- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Wednesday's Technical Analysis: AUD/USD, EUR/JPY, EUR/USD, GBP/JPY

*All the charts are 30M charts with daily pivot points.

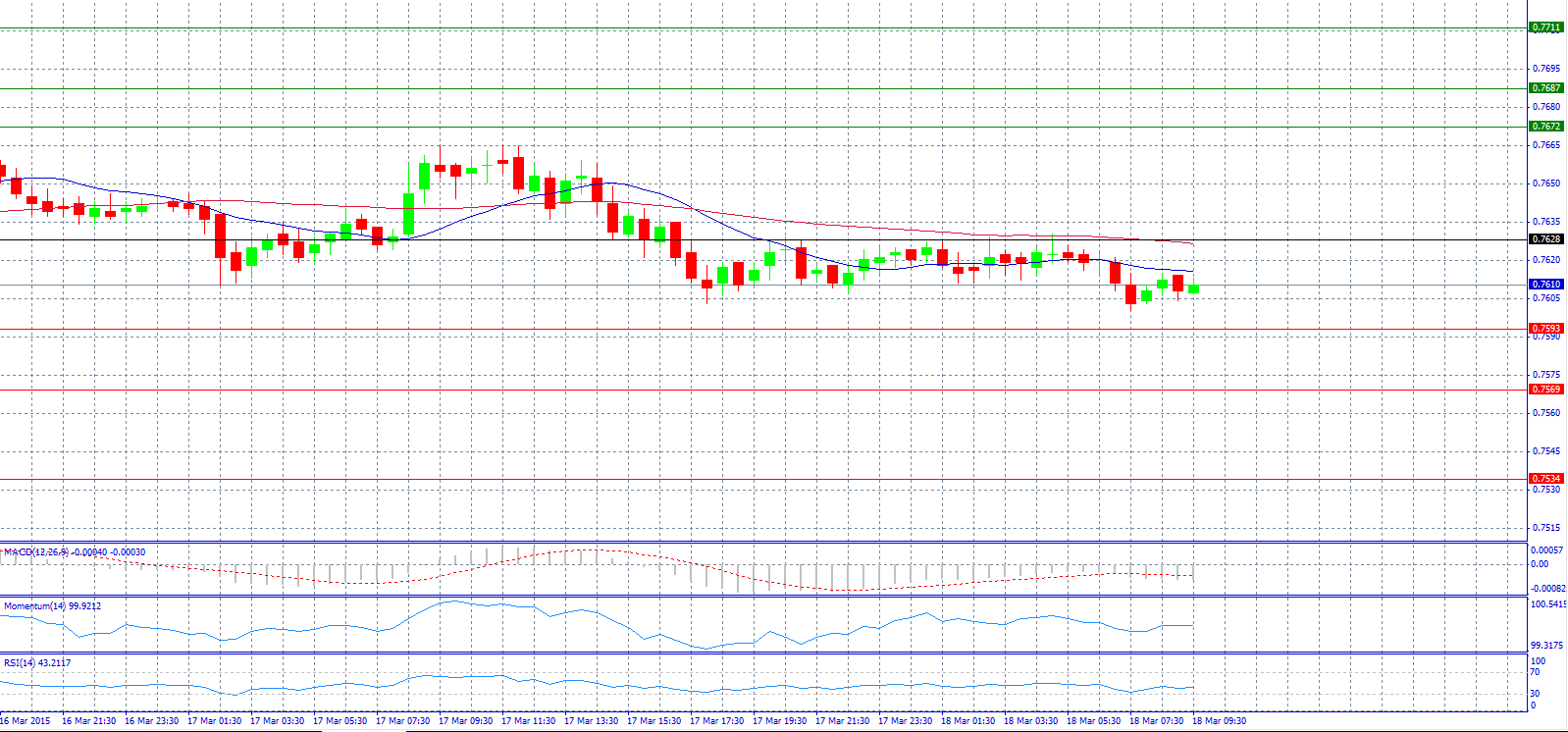

Market Scenario 1: Long positions above 0.7628 with target @ 0.7672.

Market Scenario 2: Short positions below 0.7628 with target @ 0.7569.

Comment: The pair erased previous gains and fell near to 0.7600 level ahead of Europe open.

