin rose 260 basis points (bps) to 8.2%.

Segment Details

Chicken: Sales at this segment remained almost flat year over year at $2.74 billion as a 0.9% dip in sales volume was offset by a 0.4% reduction in average price. Sales volume declined due to company’s strategy of optimizing its mix. Average sales price increased in the fiscal third quarter on positive mix.

Beef: Sales at this segment declined 12.12% year over year to $3.78 billion, as 2.9% increase in sales volume was offset by a 14.6% decrease in average selling price (ASP). ASP declined due to higher domestic availability of fed cattle supplies, while sales volume was hurt by reduction in live cattle processed.

Pork: Pork segment sales were up 5.30% year over year to $1.27 billion as 1.7% increase in sales volume was offset by a 7.2% rise in average price.

Prepared Foods: Sales at Prepared Foods remained flat year over year at $1.80 billion as 1.9% gain in volume was offset by an equal decline in ASP. Adjusted sales volume grew on positive mix. Adjusted ASP slipped primarily due to a decline in input costs, partially offset by a change in product mix.

Other: In the fiscal first quarter, the company’s International segment was shifted under ‘Other’ following the sale of the Mexico and Brazil chicken operations in fiscal 2015. The Other segment also includes the foreign operations related to raising and processing live chickens in China and India and third-party merger and integration costs.

Sales nosedived to $99 million from $244 million in the year-ago quarter.

Fiscal 2016 Guidance

For fiscal 2016, Tyson maintains sales guidance at approximately $37 billion, lower than the year-ago level due to declines in beef, pork and feed prices.

The company expects an increase in overall domestic protein production (chicken, beef, pork and turkey) of roughly 2–3% year over year.

The company projects annual earnings in the range of $4.40–$4.50 per share compared with $4.20–$4.30 per share expected earlier.

Fiscal 2017 Guidance

The company issued fiscal 2017 guidance in concurrence with the earnings call. The company expects sales to inch up 1% as sales volume grow, partially offset by the impact of lower beef, pork and chicken prices. For fiscal 2017, the company expects domestic protein production (chicken, beef, pork and turkey) to increase approximately 2–3% from the fiscal 2016 levels. Tyson expects to realize synergies of approximately $700 million in fiscal 2017 from the acquisition.

Tyson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the consumer staple sector include Omega Protein Corporation (NYSE:OME) , Post Holdings, Inc. (NYSE:POST) and Pinnacle Foods Inc. (NYSE:PF) . While Omega Protein sports a Zacks Rank #1 (Strong Buy), Post Holdings and Pinnacle Foods holds a Zacks Rank #2 (Buy).

TYSON FOODS A (TSN): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

POST HOLDINGS (POST): Free Stock Analysis Report

PINNACLE FOODS (PF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Market Overview: S&P 500 Emini Futures The S&P 500 Emini has formed a monthly Emini trading range in the last 5 months. The bulls want a breakout into new all-time highs...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.