- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TEGNA To Buy Midwest Television's Broadcasting Stations

TEGNA Inc. (NYSE:TGNA) has inked a deal to acquire the broadcasting stations of Midwest Television, Inc. for $325 million in cash. Following this announcement, shares of TEGNA rose 3.45% to $14.09 on Dec 18.

TEGNA will fund the transaction through available cash and borrowing under its existing credit facility. Subject to customary regulatory approvals and closing conditions, the buyout is expected to close in the first quarter of 2018.

The deal’s value is equivalent to 6.6 times of average expected 2017/2018 EBITDA. This will further include expected run rate savings and tax benefits. The deal is expected to boost TEGNA’s free cash flow on an immediate basis and drive the bottom line by a few cents within a year.

Television stations — KFMB-TV and KFMB-D2 (CW) — and radio broadcast stations — KFMB-AM and KFMB-FM — will be acquired by TEGNA. The assets will be added to the company’s existing media division. The media division is engaged in content creation rather than TV broadcasting. With 46 television stations in 38 markets, TEGNA delivers relevant content and information to viewers in all platforms. The company is the largest owner of top four affiliates in the top 25 markets, reaching approximately one-third of all television households nationwide.

We believe that the move to buy the San Diego-based company’s broadcasting stations is prudent. Currently, San Diego is the 29th largest U.S. TV market with 1.1 million households and the 17th largest radio market. KFMB-TV is the dominant market leader in San Diego, with higher audience ratings. KFMB-D2 is a CW-affiliated television station, which operates as a second digital subchannel of KFMB-TV, and is branded as The CW San Diego. KFMB-AM, KFMB-FM and KFMB-TV share studios in the Kearny Mesa district of San Diego.

In a bid to sustain growth, the company is focused on acquiring other lucrative businesses along with making additional investments to increase shareholder’s wealth.

Zacks Rank & Price Performance

Currently, TEGNA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

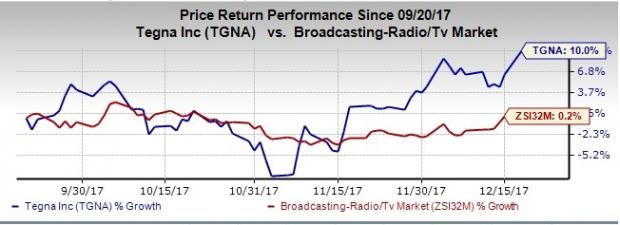

TEGNA portrays an impressive price performance. In the past three months, the stock has returned 10% compared with the industry’s rally of 0.2%.

When compared with the market at large, the stock looks favorable, as the S&P 500 index has rallied 7.0%.

Key Picks

A few better-ranked stocks in the Consumer Discretionary sector are Cable One Inc (NYSE:CABO) , Imax Corporation (NYSE:IMAX) and Netflix, Inc (NASDAQ:NFLX) . All the companies carry a Zacks Rank #2 (Buy).

Cable One, Netflix and Imax portray a decent earnings surprise history, beating the Zacks Consensus Estimate in twoof the last four quarters with an average of 2.6%, 1.25% and 41.3%, respectively.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Cable One, Inc. (CABO): Free Stock Analysis Report

Imax Corporation (IMAX): Free Stock Analysis Report

TEGNA Inc. (TGNA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.