- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

The Treasury Market Sees A Rate Hike Next Month… Maybe

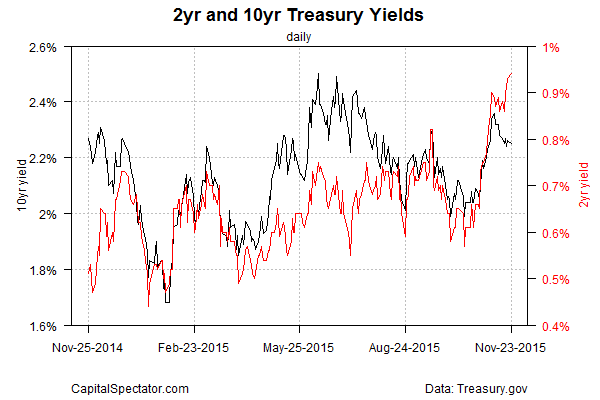

Fed Chair Janet Yellen yesterday reaffirmed the case for keeping interest rates near zero percent and raising rates slowly in the future. But the Treasury market seemed to have a mixed reaction. The 2-year yield–widely followed as the most-sensitive spot on the curve for rate expectations—ticked higher, rising to a five-and-a-half-year high of 0.94% yesterday (Nov. 23), based on constant maturity data at Treasury.gov. The benchmark 10-Year yield, by contrast, slipped to 2.25%–comfortably below the recent high of 2.50% from mid-June.

The diverging trends in the 2- and 10-year yields of late seems to capture the spirit of the times. On the one hand there’s a growing sense that the Fed will start raising rates at its policy meeting next month, if only slightly. But with economic data painting a lukewarm growth profile in recent months, along with low inflation that remains well below the Fed’s 2% target, there are no smoking guns in the cause of squeezing monetary policy.

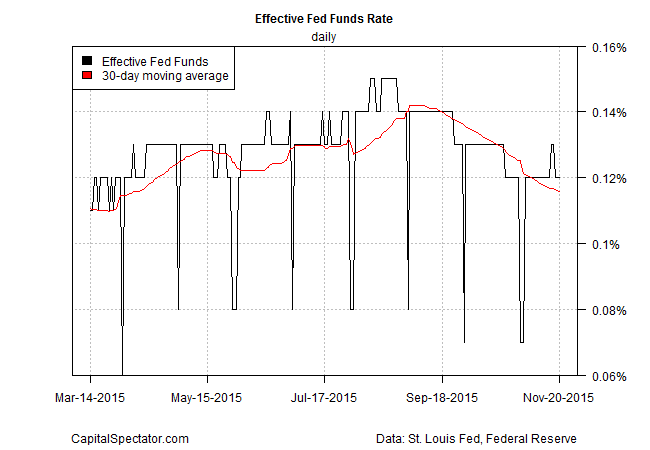

Speaking of mixed messages, consider the following. On the one hand, the Fed fund futures market is pricing in a 70%-plus probability that Yellen and company will raise rates above the current zero-to-0.25% target at the Dec. 16 policy meeting, the FT reports today. Yet the effective Fed funds (EFF) rate shows little if any upward bias. Indeed, as the chart below shows, the latest published EFF is at just 0.12% and the 30-day average EFF continues to tick lower. For the moment, it doesn’t appear that the central bank is laying the groundwork for a rate hike.

Perhaps the monetary mavens are waiting to see more data. There’s certainly a rich lode of numbers scheduled for release between now and Dec. 16, starting with today’s revised data for Q3 GDP and tomorrow’s October reports on new durable goods orders and personal income and spending.

The big game is next week’s employment report for November, of course. Is the case for a rate hike, or not, really dependent on one report? Perhaps. If the case for squeezing is still too close to call maybe the Fed is simply looking (hoping) for a clear message. But in the wake of a long stretch of warm and fuzzy data, is clarity finally set to descend from on high at the 11th hour? Unlikely.

And while we’re asking questions, would a 25-basis-point increase in Fed funds make a difference one way or the other? Unlikely.

But if the case for standing pat is still compelling, don’t expect any celebrations. As veteran Fed watcher Tim Duy advised on Sunday, “failure to hike rates in December would renew the barrage of criticism regarding their communications strategy that prompted them to highlight the December meeting in their last statement.” But that’s considered an unlikely event, according to Duy, who predicts that “the Fed is set to declare ‘Mission Accomplished’ at the next FOMC meeting.”

But if the Dec. 16 decision is already written in stone, there’s still one awkward question: Will the incoming economic data ahead of next month’s FOMC meeting fall in line with a revival of hawkish policy decisions?

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.