- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

The Week Ahead: Will There Be A January Effect This Year?

The pros are back from vacation and ready for a new year of punditry!

While there is a normal flow of news and a full trading week, I expect the financial media to focus on the New Year. That means an emphasis on slogans and seasonality.

Trader lore views January as including special predictive powers:

Will there be a January Effect?

Prior Theme Recap

In my pre-holiday WTWA I predicted that the quest for content would be filled “by forecasts of any and all flavors.” That was very accurate, partly because there was little competing news and light trading.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

While there is plenty of news on tap this week, those pundits who were on vacation still need to have their say. There is plenty of market lore about January, so it will be a highlight of discussions – at least until Friday’s employment report. Many will be asking:

Is it time for a strong seasonal rally in stocks?

There is plenty of trader lore about January.

- January is seasonally strong, especially after a good year. Josh Brown reports Merrill Lynch research going back to 1929.

- As goes January, so goes the year. Also the first week forecasts the whole month. And even the first day forecasts the week. (Sober Look).

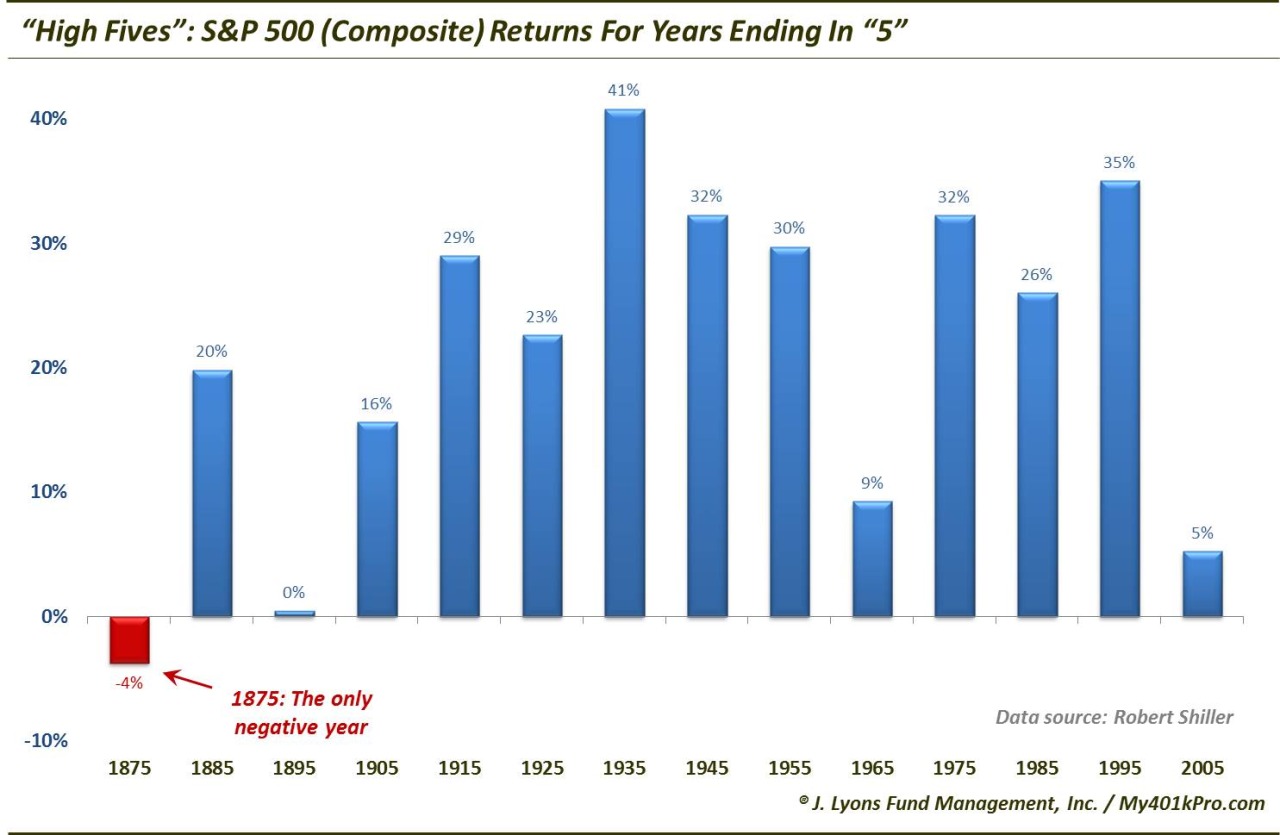

- It is a year ending in “5.” Dana Lyons charts the data (below). He also analyzes the four instances where there was a big drop on the last day of the year, noting that this is probably not meaningful. At least he points this out, as opposed to those who talk about the two prior times QE ended!

- It is the third year of a Presidential term. And the seventh year of a Presidential administration. (WSJ).

- The January Effect follows December’s tax loss selling. (See Zacks).

As always, I have some ideas about this question in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was not much news over the holidays. On balance it was mildly disappointing.

