- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TEGNA (TGNA) Tops Q3 Earnings And Revenues Estimates

TEGNA Inc. (NYSE:TGNA) is a leading broadcast TV company. TEGNA owns 64 television stations and is the largest independent television station group of major network affiliates in the top 25 markets.

TEGNA has been riding high, following the completion of two strategic business moves. The company plans to utilize gross proceeds of $250 million from the sale of its web portal CareerBuilder, to clear off existing debt. The spin-off of its auto-sales website, Cars.com into two publicly traded companies — TEGNA and Cars.com — is anticipated to increase the company’s prospects and appropriate market valuations. Moreover, TEGNA’s media business is faring well, evident from its revenue growth.

However, Soft advertising market is also a near-term headwind for the company. Meanwhile, the media and entertainment industry is one of the rapidly-changing industries in terms of technical improvements in content creation, aggregation and distribution platforms. Such upgrades add to the company’s programming costs and expenses, which are likely to affect the bottom line.

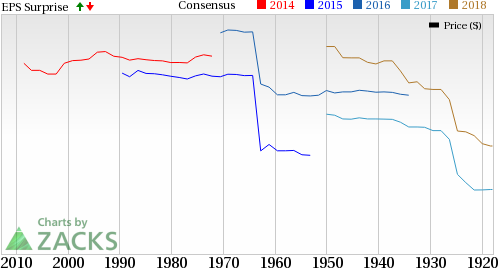

Zacks Rank: TEGNA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here. The company has generated a positive average earnings surprise of 7.90% in the previous four quarters. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: TEGNA’s Q3 2017 adjusted earnings surpassed our estimate. The company reported adjusted earnings per share of 23 cents, which was a penny higher the Zacks Consensus Estimate. Investors should note that these figures take out stock option expenses.

Revenue: TEGNA reported total revenue of $464.3 million, down 10.7% year-over-year while surpassing the Zacks Consensus Estimate of $460.9 million.

Key States to Note: In the reported quarter, revenues from B2B Marketing services grew 49% year over year and OTT advertising revenues grew 92% sequentially.

Check back later for our full write up on this TEGNA earnings report later!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

TEGNA Inc. (TGNA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.