Supports and Resistances:

R3 0.7711

R2 0.7687

R1 0.7672

PP 0.7628

S1 0.7593

S2 0.7569

S3 0.7534

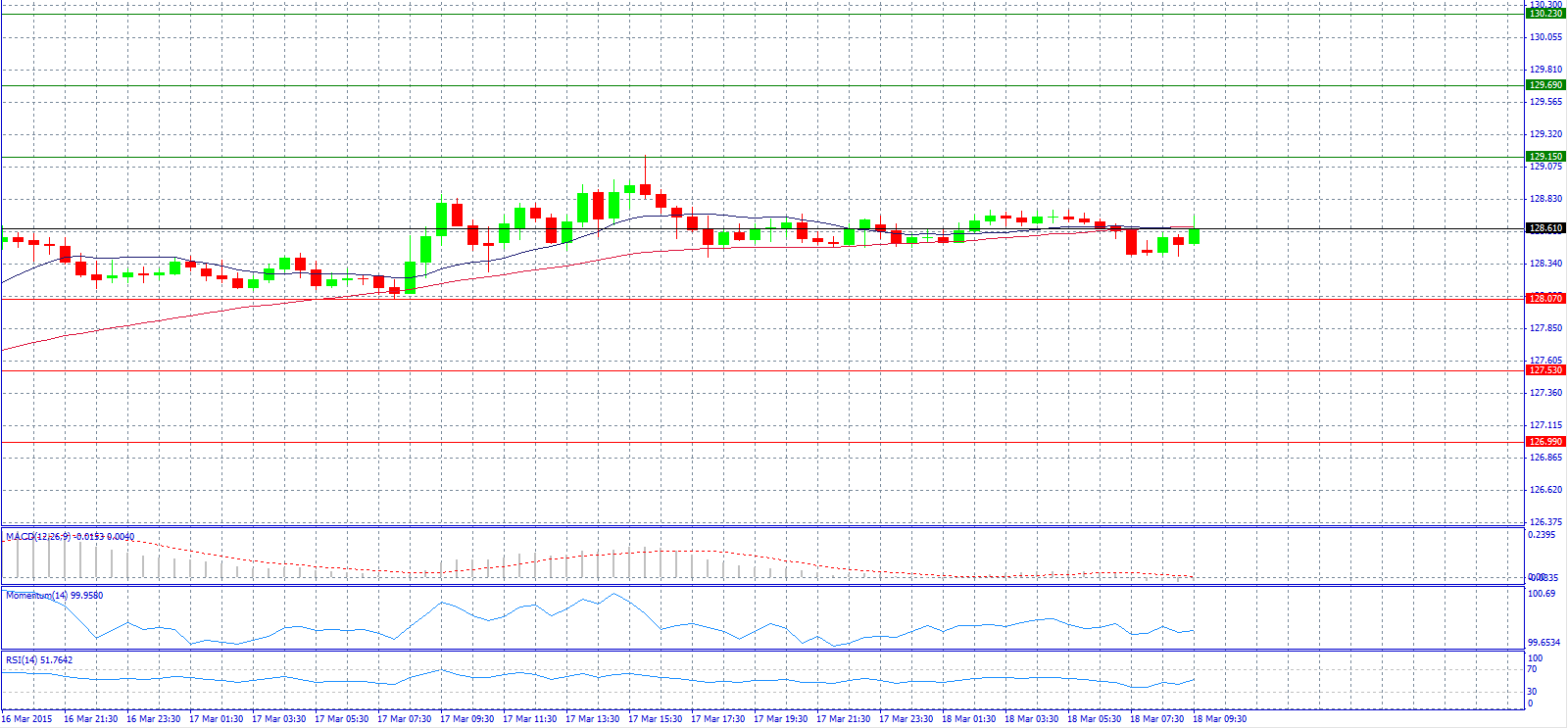

Market Scenario 1: Long positions above 128.61 with target @ 129.15.

Market Scenario 2: Short positions below 128.61 with target @ 128.07.

Comment: The pair continues to gain some momentum ahead of the Fed meeting today.