- The Keystone Pipeline remains first on the GOP Senate agenda. While there is still the threat of a Presidential veto, I expect a successful bipartisan coalition and compromise. This will be an early test of whether compromises can be forged and legislation passed in this Congress. My environmentalist friends should note that I am not citing this as desirable public policy. I am merely sticking to my rules concerning what is “market friendly”.

- Hotel occupancy remains strong. (See Calculated Risk).

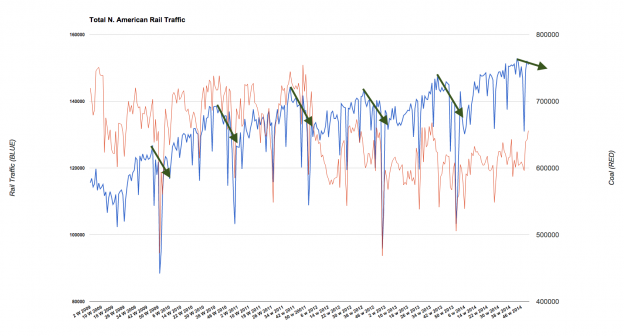

- Rail traffic remains strong. Todd Sullivan explains why this is a solid indicator.

- High frequency indicators remain positive. New Deal Democrat has the important weekly report.

The Bad

The bad news was pretty minor, although most items were a bit soft.

- Financial crisis risk is not much lower than it was in 2007-09 according to Boston Fed President Rosengren. Ben Leubsdorf at Real Time Economics describes the rationale, citing money-market funds, broker-dealers, and short-term funding.

- Canada? I thought we were worried about Europe, China, and the emerging markets. Sober Look warns about how low oil prices affect Canada’s economy

- Greece. After two tries there is still not a new government in place. There is concern about Greece, but also about the implications for the Eurozone and the potential impact on the world economy. Brookings offers a balanced view of the prospects.

- The auto bailout tab is in at $9 billion if you count the interest payments or $16 billion if you do not. This is on an investment of about $80 billion – 25 by Bush and 55 by Obama. Early estimates were for a loss of about $44 billion. We will never know what would have happened without the bailout, especially since the government would have been on the hook for some of the pensions.

- Insider trading at BP) as well as various bank currency desks. Bloomberg explains.

- Construction spending shows weakness. (See Steven Hansen at GEI).

