- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Momentum Stocks To Buy For March 5th

Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, March 5th:

Sangamo Therapeutics, Inc. (SGMO): This biotechnology company that focuses on translating science into genomic medicines has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.2% over the last 60 days.

Sangamo Therapeutics’ shares gained 6.3% over the last one month against the S&P 500’s decline of 6.1%. The company possesses a Momentum Score of A.

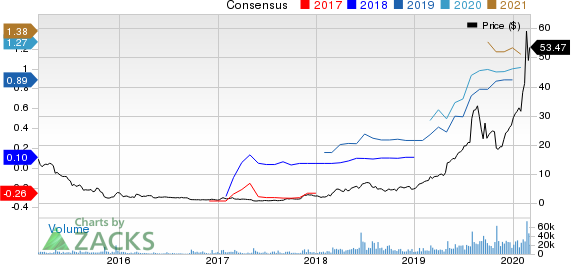

Stamps.com Inc. (STMP): This company that provides Internet-based mailing and shipping solutions has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 30.2% over the last 60 days.

Stamps.com shares gained 634% over the last one month. The company possesses a Momentum Score of B.

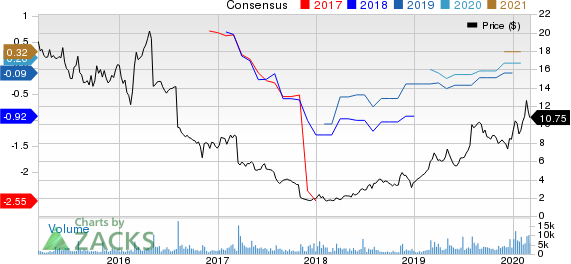

Enphase Energy, Inc. (ENPH): This company that designs, develops, and sells home energy solutions for the solar photovoltaic industry has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 25.7% over the last 60 days.

Enphase Energy’s shares gained 44.9% over the last one month. The company possesses a Momentum Score of B.

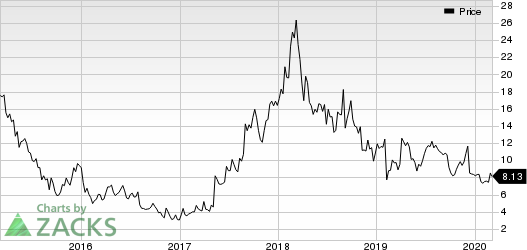

The Rubicon Project, Inc. (RUBI): This company that provides technology solutions to automate the purchase and sale of digital advertising inventory for buyers and sellers has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing more than 100% over the last 60 days.

The Rubicon Project’s shares gained 8.6% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

The Rubicon Project, Inc. (RUBI): Free Stock Analysis Report

Enphase Energy, Inc. (ENPH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.