Supports and Resistances:

R3 130.23

R2 129.69

R1 129.15

PP 128.61

S1 128.07

S2 127.53

S3 126.99

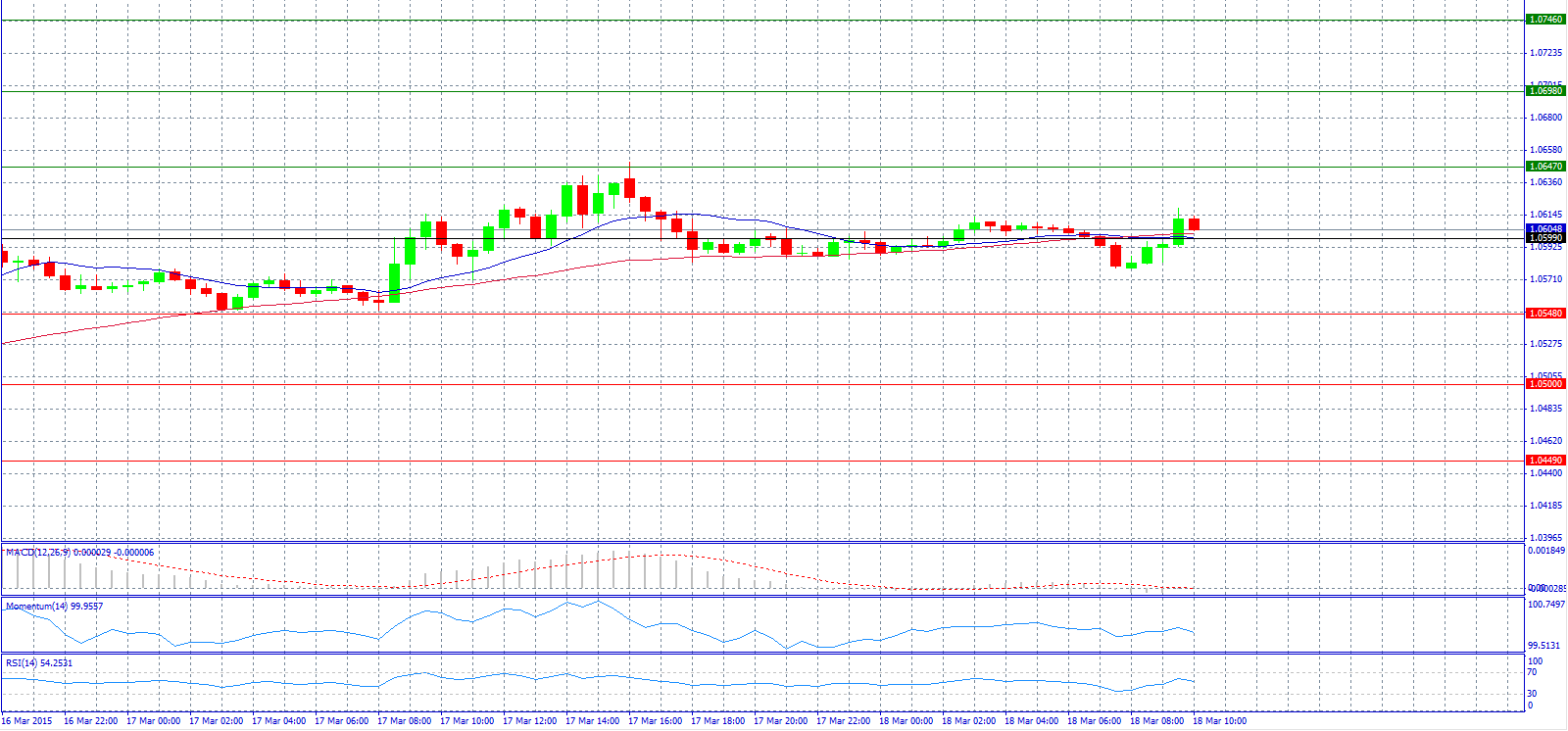

Market Scenario 1: Long positions above 1.0599 with target @ 1.0647.

Market Scenario 2: Short positions below 1.0599 with target @ 1.0548.

Comment: The pair rose above 1.0600 level but now fell below it again.