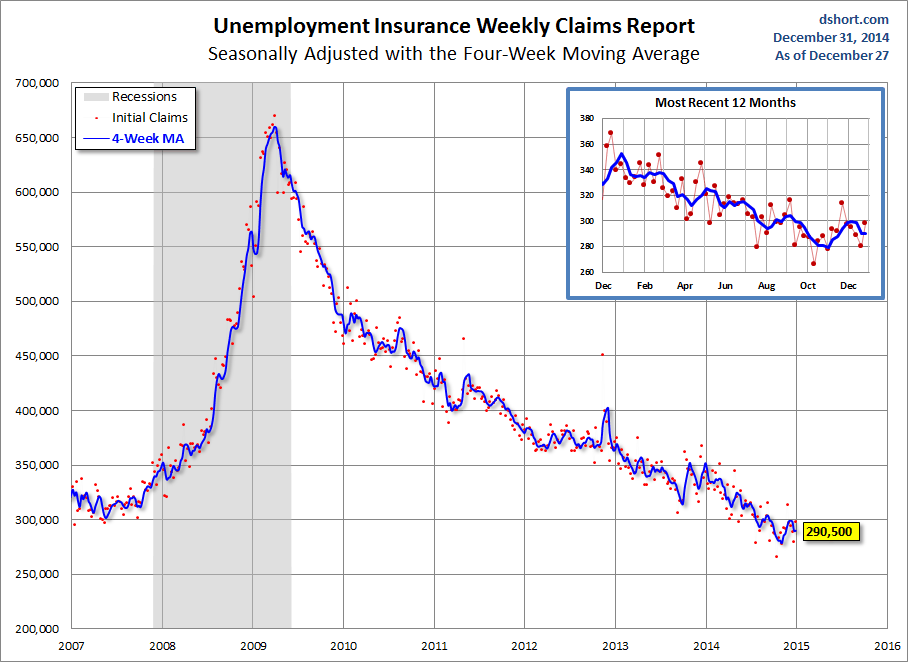

- Jobless claims have drifted a bit higher, both on the weekly numbers and the four-week average. It has been a small weekly amount, but it is worth noting. Doug Short’s chart puts it all in context and the accompanying post provides excellent analysis of the underlying trends.

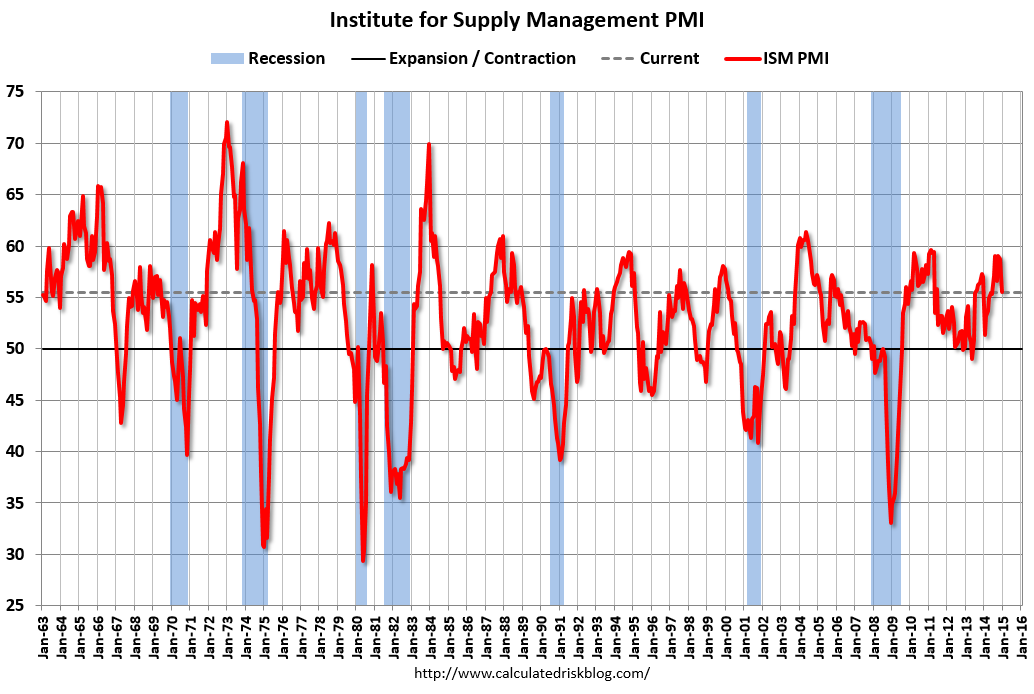

- ISM manufacturing declined and missed expectations at 55.5. This level is still consistent with real GDP of 4.1% according to the ISM analysis, but that seems to have been a bit high in recent years. Calculated Risk has the story and notes the West Coast dock slowdown as a factor.

