- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

McCormick (MKC) Q2 Earnings, Revenues Beat On Acquisitions

McCormick & Co. Inc. (NYSE:MKC) posted second-quarter fiscal 2017 results, wherein both the company’s earnings and revenues outpaced the Zacks Consensus Estimate. Shares were up 1.87% in the pre-market trading.

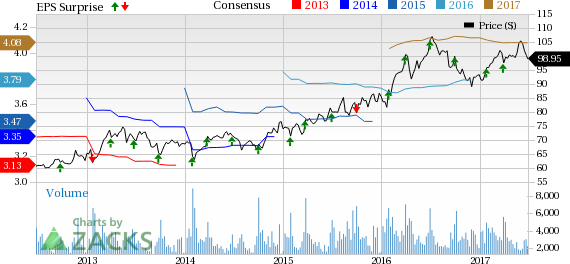

Adjusted earnings of 82 cents per share beat the Zacks Consensus Estimate of 77 cents by 6.5%. We note that the company has delivered positive earnings surprise in 12 of the last 14 straight quarters. In the third quarter, adjusted earnings were also 9% higher year over year owing to higher operating income. Further, the favorable impact of higher sales and cost savings were offset by an increase in brand marketing and material costs and currency headwinds.

Revenues and Profits

In the reported quarter the global leader in flavors and spices generated revenues of $1.11 billion, which exceeded the Zacks Consensus Estimate of $1.09 billion by 1.4%. Revenues grew about 5% from the prior-year quarter, despite currency headwinds of 2%. Sales were driven by strong base business and impressive product portfolio growth. The acquisitions (Gourmet Garden in Apr 2016 and Enrico Giotti SpA in Dec 2016) also contributed to higher sales by 3%.

Product innovation, brand marketing support and expanded distribution as well as pricing actions contributed to the growth in sales, offsetting the negative impact of currency. Excluding currency headwinds, revenues grew 7%, driven by both the consumer and industrial segments.

The company’s adjusted operating income grew 6.2% to $137 million in the second quarter. On a constant currency basis, it increased 9% due to higher sales and cost savings which were offset by increase in brand marketing expenses and currency headwinds. A shift in the portfolio to more value added products also boosted sales.

Segment Details

Consumer Business: Segment revenues grew 2%, primarily driven by strong base business and new product sales compared with the year-ago period. Solid performance in the Americas, strong momentum in China and the incremental impact of Gourmet Garden were partially offset by the impact of challenging environments in Europe, Middle East and Africa (EMEA) region. Currency also hurt the segment by 2%. Sales rose 2% on a constant currency basis. While Sales increased on a constant currency basis in the Americas and Asia/Pacific, it declined in Europe, Middle East and Africa (EMEA) due to weak sales in the U.K. where the retail environment suffers from stiff competition.

Adjusted operating income grew 7%, on a constant currency basis, driven by the favorable impact of sales growth and cost savings more than offsetting the impact of higher material costs.

Industrial Business: Industrial segment sales grew 9% despite currency headwinds of 3%. Industrial revenues growth was driven by increased sales across all three of its regions, including the incremental impact of the acquisition of Giotti, acquired in Dec 2016. On a constant currency basis, segment sales increased 12% year-over-year and doubled from the sequential quarter.

On a constant currency basis, adjusted operating income rose 13% year over year, driven by favorable impact of higher sales, product mix and CCI-led cost savings, more than offset the unfavorable impact of increases in material costs and an increase in brand marketing.

Fiscal 2017 Guidance

For fiscal 2017, the company has lowered its currency impact on sales. The company now expects sales to grow approximately 4–6% in fiscal 2017, in comparison with approximately 3–5% announced earlier.

Excluding currency, McCormick has reaffirmed its sales growth and adjusted earnings outlook. The company continues to expect the projected sales growth rate in the range of 5–7%, on a constant currency basis. The company expects higher brand marketing, increased pricing, new products, expanded distribution and acquisitions to contribute to the growth. Further, the company anticipates pricing actions to offset an anticipated mid-single digit increase in material costs. The company also has plans to achieve approximately $100 million of cost savings.

The company expects 2017 adjusted operating income to grow approximately 8–10%, from adjusted operating income of $657 million in 2016. On constant currency basis, adjusted operating income is expected to grow 9–11%.

McCormick expects 2017 adjusted earnings in the range of $4.05–$4.13 per share, which marks an increase of 7–9% compared with $3.78 in 2016. The guidance also includes unfavorable currency headwinds of 2 percentage points. The Zacks Consensus Estimate for fiscal 2017 is $4.08 per share, which is within the guidance range.

Our Take

Overall, McCormick is focusing on driving revenues through acquisitions and expects the momentum to continue in fiscal 2017. Its cost-saving initiative is also appealing. However, earnings growth is likely to be hurt by higher brand-marketing expenses.

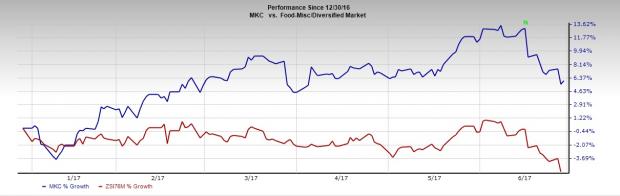

Share Price Movement

If we look into past six months’ performance, McCormick’s shares have outperformed the Zacks categorized Food-Miscellaneous/Diversified industry. The stock rallied 6.0% against the industry’s decline of 5.3%.

Zacks Rank & Key Picks

McCormick currently carries a Zacks Rank #3 (Hold).

Some better-ranked food companies include SunOpta, Inc. (NASDAQ:STKL) , Aramark (NYSE:ARMK) and B&G Foods, Inc. (NYSE:BGS) .

While SunOpta has a Zacks Rank #1 (Strong Buy) and a long-term earnings growth rate of 15.00%, Aramark and B&G Foods, both carrying a Zacks Rank #2 (Buy) have long-term earnings growth rate of 12.00% and 10.00%, respectively. All of the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

B&G Foods, Inc. (BGS): Free Stock Analysis Report

SunOpta, Inc. (STKL): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Aramark (ARMK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.