Supports and Resistances:

R3 1.0746

R2 1.0698

R1 1.0647

PP 1.0599

S1 1.0548

S2 1.0500

S3 1.0449

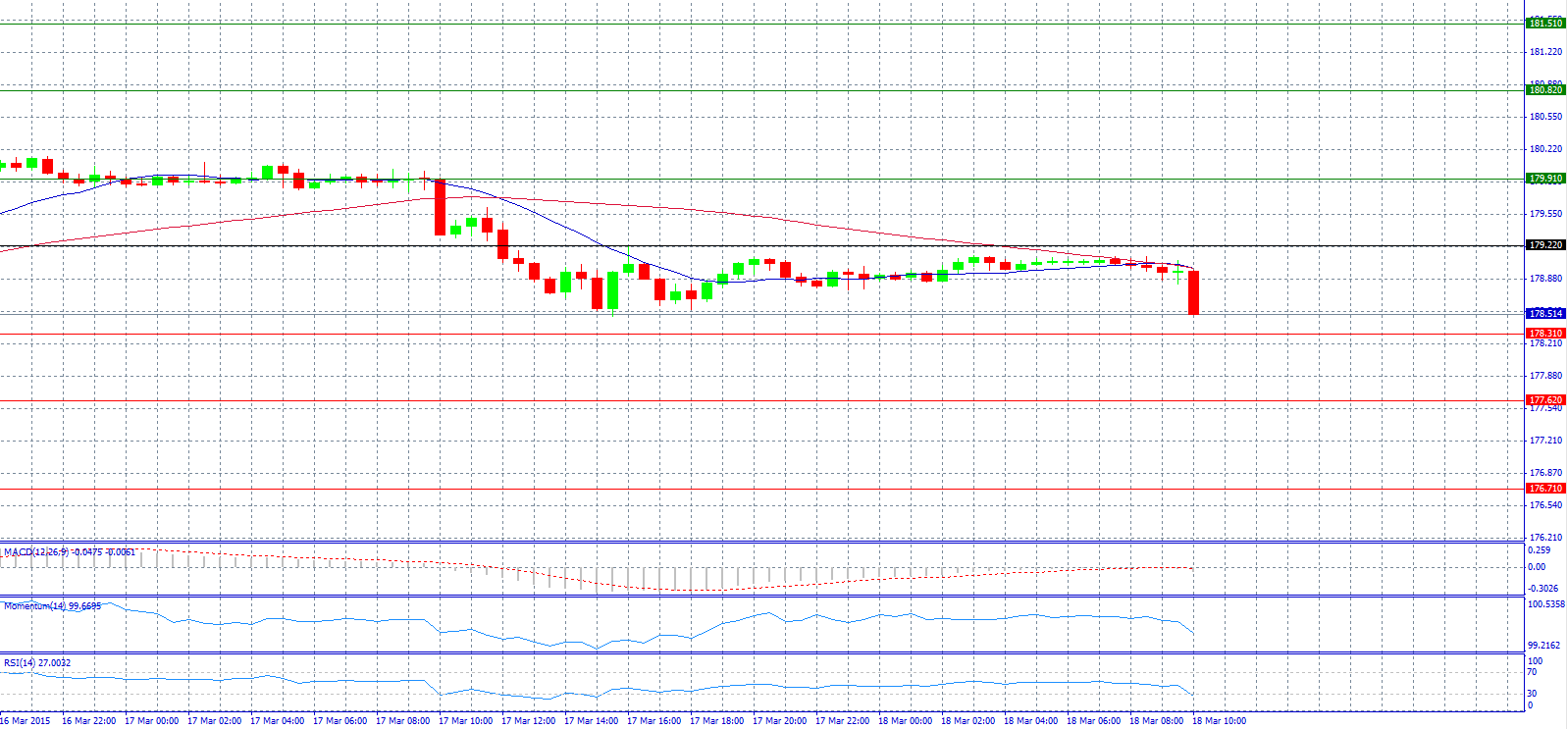

Market Scenario 1: Long positions above 179.22 with target @ 179.91.

Market Scenario 2: Short positions below 179.22 with target @ 177.62.

Comment: The pair trades below 179.00 level.

