- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

The Most Wonderful Time Of The Year (80% Of The Time)

It is not a little known fact that the stock market has showed a tendency to perform well during the end-of-year “Holiday Season”. How well? Let’s take a look.

The Test

Let’s first define “Holiday Season” as it relates to the stock market. We will focus our attention on the following period:

- From the close on the Friday before Thanksgiving through the close on the last trading day of the year.

Figure 1 displays the growth of $1,000 invested in the Dow Jones Industrials Average only during this holiday season time period starting in 1942.

Figure 1 – Growth of $1,000 invested in Dow Industrials ONLY from close on Friday before Thanksgiving through close on last trading day of the year; 1942-2016

For the record:

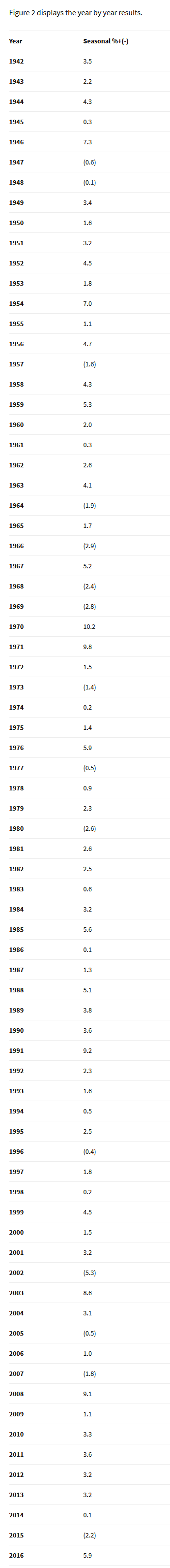

- # of times UP = 60 (80% of the time)

- # of times DOWN =15 (20% of the time)

- Average UP% Gain= +3.3%

- Average DOWN% Loss = (-1.8%)

- #of Rolling 5-year periods showing a gain = 69 (97% of the time)

- # of Rolling 5-year periods showing a loss = 2 (3% of the time)

- #of Rolling 10-year periods showing a gain = 66 (100% of the time)

- # of Rolling 10-year periods showing a loss = 0 (0% of the time)

The good news is the long-term consistency of returns (80% of all 1-yr, 97% of all 5-yr. and 100% of all 10-yr. periods show a gain)

The bad news is that this is still no “sure thing” as 15 times in 75 years – or 20% of the time – this supposedly “bullish” seasonal period showed a loss. The 5 worst losing periods were:

- 2002 (-5.3%)

- 1966 (-2.9%)

- 1969 (-2.8%)

- 1980 (-2.6%)

- 1968 (-2.4%)

While these losses seem small, it should be noted that a “mere” -2.4% decline from current levels would knock roughly 560 points off of the Dow. A -5.3% declines would total roughly 1,250 Dow points. That would not exactly qualify as “wonderful”.

Figure 2 – % gain(loss) for Dow Jones Industrials Average during 3 Trading Days prior to Thanksgiving through December 31 (Dow Jones Industrials Average)

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

For every trader, choosing a reliable broker is a cornerstone of success. Achieving consistent gains in trading is not a walk in the park as it is, and you don't want any extra...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.