- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TEGNA (TGNA) Beats Earnings, Revenue Estimates In Q3

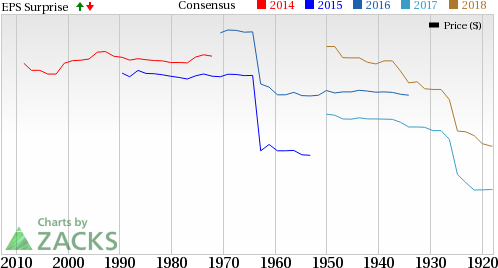

TEGNA Inc. (NYSE:TGNA) reported impressive financial results in the third quarter of 2017, wherein both the top line and the bottom line outpaced the Zacks Consensus Estimate.

Net Income

Net income from continuing operations was $50.8 million or 23 cents per share compared with $76.7 million or 35 cents per share in the prior-year quarter. The company reported adjusted earnings of 23 cents per share, a penny higher than the Zacks Consensus Estimate.

Revenues

Total revenues in the reported quarter were $464.3 million,outperforming the Zacks Consensus Estimate of $460.9 million.

Operating Metrics

In the third quarter of 2017, operating expenses were $347.4 million, reflecting an increase of 4.1% year over year. Operating income was $116.9 million, declining 37.1% year over year. Quarterly adjusted EBITDA (earnings before interest, tax, depreciation and amortization) was $145 million compared with $222.9 million in the year-ago quarter.

Cash Flow

In the third quarter of 2017, TEGNA generated $111.9 million of cash from operations compared with $225.5 million in the prior-year quarter. Free cash flow in the reported quarter was $97.7 million compared with $197 million in the year-ago period.

Liquidity

TEGNA’s long-term debt outstanding was $3.3 billion and total cash was $383 million at the end of the third quarter of 2017. Dividends paid in the quarter totaled $15 million.

Fourth Quarter 2017 Guidance

The company expects its non-GAAP total revenues to increase in the high single to low double-digits year-over-year. On a GAAP basis, total revenues are projected to decline in the high single to low double-digits year over year.

TEGNA operates in an intensely competitive broadcast radio and television industry, with major competitors such as CBS Corp. (NYSE:CBS) , Gray Television Inc. (NYSE:GTN) and Entercom Communications Corp. (NYSE:ETM) . Notably, the U.S. broadcast TV industry has long been grappling with declining advertising revenues and increasing cord-cutting in the cable TV industry. TEGNA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

CBS Corporation (CBS): Free Stock Analysis Report

Entercom Communications Corporation (ETM): Free Stock Analysis Report

Gray Television, Inc. (GTN): Free Stock Analysis Report

TEGNA Inc. (TGNA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.