- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

These 3 Stocks Have Reached Pivotal Turning Points - Here's How to Trade Them

- Some stocks have surged over the last couple of weeks.

- In this piece, we will try and analyze if these stocks are still worth buying at current prices

- The stocks we will analyze are Paramount Global, Meta, and Micron.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- Paramount Global (NASDAQ:PARA): The stock has risen by 10% since March 25.

- Micron (NASDAQ:MU): The stock surged by 12.5% during the same period.

- Meta Platforms: Despite gaining 4.36% last week, Meta's stock gave back all its gains this week.

- What's Driving the Gains:

- What's Driving the Gains:

In the following article, we will analyze the potential future performance of three stocks that have reached key turning points in their year-to-date trajectories. By diving into technical and fundamental metrics, we will explore the reasons behind their recent price movements and understand where they may go next.

In the past few weeks, two of the three stocks mentioned below have posted decent gains. In Meta's (NASDAQ:META) case, the stock surged last week, only to erase all its gains this week.

Here's the summary of their activity:

We will utilize insights from InvestingPro to delve into these stocks further.

1. Paramount Global

Paramount Global plans to sell its production division in isolation, despite its modest cash flow, it could attract the attention of other potential strategic buyers.

Investment firm Apollo Global Management (NYSE:APO) has submitted an $11 billion bid to buy the film and television production division.

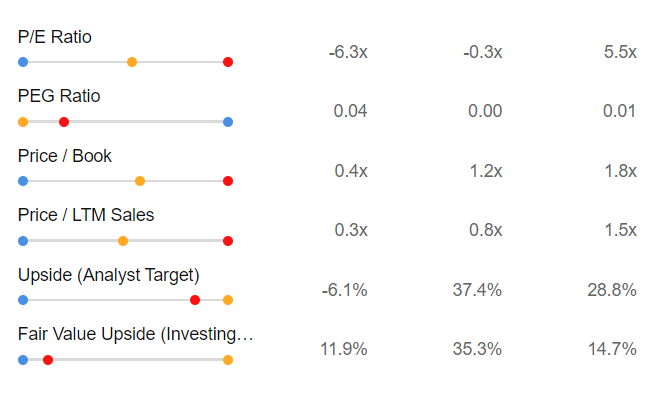

Source: InvestingPro

Wolfe Research upgraded the rating on Tutolo to Peer Perform from Underperform due to the potential increase in discretionary cash flow. Recent media coverage suggests this could attract competitive bids from Skydance.

Paramount's Fair Value, as summarized by InvestingPro, stands at $13.84, which is 11.9% higher than the current price.

InvestingPro subscribers tracked analysts' forecasts, which indicate a bullish target price of $13.26 for the stock.

While both analysts and Fair Value foresee a potential increase, the risk profile is somewhat concerning, with a fair financial health score of 2 out of 5.

Source: InvestingPro

Paramount is now worth 0.3x its revenue compared to 1.5x for the sector, and the Price/Earnings ratio at which the stock is trading is -6.3X against an industry average of 5.5x, again pointing to an undervaluation relative to the sector.

Analysts expect strong upward movements in the stock due to recent news, aligning with the potential upside indicated by the Fair Value, despite its disappointing annual gains.

2. Micron Technology

BofA Securities changed the outlook by raising the price target to $144 from the previous $120 and maintaining a Buy rating on the Micron stock.

The new target reflects potential growth driven by demand for high-bandwidth memory (HBM), which is becoming increasingly important for artificial intelligence (AI) applications.

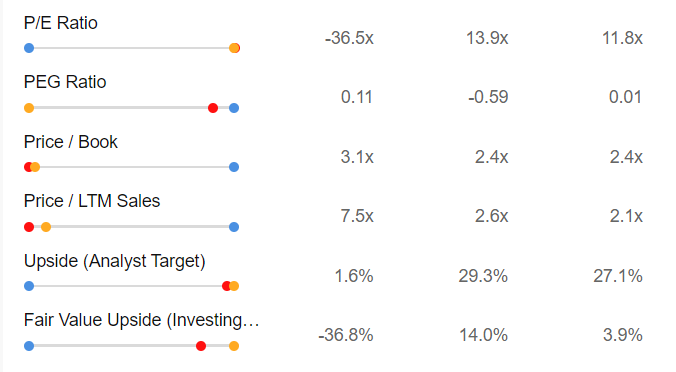

Source: InvestingPro

InvestingPro's Fair Value for Micron, which combines 12 investment models, sits at $78.5, marking a 36.8% decrease from the current price.

Analysts, when discussing the target price, express bullish sentiments towards the stock, setting it at $126.91. This figure significantly exceeds the average Fair Value.

Despite the disparity between analysts' projections and the Fair Value, concerns about the stock's risk profile persist. Micron's financial health is rated at 2 out of 5, indicating a somewhat precarious situation.

Source: InvestingPro

Micron's market value is now over 7 times its revenues, compared to the industry average of just over 2 times. The stock's Price/Earnings ratio is currently at -36.5x, while the industry average is 11.8x. This confirms that Micron is currently undervalued relative to its industry peers.

Investors are optimistic about the company's performance, which has surged by 124% over the past year. This suggests that the positive trend in the stock may continue.

However, despite strong earnings, the Fair Value outlook for Micron remains pessimistic. This is evident even though Micron may be undervalued when compared to its competitors and the industry.

3. Meta Platforms

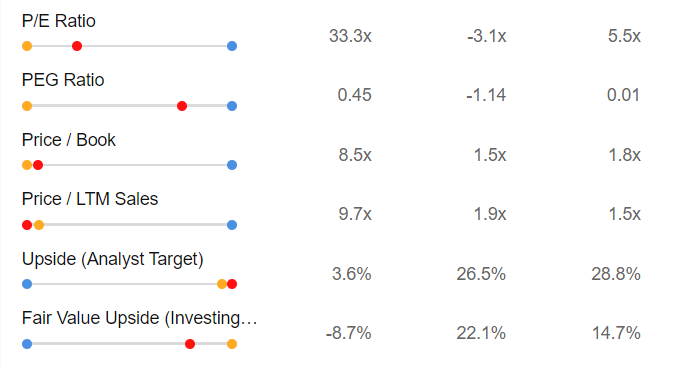

For Meta, InvestingPro's Fair Value, which summarizes 14 investment models, stands at $466.56, or 8.7% less than the current price.

InvestingPro subscribers were able to follow the development of analysts' forecasts surveyed, as for the target price they are bullish on the stock, at $526.03.

Source: InvestingPro

While analysts and Fair Value currently disagree on the possibility of a downside, good news also comes from the low-risk profile as it has an excellent level of financial health, with a score of 4 out of 5.

Source: InvestingPro

We can see that Meta is now worth almost ten times its revenues compared to 1.5x for the sector, and the Price/Earnings ratio at which the stock is trading is 33.3X against an industry average of 5.5x, which stands to confirm its overvaluation relative to the sector.

Meta Platform demonstrates strong financial health. The positive performance since the beginning of the year has boosted investor confidence.

However, the stock's valuations suggest overvaluation, indicating a potential pullback.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty margin over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.