- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Medidata's Payment Solution To Make Reimbursements Easy

Medidata Solutions Inc (NASDAQ:MDSO) recently introduced Medidata Payments, a cloud-based payment technology and an add-on to the company’s’ leading Medidata Clinical Cloud.

With this launch, the company is set to simplify the reimbursement procedure in the space of clinical research by addressing all the probable challenges like erroneous calculations along with inaccurate and delayed payments.

Medidata Payments offers a precise payment solution, unifying pre-payments, holdbacks, divide payments among different payees, payments in multiple currencies and accruals. The platform also provides clinical trial sponsors with easy solutions that identifies and calculates withholding-tax, captures indirect tax and performs worldwide disimbursement.

The Payment solution works in three major steps -- managing of contract requirements, recording the costs generated by the trial data and disbursing payments to the investigative sites across multiple clinical researches worldwide.

Medidata’s new launch is likely to revolutionize the clinical trial payment platform, fortifying partnerships between sponsors, contract research organizations and clinical investigation sites. The tool is also likely to be beneficial to the sponsors who conduct multiple trials globally using more than 125 different currencies.

Notably, Medidata Solutions has 17 out of the top 25 global Pharma companies as enterprise customers, demonstrating its accomplishments in the space. Medidata Payments is likely to fortify the company’s position as it will streamline trial processes to a considerable extent.

Zacks Rank & Key Picks

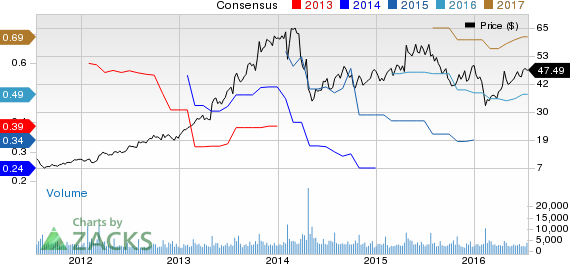

Currently, Medidata Solutions has a Zacks Rank #3 (Hold).

Better-ranked stocks in the medical instrument sector include Foundation Medicine Inc. (NASDAQ:FMI) , Omnicell Inc (NASDAQ:OMCL) and Invitae Corporation (NYSE:NVTA) . While Foundation Medicine and Omnicell sport a Zacks Rank #1 (Strong Buy), Invitae Corporation holds a Zacks Rank #2 (Buy).

OMNICELL INC (OMCL): Free Stock Analysis Report

MEDIDATA SOLUTN (MDSO): Free Stock Analysis Report

FOUNDATION MED (FMI): Free Stock Analysis Report

INVITAE CORP (NVTA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.