Supports and Resistances:

R3 181.51

R2 180.82

R1 179.91

PP 179.22

S1 178.31

S2 177.62

S3 176.71

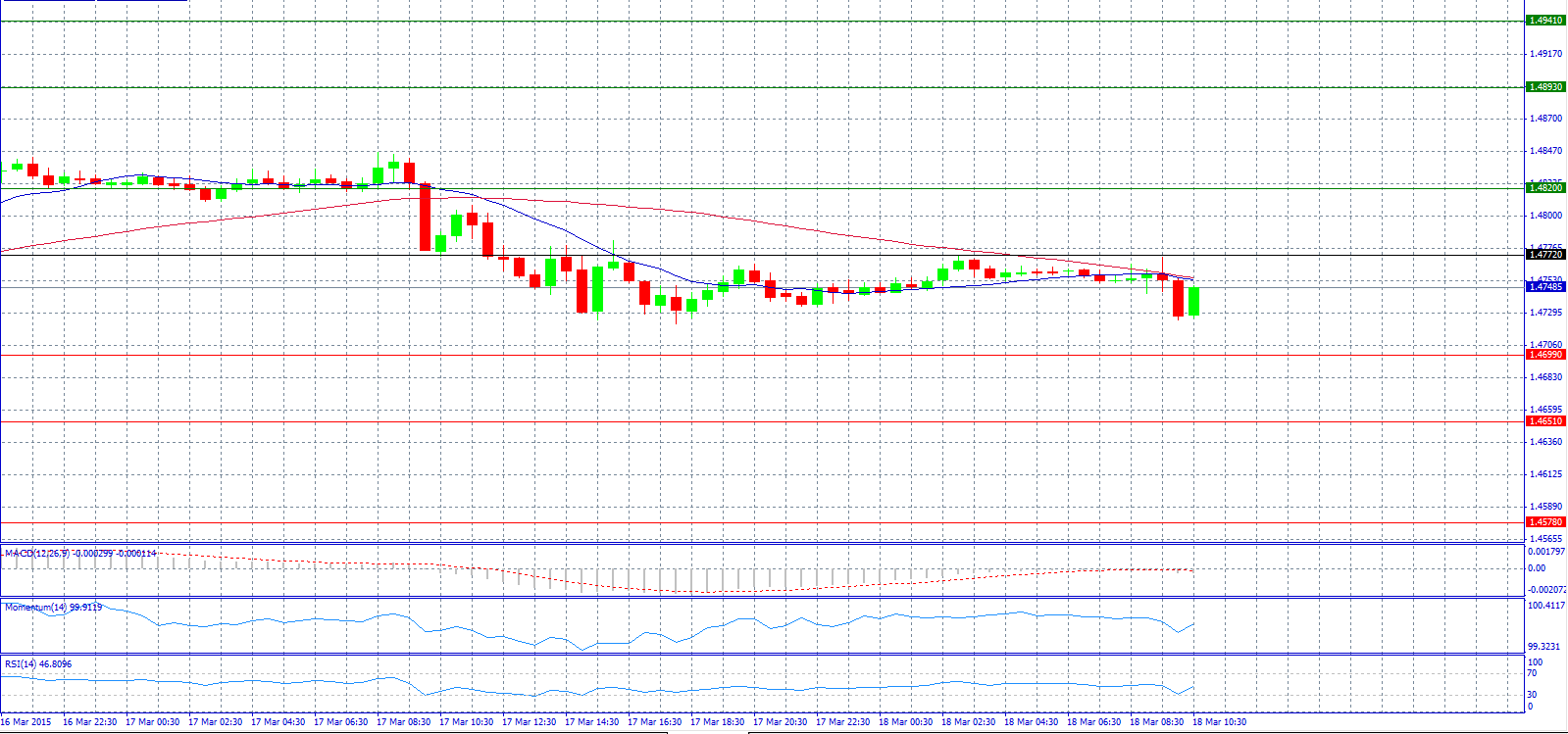

Market Scenario 1: Long positions above 1.4772 with target @ 1.4820.

Market Scenario 2: Short positions below 1.4772 with target @ 1.4699.

Comment: The pair fails to gain a foothold above 2013 low.

