- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Theravance Biopharma (TBPH) Q4 Loss Wider, Sales Drop Y/Y

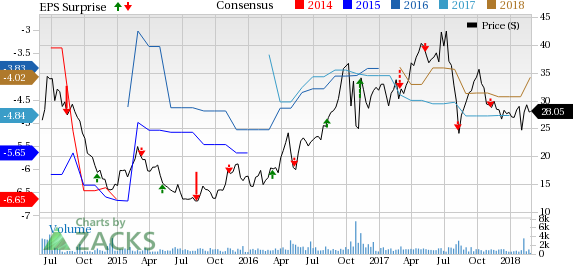

Theravance Biopharma (NASDAQ:TBPH) reported fourth-quarter 2017 loss of $1.64 per share, wider than both the Zacks Consensus Estimate of a loss of $1.15 and the year-ago loss of $1.36.

Total revenues in the quarter plunged 21.1% year over year to $4.5 million compared with the prior-year figure. This downside can mainly be attributed to lower sales from the company’s sole marketed product, Vibativ (telavancin). However, the top line surpassed the Zacks Consensus Estimate of $4 million.

Theravance’ shares were down more than 2% on Feb 27 in after-hours trading following the earnings release, which reported wider loss. Moreover, the shares have underperformed the industry in a year’s time. The stock has lost 8.4% versus the industry’s 0.8% increase.

Quarterly Details

Vibativ generated U.S. revenues of $4.1 million in the fourth quarter, down 18% from the year-ago period. Sales decreased mainly due to the impact of generic competition in the United States.

Revenues from collaborations were $0.4 million compared with $0.7 million in the year-earlier quarter.

Research and development expenses were $51 million, up 21.4% from the year-ago period, mainly due to increases in employee-related costs and advancement of the company’s priority pipeline programs, partially offset by reduction in external expenses.

Selling, general & administrative expenses rose 44.6% to $20.9 million, primarily on higher employee-related costs.

2017 Results

Full-year sales slumped 68.3% year over year to $15.4 million. However, the number beat the Zacks Consensus Estimate of $14.5 million.

Full-year loss of $5.45 per share was wider than the year-ago tally of $4.26. Loss was also wider than the consensus mark of a loss of $4.85.

Pipeline and Other Updates

Earlier this February 2018, Theravance entered into a global collaboration agreement with Janssen, a subsidiary of Johnson & Johnson (NYSE:JNJ) , to jointly develop and commercialize its pan-Janus kinase inhibitor, TD-1473, for treatment of inflammatory intestinal diseases.

Pursuant to the above-mentioned contract, Theravance will be entitled to receive an upfront payment of $100 million and be also eligible to get potential payments of $900 million if J&J remains in the collaboration on completion of phase II activities.

Also in January, Theravance along with partner Mylan (NASDAQ:MYL) announced that the new drug application (NDA) for the pipeline candidate, revefenacin (TD-4208), has been accepted by the FDA for treatment of adults with chronic obstructive pulmonary disease. A response from the regulatory body is expected on Nov 13, 2018. The NDA acceptance was supported by positive data from two replicate pivotal phase III efficacy studies and a single 12-month, open-label, active comparator safety trial. In October 2016, the company reported positive data from both the phase III evaluations.

2018 Outlook

Theravance projects operating loss for 2018 in the range of $180-$200 million.

Zacks Rank & Key Pick

Theravance carries a Zacks Rank #3 (Hold). A better-ranked stock in the health care sector is Regeneron Pharmaceuticals (NASDAQ:REGN) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Johnson & Johnson (JNJ): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.