- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Theravance (TBPH) Submits NDA For COPD Candidate Revefenacin

Theravance Biopharma, Inc. (NASDAQ:TBPH) and partner Mylan (NASDAQ:MYL) announced that the new drug application for the combined entity’s key pipeline candidate, revefenacin (TD-4208), has been submitted to the FDA for treatment of adults with chronic obstructive pulmonary disease (“COPD”).

Notably, revefenacin is an experimental once-daily nebulized long-acting muscarinic antagonist (“LAMA”) to treat COPD.

We remind investors that Theravance and Mylan entered into a development and commercialization agreement for revefenacin in February 2015. Under the terms of the agreement, the companies will codevelop revefenacin for COPD and other respiratory diseases. While Theravance will lead the U.S. registration development program, Mylan will be responsible for the product’s commercial manufacture.

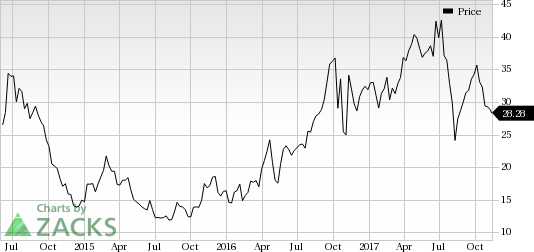

Shares of Theravance have underperformed the industry so far this year. The stock has lost 11.3% while the broader industry has remained flat during the period.

The NDA submission was supported by positive data from two replicate pivotal phase III efficacy studies and a single 12-month, open-label, active comparator safety trial. In October 2016, the company reported positive data from both the phase III studies. The programs met their primary endpoints demonstrating statistically significant improvements over placebo after 12 weeks of dosing for each of the doses of revefenacin comprising 88 mcg once daily and 175 mcg once daily, respectively.

Earlier in July, the company had announced positive data from the 12-month safety study. Findings from the study demonstrated that both the doses of revefenacin were generally well-tolerated with low rates of adverse events and serious adverse events, respectively.

Significantly, the company initiated a phase IIIb study, evaluating revefenacin on patients with low peak inspiratory flow rate in March 2017. Data from the study is expected in early 2018.

Per the company’s press release, COPD is the third leading cause for death in the United States. The grim picture suggests that while 12.7 million Americans are diagnosed with the disease, almost an equal number of patients remain undiagnosed. An approval will be a huge boost as patients who prefer nebulized therapy, have no access to a nebulized LAMA. Hence, there is a large commercial countrywide opportunity for revefenacin in the COPD area.

Zacks Rank & Key Picks

Theravance carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the health care sector include Ligand Pharmaceuticals Inc. (NASDAQ:LGND) and Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ligand’s earnings per share estimates have moved up from $3.68 to $3.70 for 2018 over the last 30 days. The company delivered positive earnings surprises in two of the trailing four quarters with an average beat of 8.22%. Share price of the company has surged 40.5% year to date.

Achillion’s loss per share estimates have narrowed from 65 cents to 63 cents for 2017 and from 74 cents to 67 cents for 2018 over the last 30 days. The company came up with positive earnings surprises in two of the trailing four quarters with an average beat of 4.51%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Achillion Pharmaceuticals, Inc. (ACHN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.