Supports and Resistances:

R3 1.4941

R2 1.4893

R1 1.4820

PP 1.4772

S1 1.4699

S2 1.4651

S3 1.4578

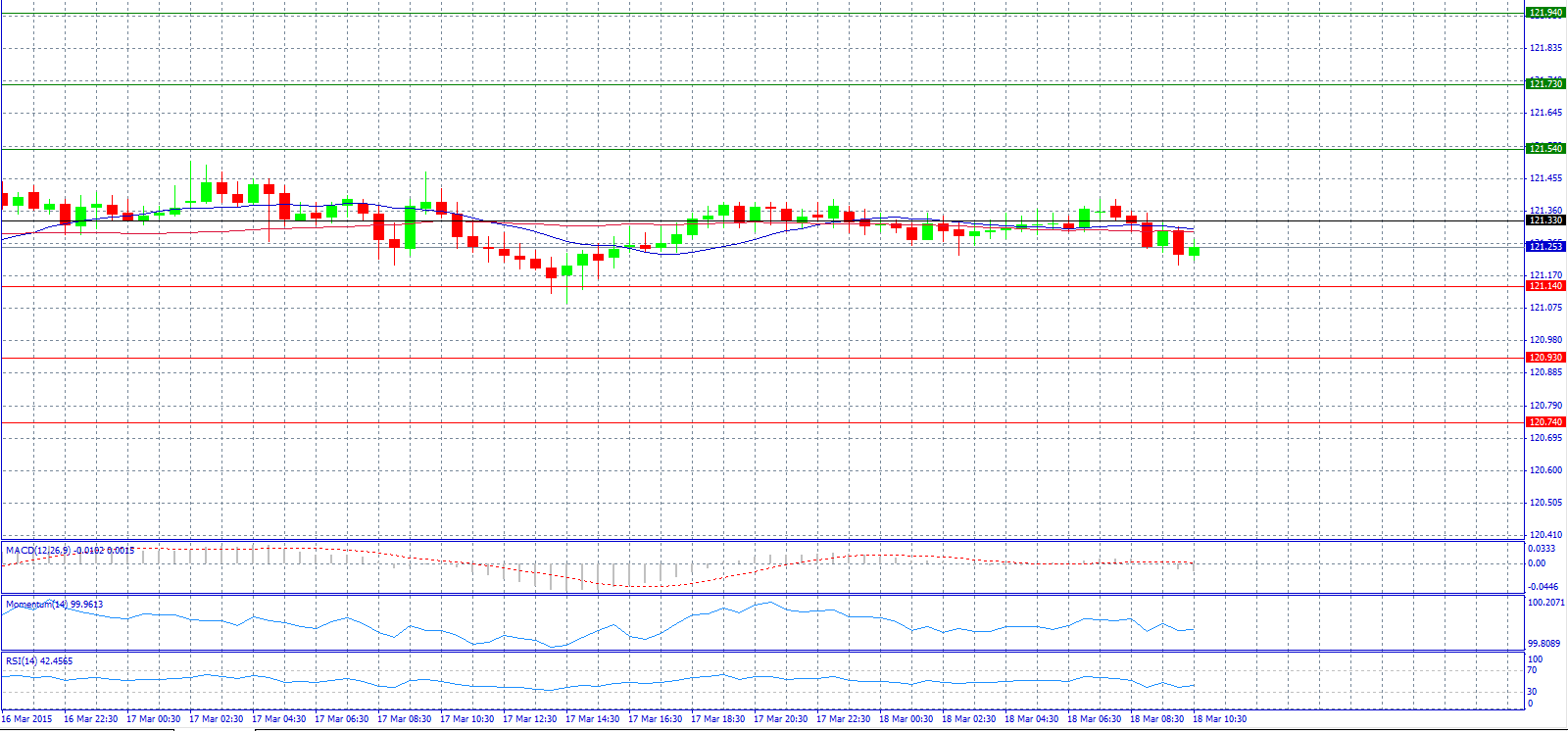

Market Scenario 1: Long positions above 121.33 with target @ 121.54.

Market Scenario 2: Short positions below 121.33 with target @ 120.93.

Comment: The pair stays dead flat ahead of the Fed.

