- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FXI Calls Fly Off The Shelf On China Trade Optimism

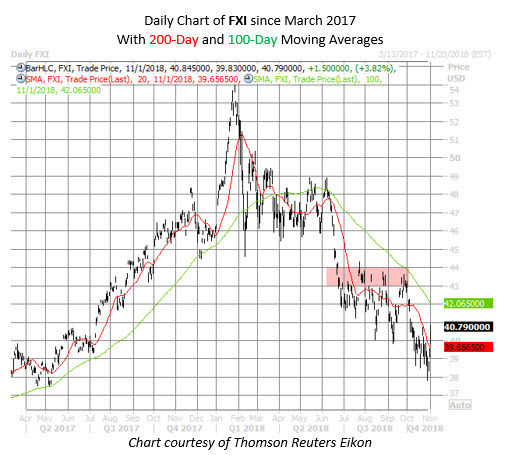

The iShares China Large-Cap ETF (FXI) is moving higher today, thanks to President Donald Trump's encouraging tweet on trade. The exchange-traded fund (ETF) was last seen 3.8% higher at $40.79, and it looks like one options trader is cashing in, with FXI call volume skyrocketing.

Shares of the fund have struggled since peaking at $54 in January, amid escalating trade tensions between the U.S. and China. However, FXI is set to topple its 20-day moving average for the first time in a month, after touching an annual low of $37.84 just last week. Still, the ETF's formerly supportive 100-day moving average still rests in the overhead $42 area, and the $43-$44 neighborhood has stifled rebound attempts in the second half of 2018.

As alluded to earlier, FXI call options are flying off the shelves today. So far, the ETF has seen roughly 522,000 calls change hands -- seven times the average intraday pace. That's compared to just 90,000 FXI put options traded.

Most of the action has centered around the December 42 and 45 calls, which have seen about 155,000 and 177,000 contracts cross the tape, respectively, mostly in big blocks marked "spread." Trade-Alert indicates that one trader likely took profits on a call spread opened back in October, when FXI was notably lower.

Today's appetite for calls is just more of the same for the China-based ETF, despite its recent quest for new lows. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), traders have bought to open more than twice as many FXI calls as puts in the past two weeks. The ETF's 10-day call/put volume ratio of 2.49 is in the 89th percentile of its annual range, pointing to a healthier-than-usual appetite for bullish bets over bearish recently.

However, it's worth noting that short interest skyrocketed nearly 35% on FXI in just the most recent reporting period. These bearish bets now account for almost a quarter of the ETF's total available float. As such, some of the recent call buying -- particularly at out-of-the-money strikes -- could be attributable to FXI shorts seeking an options hedge in the event of an upturn, like we're seeing today.

Related Articles

MON: Eurogroup Meeting, Norwegian CPI (Feb), EZ Sentix Index (Mar), Japanese GDP (Q4) TUE: EIA STEO WED: 25% US tariff on all imports of steel and aluminium comes into effect,...

Brief Reminder In 2018, US President Donald Trump initiated a trade war update with sanctions against China. Economic disagreement between the United States and China began in...

Trump’s U-Turns Keep the Market Under Pressure Both US equity indices and the US dollar remain under severe stress as US President Trump continues his back-and-forth on the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.