- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Turkish Data: Economic Growth Ahead?

We had/are having important data this week in Turkey. I already wrote about consumer confidence in my latest post, and let me try to bring out a few general themes from the other releases rather than try to examine each in detail; after all, you have the analyst/market economist reports for that.

External Rebalancing: The current account deficit came in lower than expected in November, almost like a prelude to the rebalancing to come because of the slowdown this year. But the downside is that capital flows are also set to retreat, even if the political crisis is solved.

The construction sector is alive and well, but for how long: Two sets of data revealed a lot about construction. First, REIDIN residential property price indices showed that prices rose in December, even more so in Istanbul. I was really worried in the summer of 2012 that we would see mini-bust of the real estate boom because of the supply-demand mismatch. Demand has turned out to be strong since then, keeping prices rising- for now… Second, once adjusted for seasonality, it turned out that most of the gains in employment in October were coming from the construction sector. Of course, given the sector’s involvement in the graft scandal as well as the weak lira (a recent Central Bank study, based on survey data, claims that 70% of total debt in the sector is FX debt; I would guess that most of that debt is short-term), questions remain on the health of the sector this year.

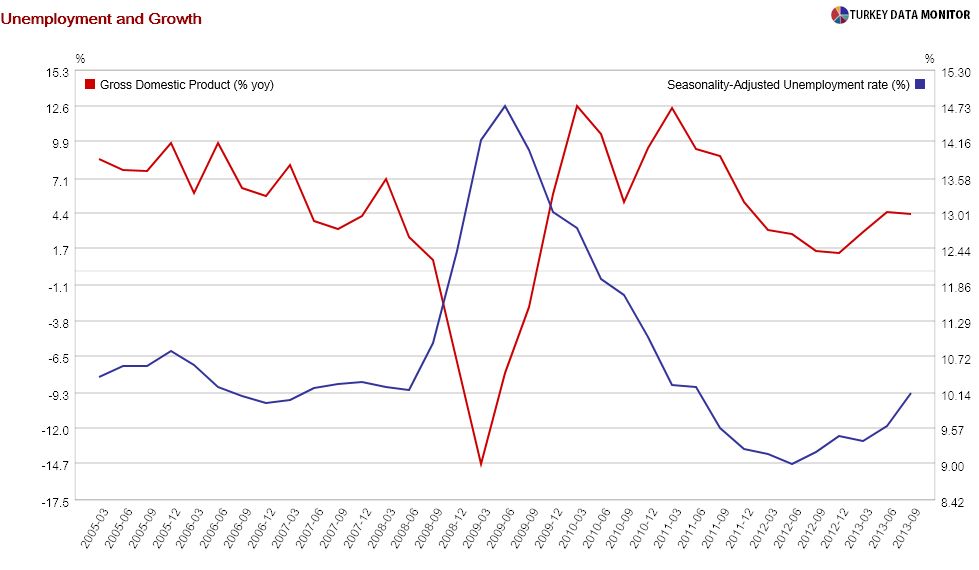

Unemployment: Speaking of the devil, seasonally-adjusted data showed a fall in unemployment in October, but that is not surprising, given that the the economy grew 4.5 and 4.4 percent in the second and third quarters of 2013 and that unemployment is a lagging indicator. In fact, Istanbul think-tank Betam, whom I consider to be Turkish labor market experts, noted that while the increase in the labor force was in line with structural trends, the rise in employment was in line with growth of around 4 percent. As with construction, the key question is whether unemployment will rise in 2014- and the answer depends on growth. Most Turkish economists would agree that you’d need growth on the order of 3-3.5 percent to prevent unemployment from rising.

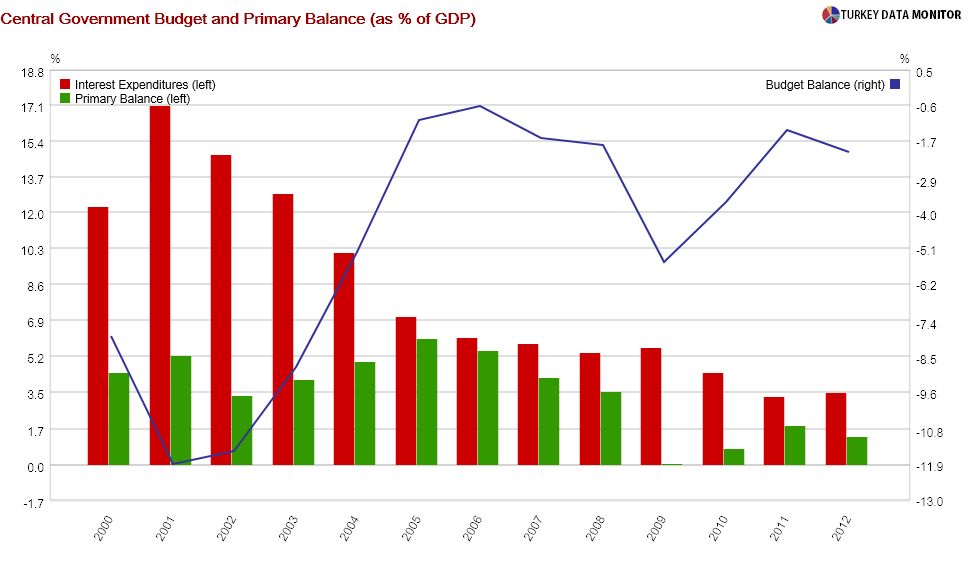

Budget: Last but not definitely not the least, the budget! Finance Minister Mehmet “Nominal” Simsek’s pride and joy- the lowest deficit to GDP ratio since 2006 that he announced to great fanfare on Wednesday. On the face of it, the figures do look impressive, but it is important to add in two small but important footnotes. First, the strong turnout was driven by value-added taxes, for imports as well as domestic goods. With the impending slowdown in domestic demand, you should not expect such a strong contribution from these items this year. More importantly, as the IMF recently noted in a blog post on the Turkish economy, the budget is not flexible, in the sense that a significant chunk of the expenditures is made up of “non-discretionary primary spending such as compensation to employees and transfers to social security”. On the revenue side, the dependence on indirect taxes means that revenues are extremely correlated with economic growth. In plainspeak, no growth, no taxes…

I apologize if this seemed a bit disorganized; it is past 1am in Turkey, and I am really sleepy. However, I am planning Friday’s Hurriyet Daily News column on the same topic, and so I should present it a bit more organized there.

Original post

Related Articles

Markets have been through another week where tariffs have been the driving force behind market moves. The PCE data which I had thought would be the major event for the week failed...

NFP take center stage amid DOGE layoffs ECB decides monetary policy after CPI data Canada jobs report and RBA minutes also on tap Will DOGE layoffs weigh on NFP? The US dollar...

US Dollar's Strength Triggers a Sell-Off in Gold The gold (XAU/USD) price plunged by more than 1.3% on Thursday as the US Dollar Index (DXY) moved sharply higher after a strong US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.