- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Growth Stocks To Buy For March 16th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, March 16th:

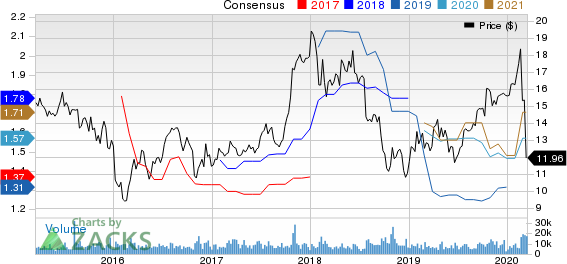

Focus Financial Partners Inc. (FOCS): This provider of wealth management services, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.6% over the last 60 days.

Focus Financial Partners has a PEG ratio of 0.25 compared with 0.64 for the industry. The company possesses a Growth Score of A.

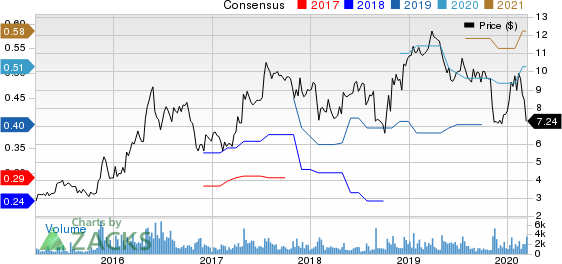

TRI Pointe Group, Inc. (TPH):This company that designs, constructs and markets single-family detached and attached homes, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.8% over the last 60 days.

TRI Pointe has a PEG ratio of 0.69, compared with 0.88 for the industry. The company possesses a Growth Score of A.

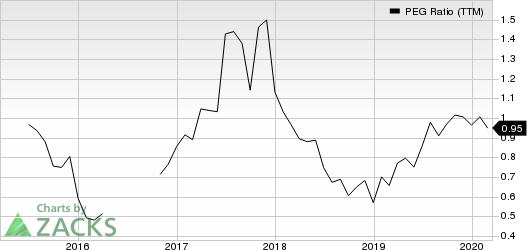

Mitek Systems, Inc. (MITK): This developer of mobile image capture and digital identity verification solutions, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.3% over the last 60 days.

Mitek Systems has a PEG ratio of 0.94, compared with 1.67 for the industry. The company possesses a Growth Score of A.

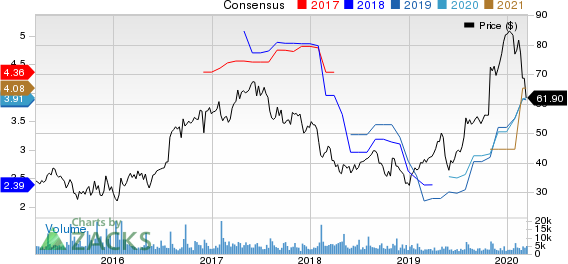

Cirrus Logic, Inc. (CRUS): This fabless semiconductor company, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 14.5% over the last 60 days.

Cirrus Logic has a PEG ratio of 1.05, compared with 3.69 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

TRI Pointe Group, Inc. (TPH): Free Stock Analysis Report

Mitek Systems, Inc. (MITK): Free Stock Analysis Report

Focus Financial Partners Inc. (FOCS): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.