- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Two Tech Titans Are Regaining Their Mojo

As of yesterday, earnings for the Zacks Computer and Technology sector were up +23.3% from a year ago, with revenues up +10.9%. This amazing performance is not expected to be an isolated to Q3 17, as current estimates are pointing to double digit growth over the next three quarters as well. Within the tech sector, the three biggest areas of growth are expected to come from the cloud, IoT (internet of things), and data centers. The table below shows the earnings and revenue growth for the most recent time periods, and some historical context.

.jpg)

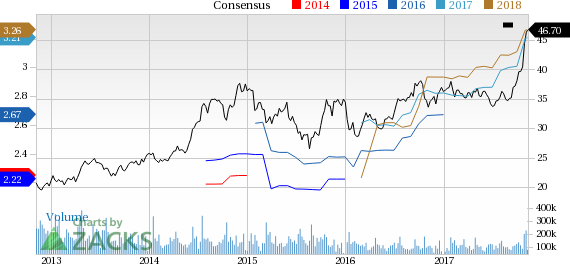

This week, I highlight two technology companies that have exposure to these high growth areas and pay out a solid dividend.

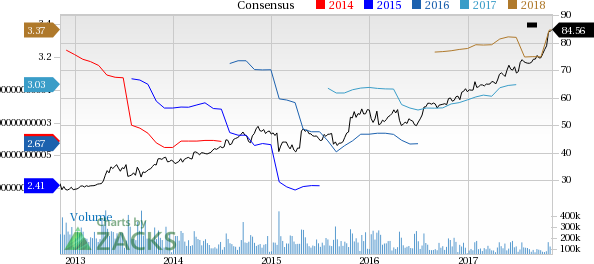

First is Microsoft (MSFT), a Zacks Rank #2 (Buy), recently reported earnings where they easily beat both the Zacks consensus earnings and revenue estimates for the fourth consecutive quarter. Specifically, the company saw year over year gains in the following: revenues +12%, operating income +15%, net income +16%, and diluted earnings per share +17%. On a segment basis MSFT reported gains almost every group, but their big driver was cloud growth. In the quarter the company exceeded $20 billion in commercial cloud average rate of return (ARR), well ahead of their set goal two years ago. Commercial cloud revenues were up +56% year over year, and now accounts for 31% of revenues. Their Azure cloud computing service grew by +90% year over year, and was twice the growth rate of Amazon (NASDAQ:AMZN) Web Services (AWS).

This positive news caused management to guide Q2 revenues just above the street consensus, and kept EPS expectations in line with previous estimates. Further, management recently increased their dividend payment by +8% to $0.42 per share. This brings their annual dividend payment to $1.68 per share for a dividend yield of +2.0%.

Microsoft also just released their newest console, Xbox One X which supports 4K video, has 8 million pixels, and offers a high-dynamic range (HDR). This launch is an example of the company investing more money and time into their gaming business. MSFT is also looking to increase revenues via total subscriptions, games, and service sales for the Xbox One X. While we will have to wait a little bit to see how successful the new console sales are, if the lines outside the doors are any indications, it should be a hit.

As you can see in the Price and Earnings Consensus graph below, the stock price has been on a very good run for the past four quarters, and consensus annual earnings estimates have been rising as well.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.