- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Theravance Shares Rise On Approval Of Glaxo's COPD Therapy

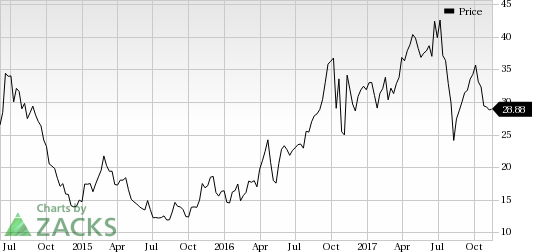

Theravance Biopharma, Inc.’s (NASDAQ:TBPH) shares rose almost 6.5% on Thursday following the approval of GlaxoSmithKline plc’s (NYSE:GSK) chronic obstructive pulmonary disease ("COPD") therapy, Trelegy Ellipta in Europe. Investors cheered the approval as Theravance has an economic interest on the royalties that Glaxo will pay to its partner Innoviva, Inc. (NASDAQ:INVA) on global sales of Trelegy Ellipta.

We note that Innoviva spun-off its biopharmaceutical operations in June 2014 into a subsidiary called Theravance Biopharma. As part of the spin-off agreement between the two entities, Theravance is eligible to receive 85% of any future payments paid by Glaxo in connection with GSK-Partnered Respiratory Programs.

Moreover, Glaxo is expected to pay Innoviva royalties in the range of 6.5% to 10% on global sales of Trelegy Elipta. Theravance will receive cash flows, which amount to approximately 5.5% to 8.5% of worldwide net sales of the drug.

However, Theravance’s shares are down 9.4% so far this year, underperforming the industry’s decline of 0.4%.

Trelegy Ellipta, a triple combination therapy, was granted marketing authorization in the EU as maintenance therapy for treatment of patients with COPD on Nov 16. It was approved in the United States in September this year. The product is expected to bring in blockbuster sales.

Meanwhile, earlier this week, Theravance submitted a new drug application to the FDA for its COPD candidate, revefenacin, which has been developed in partnership with Mylan (NASDAQ:MYL) . Revefenacin is nebulized long-acting muscarinic antagonist (“LAMA”). An approval will be a huge boost as patients who prefer nebulized therapy have no access to a nebulized LAMA.

Theravance has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Innoviva, Inc. (INVA): Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.