- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Markets Gripped By Risk Aversion; FX Devolves Into Chop-Fest

US Markets

Not the best note for US equity markets at the Bell.

*DOW JONES INDUSTRIAL AVERAGE ERASES GAIN FOR THE YEAR

*S&P 500 INDEX ERASES GAIN FOR THE YEAR

It’s clear as a bell, despite the market's daily mood swings, risk aversion has a stronger grip on markets than risk-on. And today was no exception as risk continues to trade off the back foot. US markets are perched precariously on the edge while trading at all-important pivot levels. With the S&P and NASDAQ having been drawn into the global equity maelstrom, the US bellwethers are no longer the invincible Titans that have held up global market sentiment for what seems like an eternity as investors flocked to the tech sector given it was relatively impervious to weaker global growth sentiment, but escalating US-China trade tension remains that sectors undoing. With China-US trade hopes fading as both sides appear to be digging in for the long haul things could get blustery in a hurry. Indeed the sharks are circling

In a classic case of risk aversion, US 10-year yields are back down towards 3.11% and USDJPY, 112.15. However, the dollar is much stronger across the board after the EUR breached the 1.1430 pivot that was on virtually every G-10 trader’s radar, but the bulk of the dollar demand was through EM, EUR and AUD.

European Markets

ECB President Draghi gets his chance to throw a few curveballs today. But it will be hard for the ECB to ignore eight solid months of decline in EUR PMIs which is directly attributable to weaker growth in China and the political quagmire in Italy. While the markets are expecting little change in the ECB’s policy, their outlook will be closely watched, moreso after yesterday's soft PMI data. All in all, this adds more bricks to the global equity markets wall of worry.

China Markets

Very confusing price action yesterday; a tug-of-war between two competing narratives with Beijing’s obvious desire to boost sentiment through private sector initiatives while the plentitude of geopolitical headwinds kept overall bullish sentiment depressed as markets remain entirely pessimistic to buy the China growth story, knowing full well US-China trade tensions continue to escalate.

Oil Markets

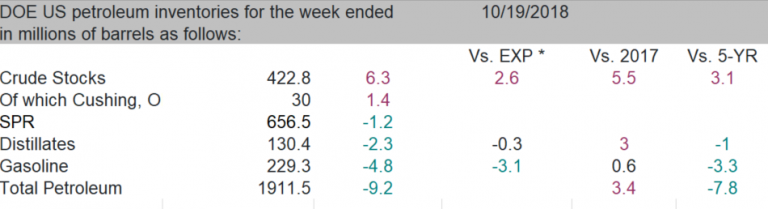

The EIA data for last week didn’t confirm the 9.9 mmbls build from Tuesday’s API data, but the 6.3 mmbls increase was approximately double the market expectation and more than the 3.1 mmbls five-year average gain. The build came despite a further 398,000 bpd increase in US crude oil exports to 2.180 mmbpd.

But digging into the data, while the confluence of EIA inventory is bearish for WTI, it’s bullish for products with total petroleum inventories declining 9.2 mmbls on the week so supportive for the oil complex on a net basis. Which sparked a mid-NY session surge in prices only to be completely faded.

Source: EIA Website data

However, the macro sell-off has been a critical catalyst in energy prices this week. The energy complex still holding long positions but oil markets are getting drawn into the risk aversion vortex as traders adopt the “everything is coming off mentality. But with the plethora of negative macro crosscurrents, it does suggest riskier assets will struggle as equity markets continue to wobble. Suggesting oil markets will be increasingly susceptible to broader market mood swings. Also, we’re seeing physical weakness getting expressed in product markets in late NY session, and that is negatively impacting oil prices into the NY close.

Predictably, there’s a lot of headline noise ahead of November 4, but the one bit that continues to resonate is what Saudi Energy Minister Khalid al-Falih said on Tuesday, that Saudi Arabia would step up to “meet any demand that materializes to ensure customers are satisfied.” When factored into the weakening macro and technical picture, it suggests that a top may be in and lower levels are likely in the weeks/months ahead. There are just far too many negative cross-asset signals to hold a bullish view on risk. Not to mention the negative runs of weak economic data in Asia suggesting regional oil demand will stall as we could be entering a protracted phase of the expanding global growth sinkhole. Indeed oil markets are nearing a tipping point.

Nonetheless, expect bargain hunting to emerge as traders will go back to the well, hoping that the worst of the worst has been priced in and there is still a significant bounce higher to be had as we draw closer to Iran sanctions. Bu this view all boils down the spare capacity equation and how many barrels can Saudi deliver.

Gold Markets

The strong US dollar continues to have an influence but the resulting gold dips should prove to be excellent entry points to buy gold even more so with the equity market putting in lows, but if these levels give way, gold will shoot significantly higher. The stronger USD is more about a weaker euro profile than anything else after the very dismal EU PMI prints rather than USD haven appeal. But in these extremely moody markets, it's all about holding one’s nerve especially if you have a negative equity view. Continue to favor gold higher in the weeks ahead, especially as we get closer to US midterms as gold traders remain singularly focused on equity watch.

Currency Markets

There are no directional trades to be had. Instead, the currency markets have devolved into a chop fest around data prints. Participation remains quite low but the main focus of the week will be Thursday, Vice Chair Clarida’s speech on the economic outlook at 12:15 EST.

EURUSD finally broke the 1.1430 after the eurozone composite PMI declined to a 25-month low, indeed a daunting number for the few Euro bulls left in the markets. While USDJPY is trending lower as the intensive flight to safety is on.

The Malaysian Ringgit

Regional sentiment continues to shift between Beijing interventions and the numerous headwinds to trade and global growth, but regional risk sentiment remains very nervous about buying into the China growth story keeping local equity sentiment sour

I expect USDMYR to continue nudging higher and will test 4.18 levels in the not too distant future perhaps even sooner if oil prices continue to slide.

But overall a very pedestrian day for the MYR.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.