- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

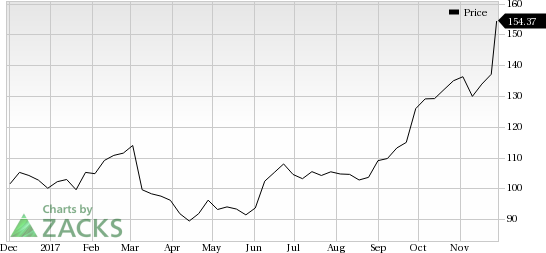

Thor Industries (THO) Looks Good: Stock Adds 13.3% In Session

Thor Industries, Inc. (NYSE:THO) was a big mover last session, as the company saw its shares rise more than 13% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This breaks the recent trend of the company, as the stock is now trading above the volatile price range of $128.04 to $137.61 in the past one-month time frame.

The move came after the company reported better-than-expected first-quarter fiscal 2018 (ended Oct 31, 2017) results.

The company has seen no changes when it comes to estimate revision over the past few weeks, while the Zacks Consensus Estimate for the current quarter has also remained unchanged. The recent price action is encouraging though, so make sure to keep a close watch on this firm in the near future.

Thor Industries currently has a Zacks Rank #2 (Buy) while its Earnings ESP is 0.00%.

Another stock worth considering in the Building Products - Mobile Homes and RV Builders industry is Winnebago Industries, Inc. (NYSE:WGO) ,which also carries a Zacks Rank #1 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is THO going up? Or down? Predict to see what others think:Up or Down

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Thor Industries, Inc. (THO): Free Stock Analysis Report

Winnebago Industries, Inc. (WGO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.