- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Technically Speaking For June 4: A Counter-Rally Is Possible

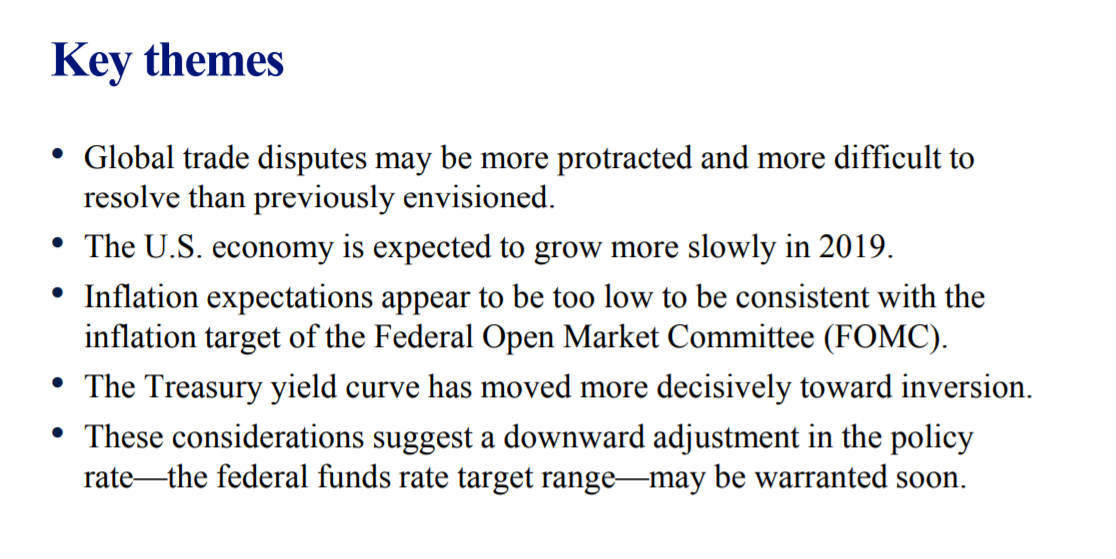

St. Louis Fed President Bullard is the first Fed president to publicly state rates may need to come down. Bullard released his speeches in PowerPoint format; here are the main points:

A great deal of information supports Bullard's points. The latest Markit PMI data continues to show a decline in exports orders in most jurisdictions. Both the Atlanta and NY Fed's respective GDP Nowcasts are predicting a slower 2Q19 (also remember that the strong 1Q GDP number was more the result of accounting issues associated with the GDP calculation rather than actual growth) - which comprise a large percentage of interest rates - have been low for this entire expansion. And the Treasury market continues to telegraph an economic slowdown. It could very well be that Bullard is the canary in the coal mine.

The federal government is upping its supervision of and investigations into the big tech companies (emphasis added):

The federal government is stepping up its scrutiny of the world’s biggest tech companies, leaving them vulnerable to new rules and federal lawsuits. Regulators are divvying up antitrust oversight of the Silicon Valley giants and lawmakers are investigating whether they have stifled competition and hurt consumers.

This is a very bearish development for the SPY (NYSE:SPY) and QQQ. Tech comprises 20.85% of the former and a whopping 43.75% of the latter. The XLK ETF has been one of the top performing sectors during the spring rally, pulling the market higher with the ETF's advance. Much like GM of old, as goes tech, so goes the economy (and the markets).

The Reserve Bank of Australia cut rates 25 basis points. While the bank argued that the purpose of the cut was to "make inroads into the spare capacity in the economy," international developments may have been the prime reason. Consider the opening paragraph of the statement (emphasis added):

The outlook for the global economy remains reasonable, although the downside risks stemming from the trade disputes have increased. Growth in international trade remains weak and the increased uncertainty is affecting investment intentions in a number of countries. In China, the authorities have taken steps to support the economy, while addressing risks in the financial system. In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up.

Note that Fed President Bullard also specifically referenced international developments in his respective remarks. An argument could be made that central bankers are growing increasingly concerned that the unintended consequences of heightened trade tensions will bleed into their respective domestic economies and slow growth.

Let's turn to today's performance table:

The markets really needed a day like today, and, thanks to the Powell put, they got it. Transports led the market higher, advancing over 3%. The QQQ was up nearly 3%, while the IWM gained over 2.5%. At the other end, notice that the long-end of the Treasury market sold off.