The Ugly

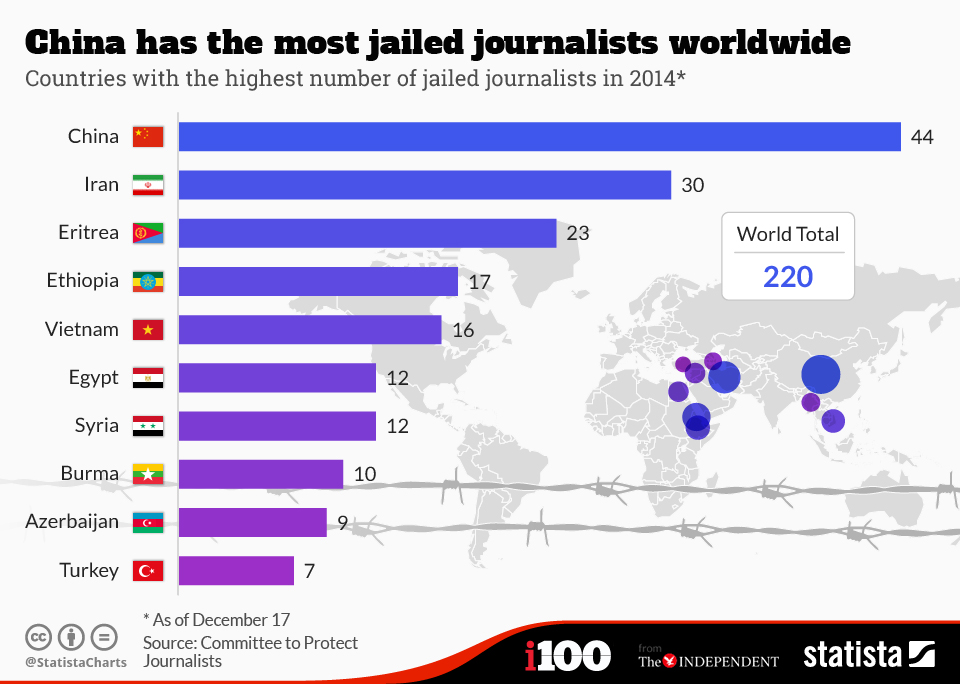

Jailed journalists in China (Felix Richter via GEI):

Increased trade and economic ties generally increase cooperation and make the world safer. It has now been 42 years since Nixon’s famous trip to China and even longer since Ping-Pong diplomacy. The world is very interested in China, its markets, and its economic data. Building confidence remains a challenge.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. This week’s award goes to RL at Slope of Hope for an interesting look at how normal charting techniques have not worked well in the recent rally.

Fans of the Silver Bullet can check out our annual review of award winners, just in case you missed one. Most investors have been bamboozled by one or more of these stories, so an annual review can be helpful.

Quant Corner

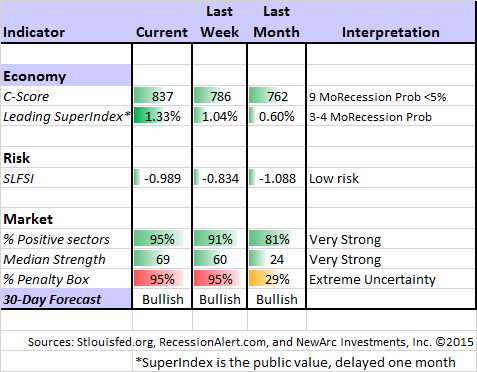

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. Georg’s BCI index also shows no recession in sight. Georg continues to develop new tools for market analysis and timing. Some investors will be interested in his recommendations for dynamic asset allocation of Vanguard funds. Georg has a new method for TIAA-CREF asset allocation. He has added a method for Vanguard Dividend Growth Funds. I am following his results and methods with great interest. You should, too.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators.

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. Doug has the latest interviews as well as discussion. Also see Doug’s Big Four summary of key indicators.

