- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

The Central Bank Waiting Game

The Central Bank waiting game is taking hold of the G-10 complex as Investors nervously contemplate their pending decisions while mindfully scanning the geopolitical landscape.

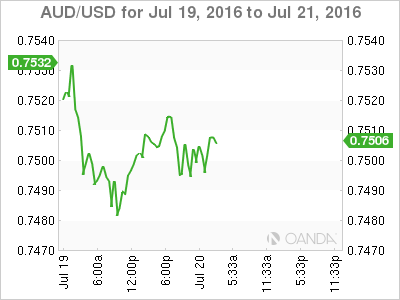

Australian Dollar-Losing Yield Appeal

Fissures are appearing in the yield carry backstop that has supported the Australian Dollar post-Brexit.

Yield appeal tarnished after the RBA left the door open to an August rate cut. Unlike how the market views the recent post-OCR meeting statement, yesterday’s monetary policy meeting minutes – referred to both the labour market and the housing market with some degree of uncertainty. A mention that inflation was expected to remain weak for some time saw an immediate repricing of the Australian short-term interest rate curve, which moved from 45% to 62% probability of an August interest rate cut, and then paved the way for an overnight move to below .7500.

Given the RBA bias, the market should continue to price in a rate cut, Risk Premia, through the Q2 CPI release on July 27, which should cap the Australian dollar upside in the near term.

The RBA market watch is now in full swing as next week’s CPI print is likely the key to open the rate cut door

Before the RBA Meeting minutes, the Austrian dollar was tracking its antipodean neighbour lower after the RBNZ moved to quash the domestic housing boom. Apparently uncomfortable with the accelerating pace of the country property market prices, the RBNZ has tightened up its macro-prudential measures by kerbing the amounts of money property investors can borrow by requiring a minimum 40 % deposit. With Australia housing market similarly frothing, speculation is mounting that the RBA may invoke some wide –ranging macro-prudential measures of their own

This morning, the AUD is trading off overnight lows as profit taking sets in. Overextended shorts failed to take out the .7475 level, which represents the 38.2% retracement level of the broader AUD rally that has occurred since late May.

The Aussie bulls are not giving up so quickly. Despite shifting RBA rhetoric, momentum from the current risk rally and the rise of US equities for the 8th consecutive session, there is still a buffer for risk-sensitive currencies like the Australian Dollar. Overall, though, a diminishing yield appeal will likely trump all.

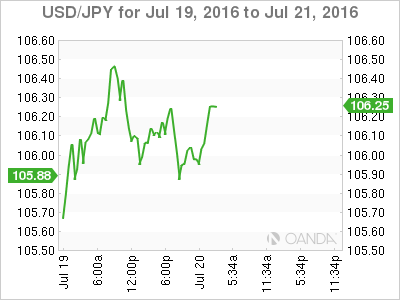

YEN-Abenomics Redux

With the situation in Turkey tapering and expectations running high for Abenomics 2, the market was quick to reprice USD/JPY, after closing, at 105 on Friday. USD/JPY continues to power ahead on stimulus expectations, with tail wind from the GBP/JPY buying in the wake of the Soft Bank deal.

An overwhelming percentage of investors are expecting Japanese Policy Makers to deliver, which should make the topside on USD/JPY the favoured short-term position, with shifting risk sentiment adding an element of surprise.

On the risk front, Post-Brexit speculation of easy money continues to support equity market. While the market has changed slightly risk-averse overnight, the skew is directed to European equities in the wake of a very tepid ZEW survey. The availability of easy money is showing little sign of abating though and risk sentiment should remain buoyant for the foreseeable future.

The market is firmly entrenched in the Tokyo stimulus short-Yen trade so that any disappointment could lead to a market washout and return to a year to date lows on USD/JPY.

Without some heavy lifting from the Fed or ongoing support from the US Dollar Index, traders may start looking at the risk-reward trade of buying Yen, anticipating that either the current wave of strong US economic data is unsustainable, or that the Tokyo policy marker will under deliver, which will make for interesting markets.

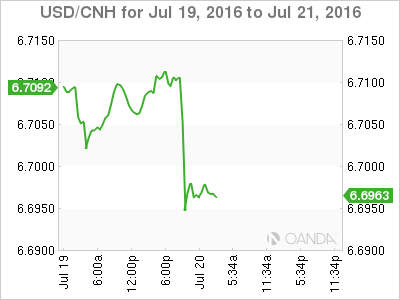

YUAN-Surprise

The Yuan was marching higher overnight as the DXY, the benchmark gauge of the dollar’s strength, rose to its strongest level since March 10.There’s certainly a growing crowd of investors that are warming up to the notion that the abundance of strong US economic data may light a fire under the Fed and lead to a surprise rate hike by year end. Overnight US housing starts reinforced the notion by rising 4.8% in June from the prior month. While the prospects of a shifting Fed policy has not created any great divide amongst traders, the US economic data will continue to be a primary focus for the market. Keep in mind; Fed Policy was the primary trigger of Chinas risk Cataclysm at the start of 2016.

Domestically, China’s slowing economy continues to weigh on traders sentiment, and it’s widely expected the Yuan will remain under pressure near term. Notwithstanding the potential meltdown emanating for the Credit and Asset bubbles that have been created on mainlands unbridled stimulus efforts.

Now enter the Fix !!

A PBOC fix of 6.6946 vs. 6.971, first firmer Yuan fix in 3 periods has caught near-term speculators long and wrong ( USD), and USD/CNH has moved aggressively lower from 6.7110 to 6.7040.

There may be some intention here on the PBOC part of keeping the offshore market near or below the 6.70 level ahead of the G20 ministers meeting in Chengdu this weekend. This shift in policy should lessen the likely- hood of competitive devaluation accusation rearing its ugly head at the weekend meetings.Certainly, the market was caught wrong footed on this one.

Ringitt -Emerging Markets Unsettled

The USDASIA complex turned bid yesterday as a cautious tone amidst profit taking set in as the fallout from the turmoil in Turkey continues to divide Emerging Market sentiment.

Overnight the stronger US economic data has seen a positive bounce in the broader G-10 space, and this should likely weigh negatively on the regional basket.

As for the Ringitt, in addition to the stronger USD momentum, crude oil prices continue to fall weighing negatively on investor appetite for Malaysia. We’re going through a soft spot in overall regional risk appetite; whether we can attribute this shift to oil prices or Chinas flagging economy, which is weighing regionally, I suspect the truth lies in the middle of that equation.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.