- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

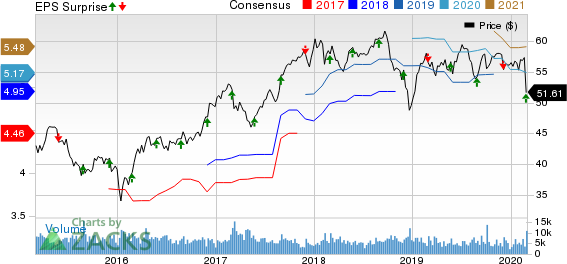

Toronto-Dominion (TD) Stock Down Despite Higher Q1 Earnings

Shares of The Toronto-Dominion Bank (TSX:TD) declined 6.1% on the NYSE since the release of first-quarter fiscal 2020 (ended Jan 31) results last week. Results reflected rising expenses and higher provisions. Further, concerns related to the impact of coronavirus on the global economy dampened investor confidence.

Adjusted earnings of C$1.66 per share were up 5.7% year over year. Also, adjusted net income grew 4% to C$3.1 billion ($2.4 billion).

Rise in revenues was partly offset by higher operating expenses and provisions. Growth in loan and deposit balances was impressive.

After considering certain non-recurring items, net income summed C$3 billion ($2.3 billion), increasing 24% year over year.

Revenues & Expenses Rise

Total revenues (on an adjusted basis) amounted to C$10.6 billion ($8.1 billion), up 6.1% on a year-over-year basis. This upside resulted from growth in both net interest income and non-interest income.

Adjusted net interest income rose 7.5% year over year to C$6.3 billion ($4.8 billion). Also, adjusted non-interest income came in at C$4.3 billion ($3.3 billion), up 4.1%.

Adjusted non-interest expenses rose 4.6% year over year to C$5.4 billion ($4.1 billion). Adjusted efficiency ratio was 50.9% compared with 51.6% on Jan 31, 2019. Fall in efficiency ratio indicates a rise in profitability.

Provision for credit losses increased 8.1% year over year to C$919 million ($698.3 million).

Strong Balance Sheet, Capital & Profitability Ratios Weaken

Total assets came in at C$1.46 trillion ($1.10 trillion) as of Jan 31, 2020, up nearly 3% from the prior quarter. Net loans inched up 1.3% on a sequential basis to C$693.2 billion ($523.7 billion), while deposits rose 2.4% to C$908.4 billion ($686.2 billion).

As of Jan 31, 2020, common equity Tier I capital ratio was 11.7%, down from 12% as of Jan 31, 2019. Total capital ratio was 15.7% compared with the prior year’s 15.9%.

Return on common equity, on an adjusted basis, came in at 14.6%, down from 15% as of Jan 31, 2019.

Major Development

In November 2019, TD Ameritrade Holding (TSX:TD) announced a deal to be acquired by Charles Schwab (NYSE:SCHW) . Per the terms of the transaction, Toronto-Dominion, which has nearly 43% stake in TD Ameritrade, is likely to have an ownership position of roughly 13% in the combined company. (Read more: Schwab's Buyout of TD Ameritrade to Shake Up Online Brokerage)

Our Take

While Toronto-Dominion’s efforts toward improving revenues, both organically and inorganically, are supported by its diverse geographical presence, rising operating expenses deter bottom-line growth to some extent. Further, rising provisions for credit losses pose a near-term concern.

Toronto-Dominion currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Canadian Bank

Canadian Imperial Bank of Commerce’s (TSX:CM) first-quarter fiscal 2020 (ended Jan 31) adjusted earnings per share were C$3.24, up 7.6% from the year-ago reported figure. Results were driven by increase in non-interest income and net interest income along with lower provisions. Also, rise in loans and deposits acted as a tailwind. However, higher operating expenses posed an undermining factor.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

The Charles Schwab Corporation (SCHW): Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM): Free Stock Analysis Report

Toronto Dominion Bank (The) (TD): Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.