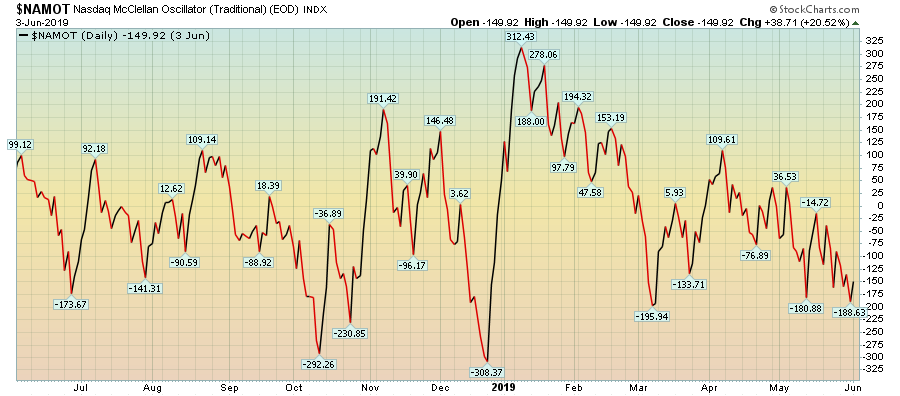

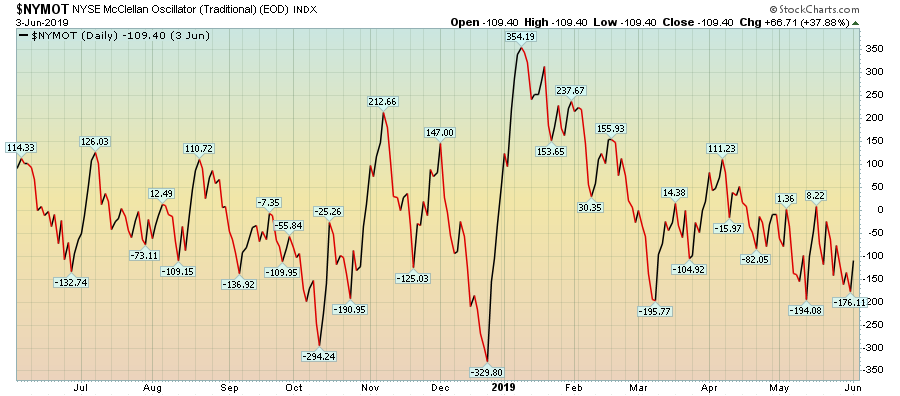

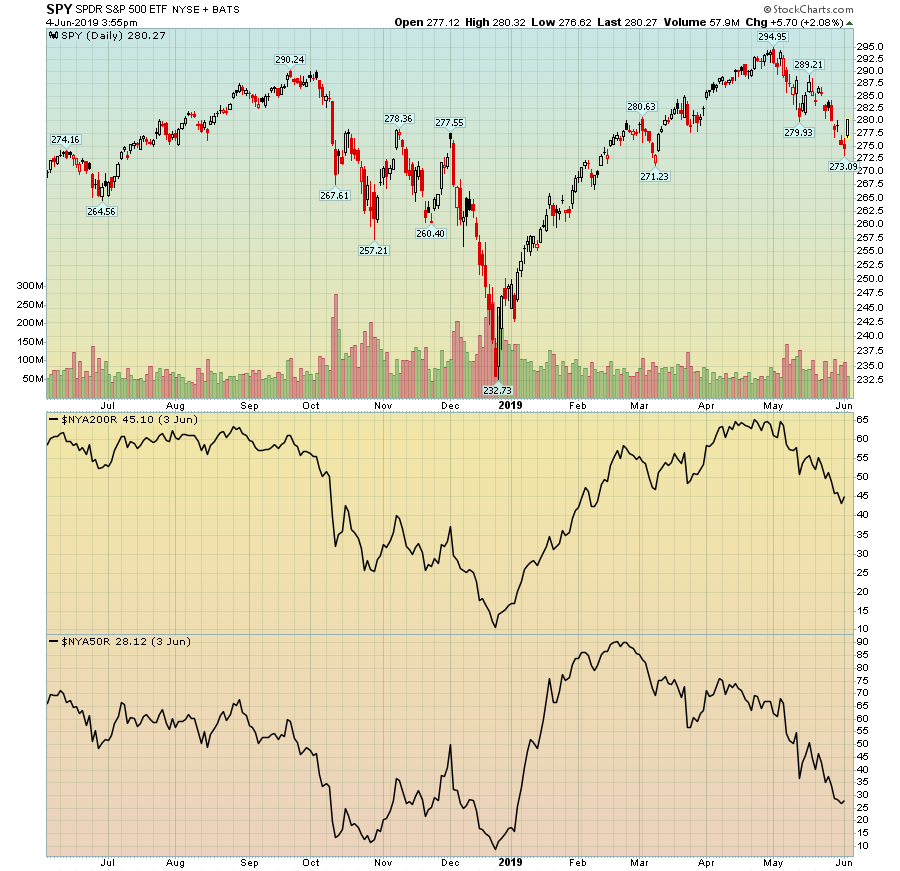

My general market thesis remains that we'll generally move lower from here. However, recent technical developments argue that we could see a counter-trend rally. Let's start with the McClellan Indexes:

The Nasdaq index is very oversold right now, as is ...

... the NY.

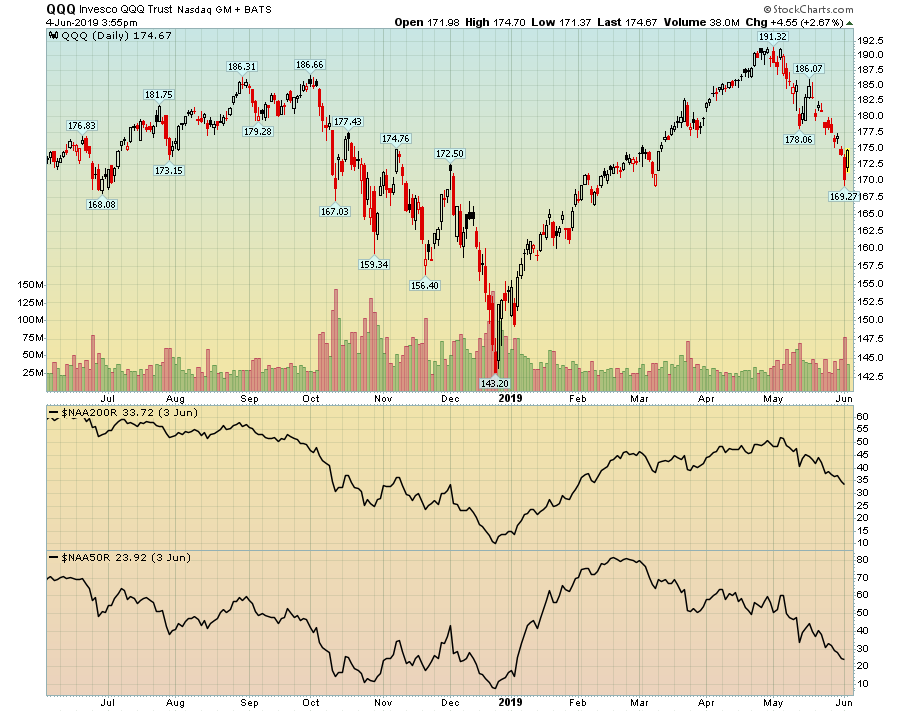

Next, let's look at the percentage of stocks above their respective 50-day EMAs.

The top panel shows the QQQ while the bottom panel shows the number of Nasdaq stocks above their respective 50-day EMAs. The latter is nearing lows.

The same situation is happening with the SPY.

Add to this mix a more market-friendly Fed. As I noted above, President Bullard is openly saying a rate cut might be in the cards. Today's speech by Chairman Powell is looking like a "Powell Put" moment. But is that enough to send the markets into another rally like the one we saw in the spring? I doubt it. The international environment is turning more and more negative and, at some, point, that will seep into the U.S. economy.

Related Articles

MON: Eurogroup Meeting, Norwegian CPI (Feb), EZ Sentix Index (Mar), Japanese GDP (Q4) TUE: EIA STEO WED: 25% US tariff on all imports of steel and aluminium comes into effect,...

Brief Reminder In 2018, US President Donald Trump initiated a trade war update with sanctions against China. Economic disagreement between the United States and China began in...

Trump’s U-Turns Keep the Market Under Pressure Both US equity indices and the US dollar remain under severe stress as US President Trump continues his back-and-forth on the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.