Supports and Resistances:

R3 121.94

R2 121.73

R1 121.54

PP 121.33

S1 121.14

S2 120.93

S3 120.74

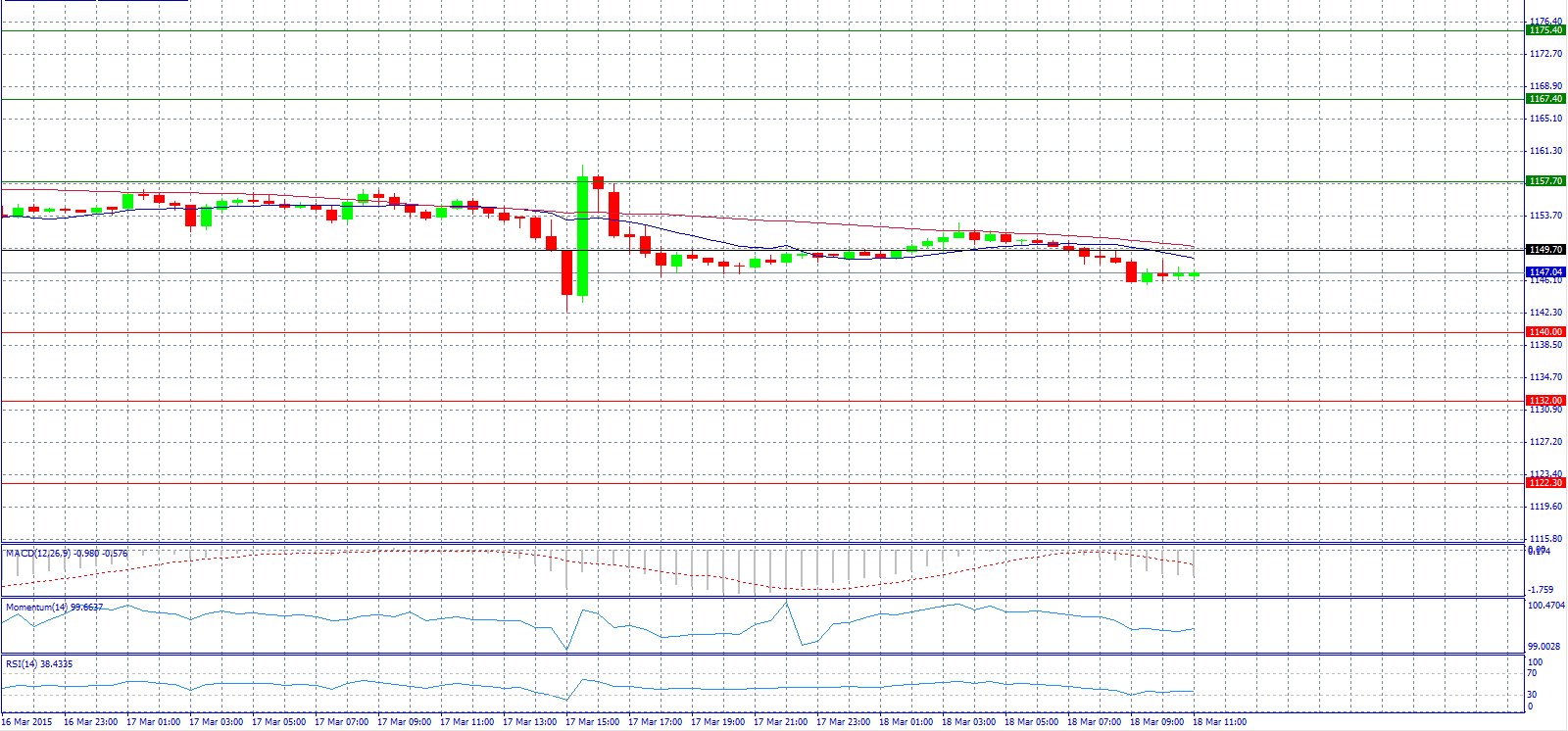

Market Scenario 1: Long positions above 1149.70 with target @ 1157.70.

Market Scenario 2: Short positions below 1149.70 with target @ 1140.00.

Comment: Gold prices slip to near four-month low as Fed seen readying rate hike path.

