- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Value Stocks To Buy For March 10th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, March 10th:

Spirit Airlines, Inc. (SAVE): This company that provides low-fare airline services has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 12.7% over the last 60 days.

Spirit Airlines has a price-to-earnings ratio (P/E) of 3.90, compared with 14.60 for the industry. The company possesses a Value Score of A.

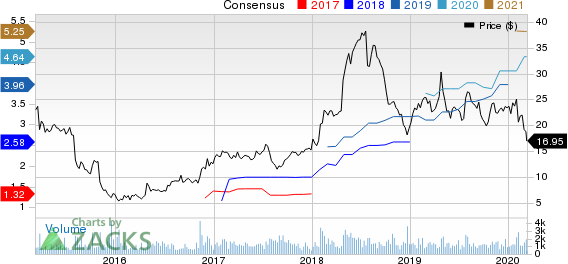

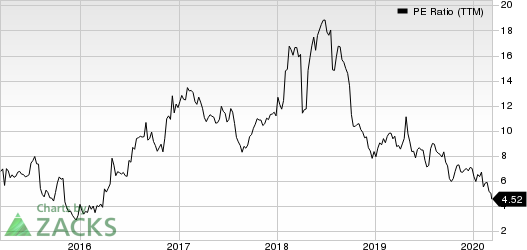

Enova International, Inc. (ENVA): This technology and analytics company that provides online financial services has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 7.9% over the last 90 days.

Enova International has a price-to-earnings ratio (P/E) of 3.65, compared with 6.60 for the industry. The company possesses a Value Score of A.

Fly Leasing Limited (FLY): This company that purchases and leases commercial aircraft under multi-year contracts to various airlines has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 3.5% over the last 60 days.

Fly Leasing has a price-to-earnings ratio (P/E) of 3.62, compared with 11.20 for the industry. The company possesses a Value Score of A.

Fiat Chrysler Automobiles N.V. (FCAU): This company that designs, engineers, manufactures, distributes, and sells vehicles, components, and production systems has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 1% over the last 60 days.

Fiat Chrysler Automobiles has a price-to-earnings ratio (P/E) of 3.54, compared with 8.10 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

Fly Leasing Limited (FLY): Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

Enova International, Inc. (ENVA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.