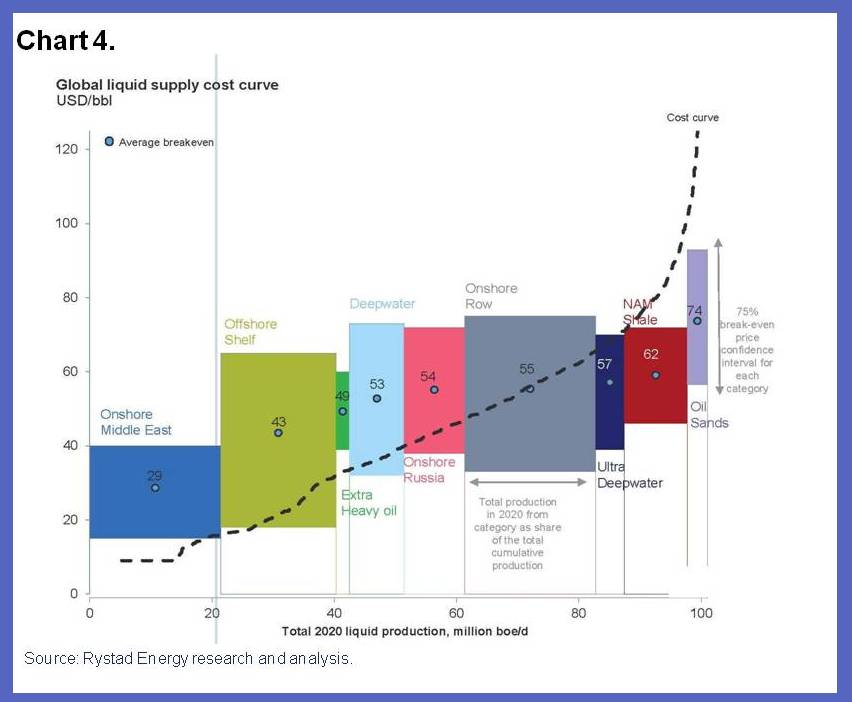

James Hamilton, our go-to expert on oil prices, has a first-rate analysis. This chart of the global supply curve is an important part of the story, but just a taste. You need to read this post carefully.

The Week Ahead

It is a full trading week with plenty of news.

The “A List” includes the following:

- Employment report (F). Last month’s gain will be difficult to match.

- FOMC minutes (W). The market seems to make something out of nothing whenever there is news from the Fed, so watch for signs that the official statement could be given a new spin.

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

- Auto sales (M). Important concurrent economic read from non-government data.

The “B List” includes the following:

- ISM services index (T). Good read on an important economic sector.

- ADP private payrolls (W). Solid independent approach to measuring employment change.

- Trade balance (W). Important component for Q4 GDP.

- Factory orders (T). November data.

The calendar for Fed speechmaking is active, featuring both hawks and doves. The Consumer Electronics Show may provide some news.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Since our last WTWA post, Felix shifted from neutral to bullish. There is still a high level of uncertainty reflected by the extremely high percentage of sectors in the penalty box. There has also been some rapid changes in the top sectors, even in a relatively quiet market. Our current position is fully invested in three leading sectors. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

There is bottom-fishing with fund flows in energy ETFs. Jim Polson at Bloomberg picks up the story. Felix did also!

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. We have updated our ideas on current ideas for investors.

We aim for a light-hearted approach in our “Hot and Not” review of the past year, but there is still a lot of investment truth. If you missed it, please take a look.

Other Advice

Here is our collection of great investor advice for this week:

Best Lessons

Josh Brown’s annual review of “What I learned” brings out pithy ideas from his many sources. I always enjoy reading the list and I always learn something. You will, too, because it combines humor and education. There is no good way to summarize this, so please read and enjoy. Here is one favorite:

“Sam Ro: if you ask, most stock market bears will tell you they’re not net short.”

Watch also for these 14 famous but meaningless phrases that pundits use to appear smart. Henry Blodget has the story. They are all so good that it is tough to pick a favorite.

Stock Ideas

Eddy Elfenbein, CNN/Money’s best buy-and-hold blogger, is out with his eagerly awaited choices for 2015. Eddy locks in the choices for a full year. This post amplifies the preliminary version (cited in our last WTWA) and provides more discussion. There are always great ideas, and you have the choice of selling during the year – if you dare!

Thirteen ideas from David Rosenberg. In contrast to the “bad news” above, he likes Canada.

