- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Growth Stocks To Buy For November 10th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, November 10th:

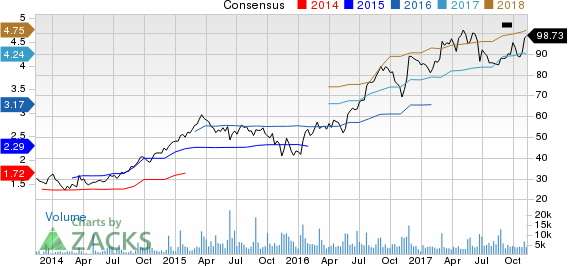

Burlington Stores, Inc. (BURL): This retailer of branded apparel products, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.2% over the last 60 days.

Burlington Stores has a PEG ratio 1.32, compared with 1.42 for the industry. The company possesses a Growth Score of A.

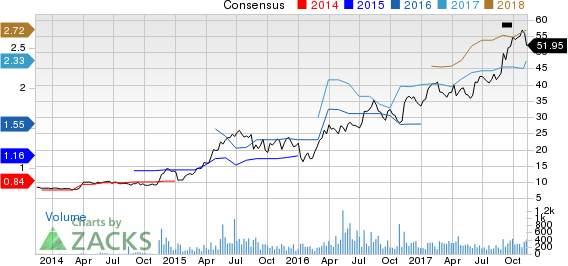

NV5 Global, Inc. (NVEE): This technical engineering and consulting solutions provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 3.6% over the last 60 days.

NV5 Global has a PEG ratio 1.20, compared with 1.44 for the industry. The company possesses a Growth Score of A.

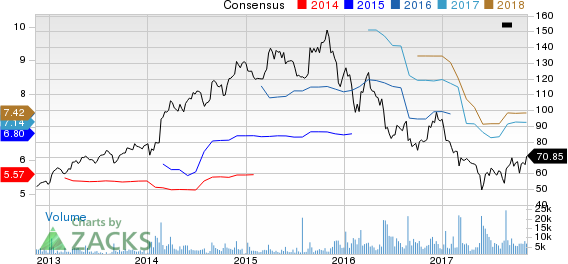

Signet Jewelers Limited (SIG): This retailer of diamond jewelry, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.4% over the last 60 days.

Signet Jewelers has a PEG ratio 1.26, compared with 1.95 for the industry. The company possesses a Growth Score of A.

Lam Research Corporation (NASDAQ:LRCX) (LRCX): This manufacturer of semiconductor processing equipment, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 13.4% over the last 60 days.

Lam Research has a PEG ratio 0.98, compared with 1.22 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Signet Jewelers Limited (SIG): Free Stock Analysis Report

NV5 Global, Inc. (NVEE): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.