Supports and Resistances:

R3 1175.40

R2 1167.40

R1 1157.70

PP 1149.70

S1 1140.00

S2 1132.00

S3 1122.30

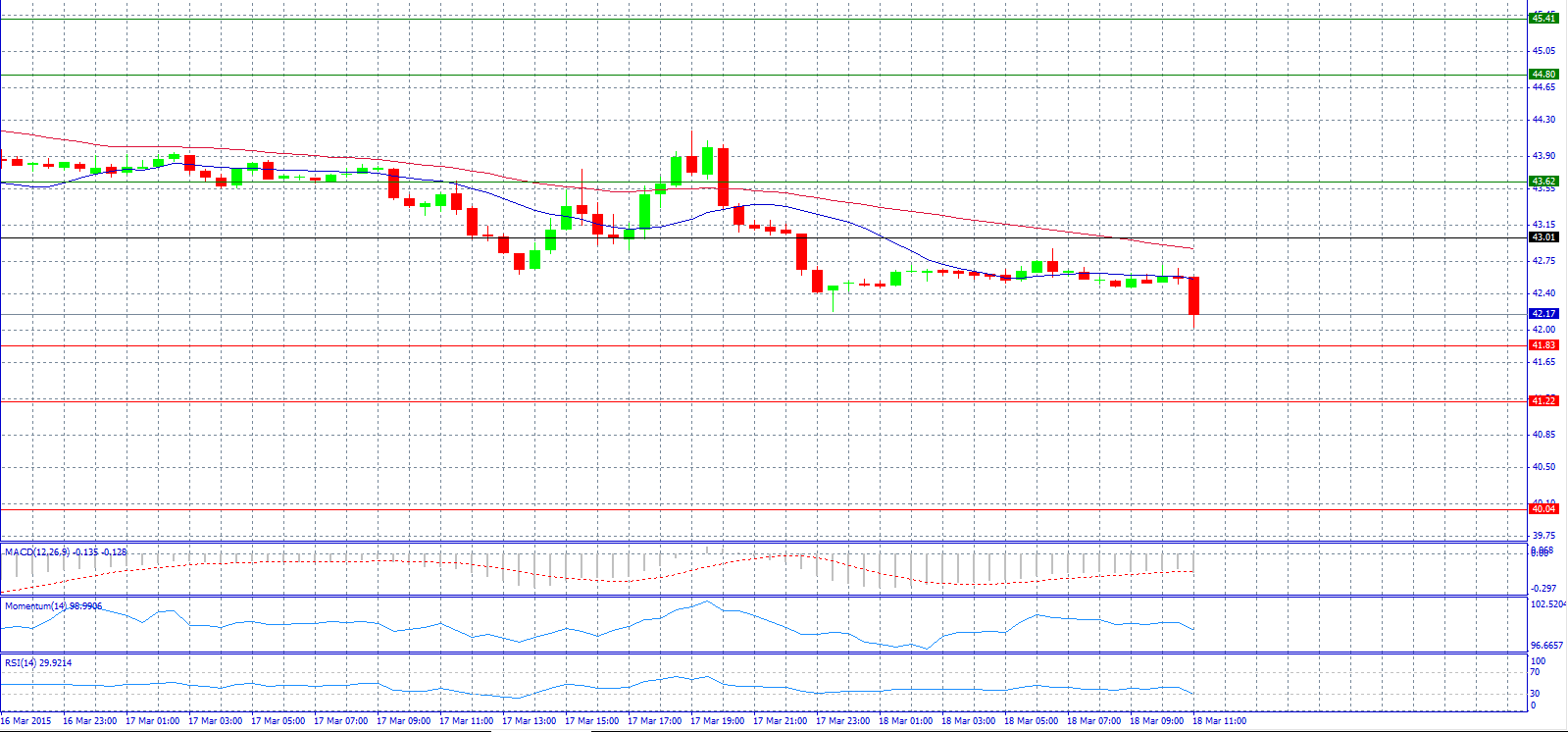

Market Scenario 1: Long positions above 43.01 with target @ 43.62.

Market Scenario 2: Short positions below 43.01 with target @ 41.22.

Comment: Crude oil nearing its final target of 32.54 level.

Supports and Resistances:

R3 45.41

R2 44.80

R1 43.62

PP 43.01

S1 41.83

S2 41.22

S3 40.04

Market Scenario 1: Long positions above 60.618 with target @ 60.970

Market Scenario 2: Short positions below 60.618 with target @ 59.579.

Comment: The pair trades ranged given the limited RUB transactions overseas.

Supports and Resistances:

R3 62.696

R2 61.657

R1 60.970

PP 60.618

S1 59.931

S2 59.579

S3 58.540

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.