Yield Plays

Robert Martorana is writing to an audience of investment managers, but you can listen in! He carefully describes the possible role of convertible bonds—very helpful.

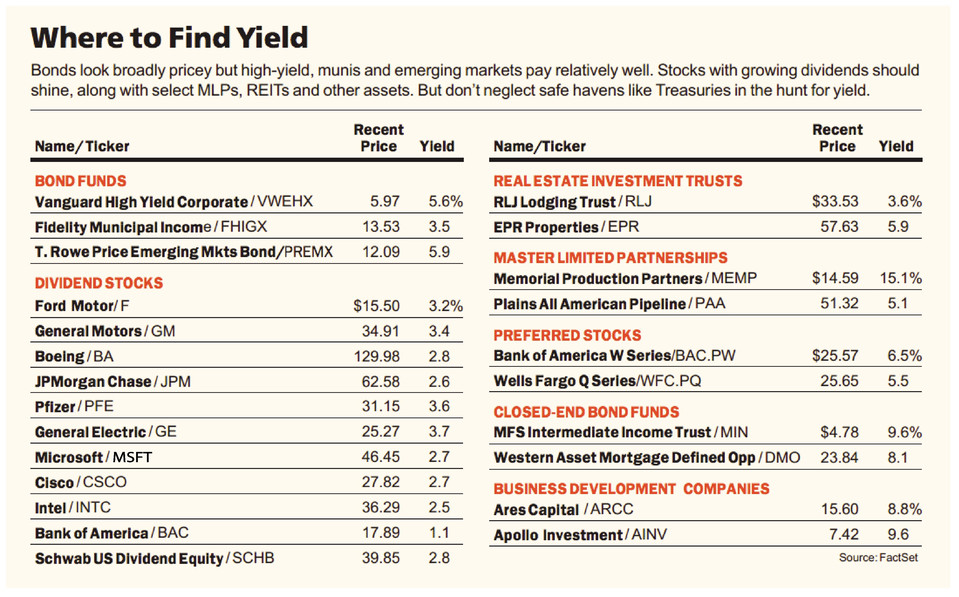

Investors continue the quest for yield and Barron’s has some ideas. Jack Hough’s cover story reports on the alternatives in the table below. Don’t stop there. The recommendations are more nuanced. There is also a nice accounting of what worked and didn’t last year.

Sticking to a Winning Strategy

Michael Batnick reviews some winning strategies and the related drawdowns, noting the challenges of staying with the program: “Finding a strategy that can beat the market over a reasonable period of time is relatively easy. It’s sticking to it that is the challenge.”

Warren Buffett’s Berkshire Hathaway B (NYSE:BRKb) stock had a great year – up 28%. Betting on Buffett is an easy choice if you understand that you should focus on methods. Those chasing past performance would have instead emphasized the prior five years, where the stock trailed the S&P 500.

Mark Hulbert sounds the same theme, with plenty of charts and examples. “Past performance is about to lead you astray – in a huge way.”

Psychology and Time Frames

Traders jump on a theme, but get bored quickly. Josh Brown is an expert on both traders and investors, often explaining how brokers sell their wares. This week he uses the Herzfeld Caribbean Basin Fund (NASDAQ: CUBA) as an example, writing as follows:

The closed-end fund is down 35% over the last week and has given back most of the gains from the announcement. I’ve seen this kind of thing play out approximately one million times. I’d been on the wrong side of these plenty of times in the early part of my brokerage career as the sexiest stories in the market were always the easiest to sell to investors. Unfortunately, they’re often the stories that are the least likely to have staying power once the hype dies down.

Did you get caught holding the bag on Cuba? Consider hiring a professional to manage your money or lessening the amount of event-driven trades you take each year.

