- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tenneco To Gain From Diversification, Pricing Pressure A Woe

On Nov 20, we issued an updated research report on Tenneco Inc. (NYSE:TEN) .

On Oct 27, Tenneco reported adjusted earnings per share of $1.67 for third-quarter fiscal 2017 (ended Sep 30, 2017), beating the Zacks Consensus Estimate of $1.59. Quarterly revenues jumped 8.5% year over year to $2.27 billion. Also, the top line surpassed the Zacks Consensus Estimate of $2.23 billion.

For the fourth quarter of fiscal 2017, the company expects total revenues to gain about 3% year over year on a constant currency basis. Further, it hopes to witness double-digit growth in commercial truck and off-highway revenues. However, the light vehicle sales are estimated to be equivalent to the industry that the company belongs to.

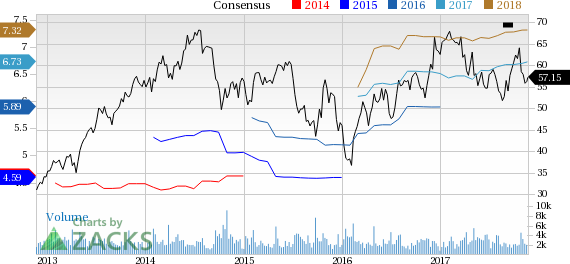

Tenneco Inc. Price and Consensus

Total revenues for 2017 are expected to rise about 6% year over year on a constant currency basis.

In order to improve revenues, product lines and drive long-term cash generation, Tenneco is diversifying its portfolio to grow its geographical footprint, customers as well as platforms. Further, it is making investments in working capital to support overall growth.

In the third quarter, the company returned $85 million to its shareholders through buybacks and dividends. This shows Tenneco’s focus to enhance the shareholder value.

As of fiscal 2016, Tenneco’s top 10 customers accounted for 63% of its sales, thus making the company heavily dependent on a handful few customers in the OEM (Original Equipment Manufacturer) segment. This reliance on others also makes it vulnerable to price changing pressures from the OEMs.

Weakening demand in European and North American off-highway markets and currency fluctuation are Tenneco’s other concerns.

The stock has seen the Zacks Consensus Estimate for quarterly earnings per share being revised 1.2% downward to $1.63 over the last 30 days.

Price Performance

Last month, shares of the company have underperformed the industry it belongs to. The stock has lost 10% compared with the industry’s 0.3% decline.

Zacks Rank & Key Picks

Tenneco carries a Zacks Rank #3 (Hold). A few better-ranked companies in the auto space include Cummins Inc. (NYSE:CMI) , Toyota Motor Corporation (NYSE:TM) and Wabco Holdings Inc. (NYSE:WBC) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cummins has an expected long-term growth rate of 12.1%. Year to date, shares of the company have been up 16.9%.

Toyota has an expected long-term growth rate of 6.2%. The stock has seen the Zacks Consensus Estimate for quarterly earnings per share being revised 4.3% upward to $2.9 over the last 30 days.

Wabco has an expected long-term growth rate of 15%. Its shares have been up 21.9% in the last six months.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Tenneco Inc. (TEN): Free Stock Analysis Report

Wabco Holdings Inc. (WBC): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.