- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Trade Desk (TTD) Beats On Q3 Earnings & Revenues, Guides Up

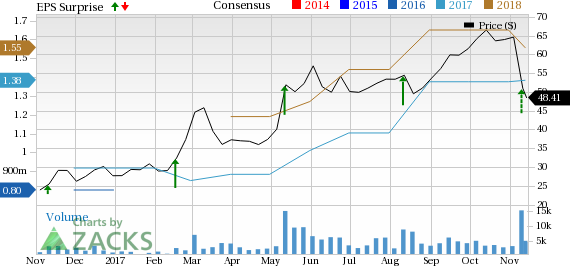

The Trade Desk Inc. (NASDAQ:TTD) reported third-quarter 2017 earnings of 35 cents per share, which beat the Zacks Consensus Estimate by 9 cents. Moreover, the figure improved 45.8% from the year-ago quarter.

Total revenues were $79.4 million, up 50% from the year-ago quarter. The figure beat the Zacks Consensus Estimate of $77 million. The strong growth reflects improving contribution from mobile (In-App, Video and Web), which accounted for 40% of total customer spending.

Based on the solid results, management raised 2017 guidance, which however, failed to appease investors. Shares have declined more than 18.4% in the last two trading sessions.

We believe that the downside reflects management’s cautious approach regarding lower spending from some large advertisers. However, Trade Desk noted that the advertisers have become selective in spending their ad-dollars. Their growing preference for programmatic advertising bodes well for the company in the long run.

Nonetheless, the selectiveness can delay spending, which doesn’t augur well for Trade Desk in the near term.

Additionally, some companies in the consumer packaged goods (CPG) and retail industries are reducing their advertising budgets to relieve margin pressure. This doesn’t bode well for Trade Desk in the near term.

Further, the company stated that events like the bankruptcy of Toys “R” Us does affect the growth trajectory (although in small amount) in the near term.

Nevertheless, we note that the stock has returned 74.9% year to date, substantially outperforming the 23.9% rally of the Internet Services industry.

Quarter Details

Omni-channel solutions continue to be the bread and butter segment for Trade Desk as the industry keeps gradually shifting to transparency and programmatic buying. On a year-over-year basis, Mobile in-app, Mobile video and Connected TV improved 77%, 140% and 159%, respectively.

Native spending was very strong in the reported quarter, surpassing the level attained through 2016. Customer retention rate was 95% in the reported quarter.

Region-wise, Germany, the U.K. and Southeast Asia grew 131%, 82% and 123% on a year-over-year basis, respectively. Seoul surged 260%, while Singapore grew 123% from the year-ago quarter.

Adjusted EBITDA surged 47.3% year over year to $24.4 million, driven by higher revenues.

Reported operating expenses, as percentage of revenues, surged 520 basis points (bps) to 76.8% in the quarter. The upside can be attributed to higher technology and development expenses that soared 280 bps from the year-ago quarter. Moreover, platform operations expenses surged 220 bps. Further, general & administrative (G&A) expenses increased 170 bps.

These were partially offset by a 150-bps decline in sales & marketing (S&M) expenses.

As a result, reported operating margin contracted 520 bps from the year-ago quarter to 23.2%.

Guidance

For fourth-quarter 2017, Trade Desk anticipates revenues of $101 million and adjusted EBITDA of $34 million.

Trade Desk currently anticipates revenues at $306 million, up from the previous guidance of $303 million, for 2017. Management expects adjusted EBITDA to be $90 million, up from $88 million.

For 2018, Trade Desk expects spend in connected TV to increase by more than 100%.

Moreover, international growth is anticipated at approximately double the U.S. business. Management expects footprint to expand, particularly in China.

Further, the amount of third-party data usage is expected to increase in 2018. Management believes that partnerships with companies like Oracle Corporation (NYSE:ORCL) , Acxiom Corporation (NASDAQ:ACXM) , Lotame and others will drive growth next year.

Zacks Rank & Key Pick

Trade Desk carries a Zacks Rank #4 (Sell).

Autohome Inc. (NYSE:ATHM) , sporting a Zacks Rank #1 (Strong Buy), is a stock worth watching in the same sector. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Autohome is currently pegged at 18.8%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Autohome Inc. (ATHM): Free Stock Analysis Report

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Acxiom Corporation (ACXM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.