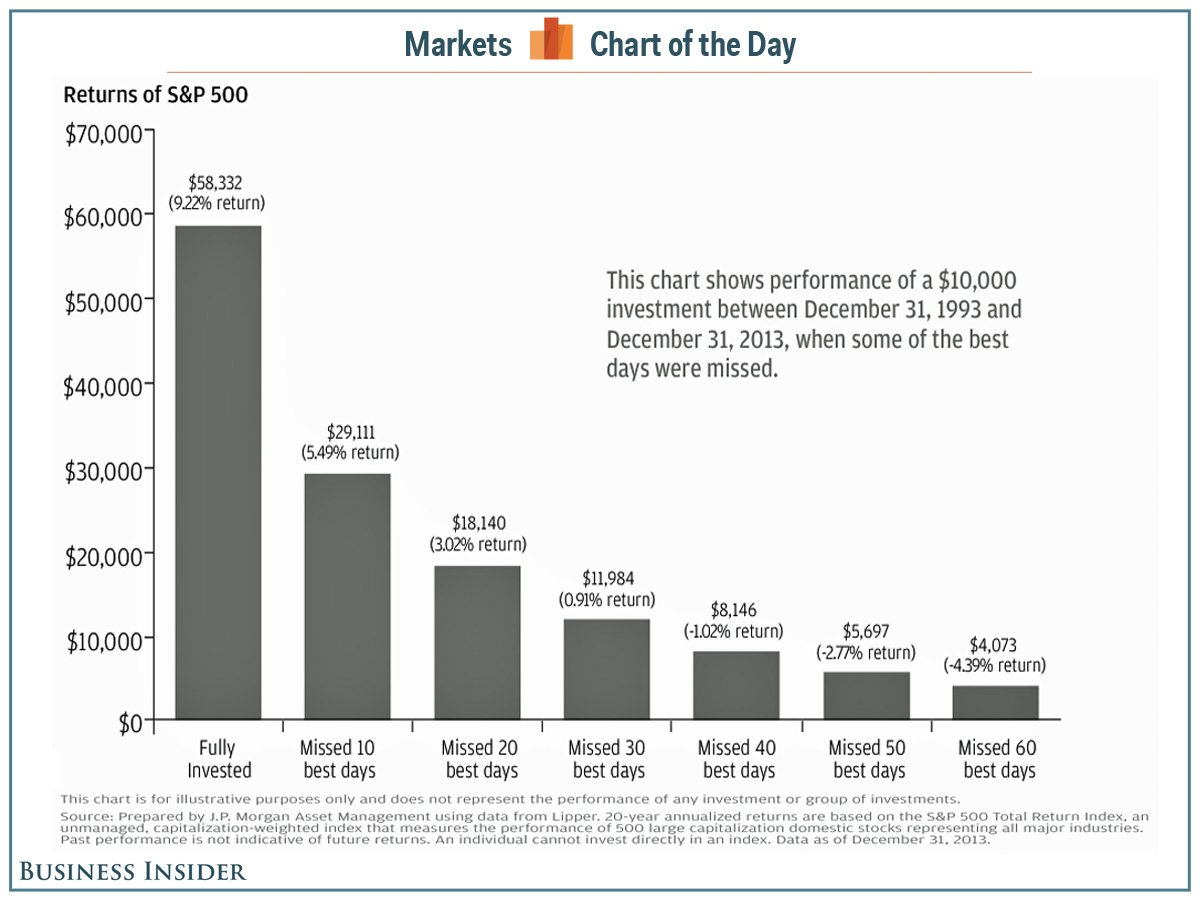

Similarly, Sam Ro at BI on how market timing attempts are costly for most investors.

Investment Scams

The hits just keep on coming! When you see a fund that is too good to be true, beware! Stephen Gandel at Fortune warns about such a fund. Every investor is seeking something that looks like a CD but pays 8% per year. Understanding the risk/reward balance is challenging for most.

Final Thought

I am not a big fan of seasonal effects unless there is a logical underlying reason. The Presidential cycle logic rests upon taking unpopular actions early in the term while emphasizing economic stimulus later. That does not have much relevance in the current environment.

The January tax loss effect is more persuasive, especially in years where there are some clear losers to sell. That was true in many sectors this year.

What are my market predictions for 2015? My own annual preview article will be out this week. I will not make a specific market forecast, but I will examine trends that I think offer the best risk/reward balance. I remain constructive on stocks since we are still in the middle part of the business cycle. I will also try, as I do in my weekly posts, to distinguish between investors and traders.

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.