- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Value Stocks To Buy For March 1st

Here are four stocks with buy rank and strong value characteristics for investors to consider today, March 1st:

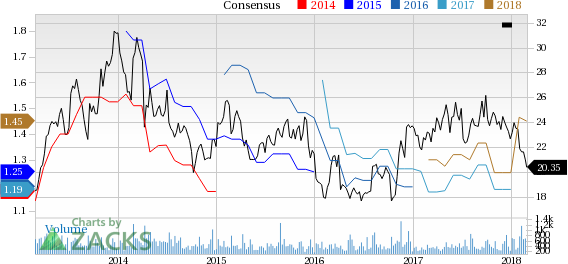

Haverty Furniture Companies, Inc. (HVT): This specialty retailer of residential furniture has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 16% over the last 60 days.

Haverty Furniture Companies, Inc. Price and Consensus

Haverty Furniture has a price-to-earnings ratio (P/E) of 14.03 compared with 19.40 for the industry. The company possesses a Value Score of B.

Haverty Furniture Companies, Inc. PE Ratio (TTM)

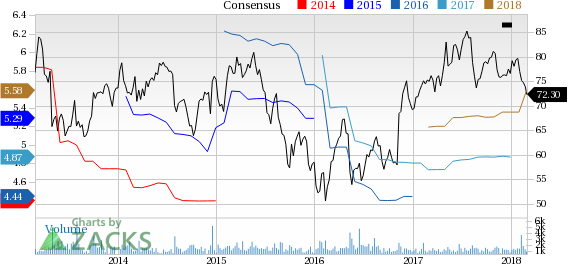

Regal Beloit Corporation (RBC): This diversified machinery products has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 4.3% over the last 60 days.

Regal Beloit Corporation Price and Consensus

Regal Beloit has a price-to-earnings ratio (P/E) of 13.18, compared with 13.80 for the industry. The company possesses a Value Score of A.

Regal Beloit Corporation PE Ratio (TTM)

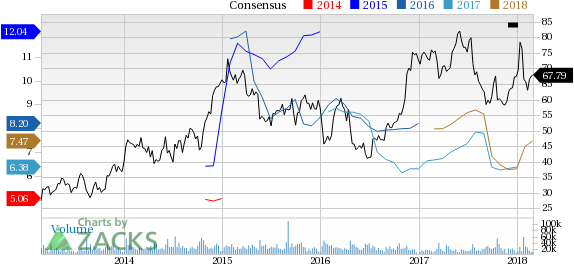

Brinker International, Inc. (EAT): This restaurant chain has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 7.2% over the last 60 days.

Brinker International, Inc. Price and Consensus

Brinker has a price-to-earnings ratio (P/E) of 10.02, compared with 17.70 for the industry. The company possesses a Value Score of A.

Brinker International, Inc. PE Ratio (TTM)

United Continental Holdings, Inc. (UAL): This air transportation services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 18.6% over the last 60 days.

United Continental Holdings, Inc. Price and Consensus

United Continental has a price-to-earnings ratio (P/E) of 9.09 compared with 13.10 for the industry. The company possesses a Value Score of A.

United Continental Holdings, Inc. PE Ratio (TTM)

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Haverty Furniture Companies, Inc. (HVT): Free Stock Analysis Report

Brinker International, Inc. (EAT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.