- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Value Stocks To Buy For November 13th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, November 13th:

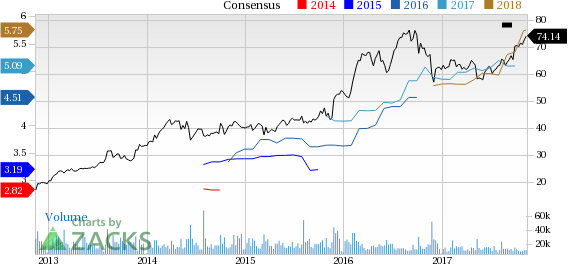

Tyson Foods (NYSE:TSN), Inc. (TSN): This operator of a food company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.6% over the last 60 days.

Tyson Foods, Inc. Price and Consensus

Tyson Foods has a price-to-earnings ratio (P/E) of 12.72, compared with 14.9 for the industry. The company possesses a Value Scoreof A.

Tyson Foods, Inc. PE Ratio (TTM)

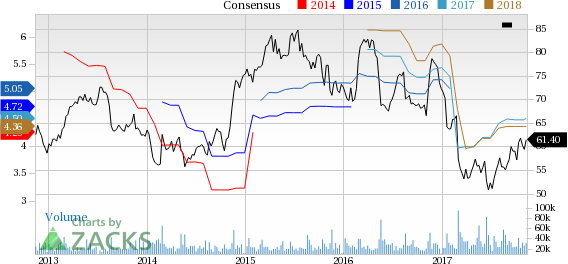

Target Corporation (NYSE:TGT) (TGT): This general merchandise retailer has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.2% over the last 60 days.

Target Corporation Price and Consensus

Target Corporation has a price-to-earnings ratio (P/E) of 13.63, compared with 16.1 for the industry. The company possesses a Value Score of A.

TYSON FOODS, INC. PE RATIO (TTM)

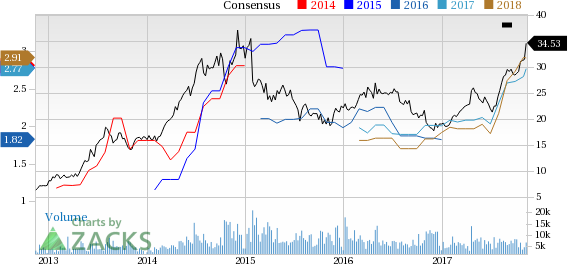

Movado Group, Inc. (MOV): This designer and developer of fine watches has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1.3% over the last 60 days.

Movado Group Inc. Price and Consensus

Movado Group has a price-to-earnings ratio (P/E) of 16.76, compared with 21 for the industry. The company possesses a Value Score of A.

Movado Group Inc. PE Ratio (TTM)

Pilgrim's Pride Corporation (PPC): This producer and distributor of chicken products has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 7.4% over the last 60 days.

Pilgrim's Pride Corporation Price and Consensus

Pilgrim's Pride has a price-to-earnings ratio (P/E) of 12.9, compared with 14.9 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

Movado Group Inc. (MOV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.