- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Income Stocks To Buy For March 5th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 5th:

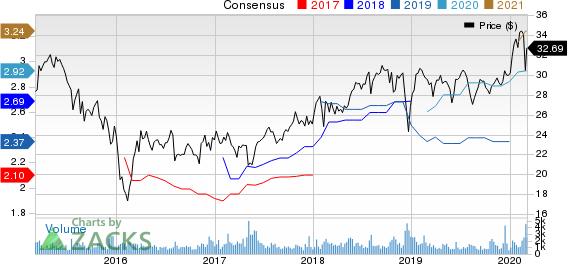

BlackRock (NYSE:BLK), Inc. (BLK): This provider of investment management services has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.8% over the last 60 days.

BlackRock, Inc. Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 2.93%, compared with the industry average of 2.78%. Its five-year average dividend yield is 2.54%.

BlackRock, Inc. Dividend Yield (TTM)

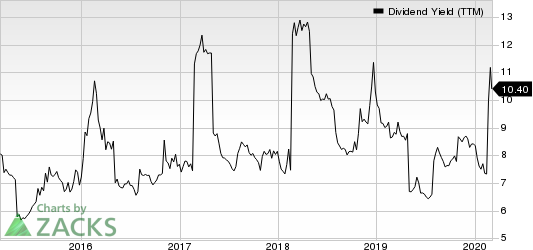

AllianceBernstein Holding L.P. (AB): This provider of investment management services has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.2% over the last 60 days.

AllianceBernstein Holding L.P. Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 10.40%, compared with the industry average of 2.78%. Its five-year average dividend yield is 8.32%.

AllianceBernstein Holding L.P. Dividend Yield (TTM)

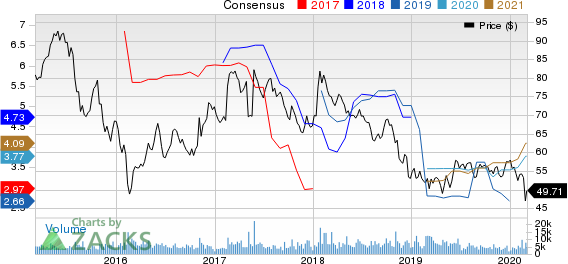

Bunge Limited (BG): This agribusiness and food company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.9% over the last 60 days.

Bunge Limited Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 4.02%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.66%.

Bunge Limited Dividend Yield (TTM)

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

BlackRock, Inc. (BLK): Free Stock Analysis Report

Bunge Limited (BG): Free Stock Analysis Report

AllianceBernstein Holding L.P. (AB): Free Stock Analysis Report

Original post

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.